Warren Buffett once said, “Beware the investment that produces applause.” “The great moves are usually greeted by yawns.” Today, if you buy Shopify Inc. (TSX:SHOP)(NYSE:SHOP), you will surely be greeted with applause. This makes sense. Shopify has been wildly successful and is transforming the world of e-commerce.

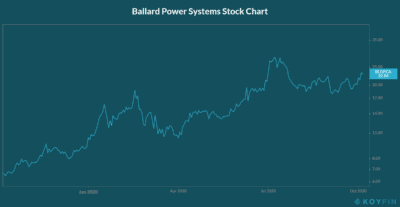

But what would the reaction be if you buy Ballard Power Systems Inc. (TSX:BLDP)(NASDAQ:BLDP)? Well, I can tell you. I have seen it for the last few years. It certainly wasn’t applause. Rather, the reaction was more of a disinterested disapproval. However, take a look at the chart below for Ballard’s stock price performance.

While Ballard’s one-year return is a market-leading 245%, this was met by yawns as many investors did not take notice. If an investment produces yawns, then the investment is probably undervalued. If it is undervalued, then it has a lot of room to move higher.

Everyone is buying Shopify stock

Today, Shopify stock is widely held by institutions and retail investors alike. It has been a great investment for all. There is a general consensus that Shopify stock is a stock to buy and it’s easy to see why. Shopify provides a multi-channel e-commerce platform for businesses. The company continues to experience strong revenue growth and continues to add new merchants to its platform as the pandemic has forced more businesses online.

Shopify has done an exceptional job: we can’t argue with that. But has the market paid up for this already? Can Shopify climb much higher? I think we are nearing the top.

Ballard Power stock is just gaining investor acceptance

Ballard Power, on the other hand, is just starting to get noticed. Unlike Shopify stock, it has a long way to go to gain investor acceptance and applause. Yet, it has had a good ride in the last couple of years. This is happening because the electrification of vehicles is progressing at an increasing rate. Ballard is a leading global provider of innovative clean energy and fuel cell solutions. Fuel cells are fast becoming the electric engine of choice for heavy duty vehicles.

The fuel cell industry is set for rapid growth. There is a global push toward eliminating carbon emissions. China, Europe, and California are at the forefront of this move and Ballard is in these markets in a big way. An estimated $130 billion opportunity will be up for grabs by 2030 as vehicles move to emission-free engines. Fuel cells will take part of this opportunity, and Ballard conservatively estimates that it can generate $5 billion in revenue in 2030. This represents a compound annual growth rate (CAGR) of 49%.

The way forward will not be easy. But Ballard has a 40-year history. It has the expertise. And it finally has the pieces of the puzzle aligning perfectly. There is an acceptance of the fact that we need zero emission vehicles to save the planet. There is a general consensus that fuel cell engines will play a big role in this. Not even Shopify stock has this many tailwinds pushing it higher.

The fuel cell industry is finally here

Costs in the fuel cell industry have been falling dramatically. Fuel cells are becoming cost competitive versus combustion engines and certainly versus battery electric engines. Corporate investments have stepped up significantly in the last two years. Industry giants like Toyota, Kenworth, and Mahle are just some of the companies investing in fuel cells. Mobility giants and energy majors alike are getting involved.

Government policies in places like China and Europe are leading the way, favouring big investments in hydrogen. We can expect the rest of the world to follow. Finally, investors are increasingly looking for ESG investments. Ballard Power benefits from all of these things.

Foolish bottom line

Warren Buffett has given us many wise tips for investing. Many of them come down to making decisions that go against widely held beliefs, ensuring that the stocks we buy are bought at reasonable, inexpensive valuations. I favour Ballard Power stock over Shopify stock today.