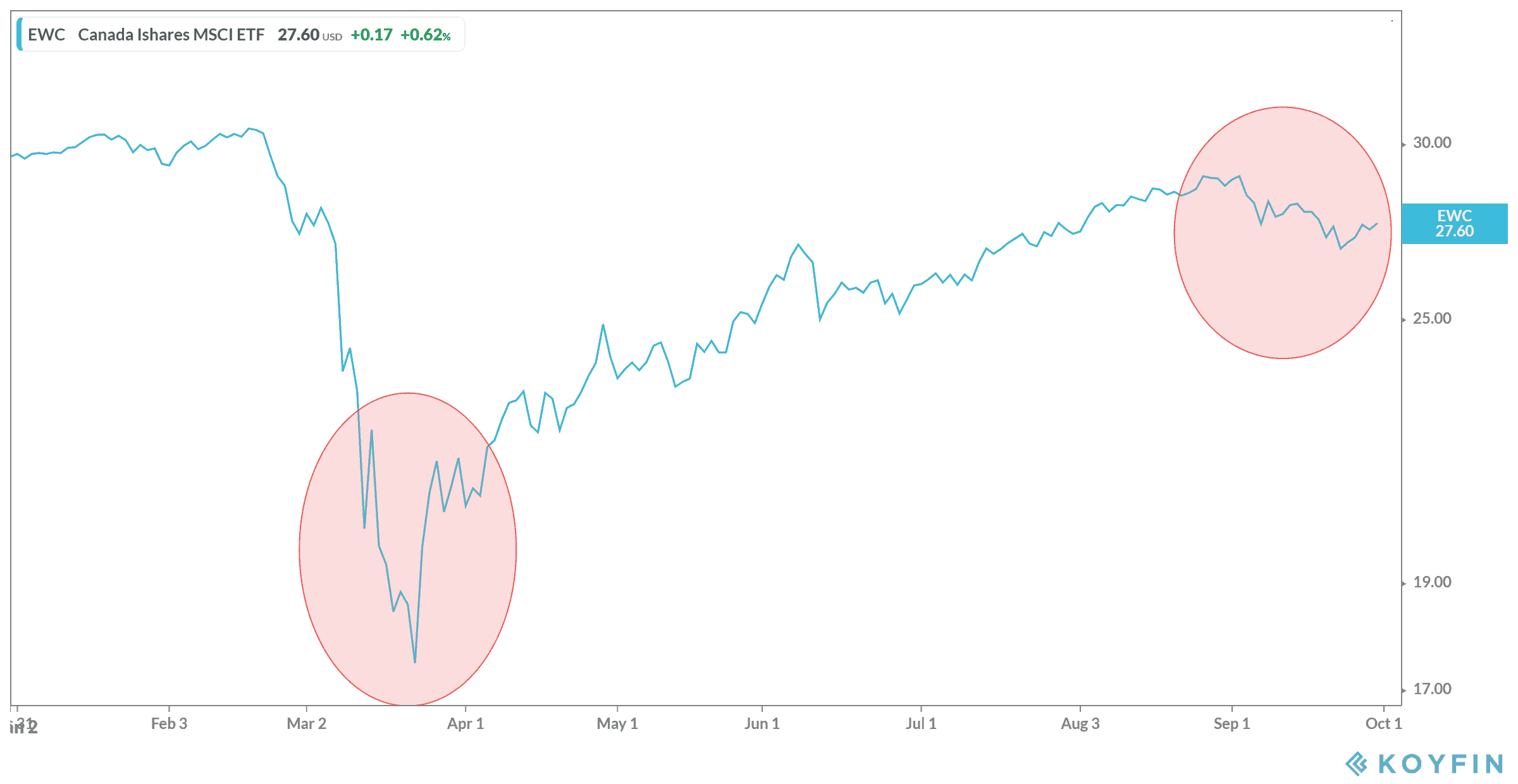

It’s been a heck of a year in 2020 — and the year isn’t over yet. But if you’re looking for some optimism in the new year, it might be a good time to start considering some new investments. Unfortunately, while some economists believe the last market crash could be the only one, it doesn’t seem likely. Already, there is a drop in the markets that looks to be yet another market crash, as you can see below.

Even worse news, this drop could only be the newest addition to a string of market crashes over the next year or so. If that’s the case, you’ll want to stock up your portfolio with strong stocks for the new year. The best time to do that is now, while the markets are falling, there is a slight discount to these strong stocks, and before the next earnings quarter comes out.

So let’s look at some top stocks for you to consider.

Cargojet

Cargojet Inc. (TSX:CJT) made a killing during the last quarter, jumping 17% in a single day, and will likely continue to bring in strong revenue growth for the next few years. The company was bolstered by the boom in e-commerce during the pandemic, seeing year-over-year revenue growth of 21%. But economists believe this could only be the beginning, thanks to its partnership with Amazon.

The e-commerce giant purchased a stake in the company in 2018 to bring in $400 million worth of businesses in the next several years. Once achieved, that stake would grow to 14.9%. But no one foresaw the boom that would be created by the pandemic. The work-from-home economy is likely here to stay, and so too should the growth for this company. The company has now seen a one-year return of 105%, and a 10-year compound annual growth rate (CAGR) of 43%! When earnings come out again on Nov. 4, 2020, investors should be ready for another jump.

Goodfood

Another company booming thanks to the growth in working from home is Goodfood Market Corp. (TSX:FOOD). With people basically forced to stay home, the company saw a huge spike in the need for meal kit services. While the growth in the company may start to slow, it’s unlikely to completely disappear in the next few years.

Even when the pandemic is gone, there are many who will likely be wary of returning to the grocery store as they had before. Meal kits provide a safe option, and at a reasonable price. The company saw a 79.7% year over year increase in revenue during the last quarter, with a one-year return of 219%. Yet there is still plenty of room to grow within this billion-dollar industry.

Docebo

Finally, talk about the right place at the right time. Docebo Inc. (TSX:DCBO) provides a learning management system for employers. It allows anyone anywhere the world to be trained by a company, powered by responsive artificial intelligence. The company came onto the scene last year, and has since grown 260% in share price.

This of course was all before COVID-19. Now, companies big and small need methods of training staff that don’t require coming into a physical location. The company really has an endless amount of growth, and it’s likely that more and more enterprises will realize this. If there’s one stock you’ll want to consider in this new post-pandemic world, it has to be Docebo.

Bottom line

Buying up these stocks for your portfolio will give you the best chance of bringing in profit rather than losing it in 2021. Right now is an ideal opportunity, as we’re still about a month from most earnings reports, and in another market crash. So consider adding these three stocks to your watch list today.