Shares of Suncor Energy (TSX:SU)(NYSE:SU) are down more than 60% this year, and for investors, it could be an appealing time to load up on this top energy stock. There is risk in the energy sector, especially as the coronavirus pandemic is keeping people indoors and minimizing travel. That’s going to hurt the demand for oil and gas, and the price of oil isn’t terribly high to begin with.

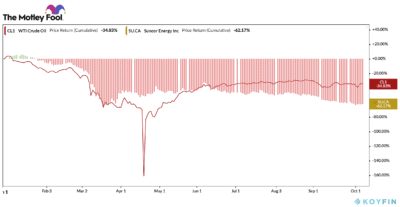

West Texas Intermediate (WTI) crude oil, a key North American benchmark price, is hovering around US$40/barrel. That’s nowhere near the US$60/barrel it was earlier this year. Suncor stock has fallen right along with WTI, although it hasn’t exactly moved in unison:

It’s a tough time for the energy sector, but Suncor is doing what it can to keep its costs down, and that includes layoffs and offering workers voluntary buyouts and early retirement packages. The company recently announced that it could lay off up to 15% of its workforce over the next year and a half.

In July, Suncor released its second-quarter results and its funds from operations of $488 million were down more than 83% from the $3 billion it generated in the same period last year. And the Calgary-based business also had to deal with a fire at its Fort McMurray base plant in August that disrupted operations, which may mean the third quarter won’t be a whole lot better.

Why there’s still hope

Investing at a time when things look bleak may be unpopular, but it can lead to some great returns later on. Suncor is still one of the top stocks on the TSX, and although Q2 was bad, it was the first time in nine quarters that the company didn’t generate positive free cash flow. And with more people traveling on planes and cities no longer under strict lockdowns, there should be a bit more optimism that things will improve in Q3. And as the economy eventually gets back to normal, that should also help get investors a bit more bullish about Suncor. The only question is how long that may take.

Outside of 2020, shares of Suncor haven’t traded this low in more than 15 years. You have to go back to the early 2000s for the last time Suncor stock was around these levels, and that’s why it’s tempting to consider picking up the stock as a contrarian buy. Even if it recovers back up to $32, you could double your money. Trading at just 0.7 times its book value, Suncor is an even cheaper buy than when it was valued at 1.4 times book value last year.

Another great reason to consider investing in Suncor is that it still pays a dividend. Although it slashed its payouts earlier this year due to the challenges facing the company, Suncor’s current quarterly dividend of $0.21 isn’t all that bad. At a share price of around $16, that means investors today will be earning an annual yield of 5.2%. That’s still a better dividend than what you’d get with many other stocks, and there is plenty of room for Suncor stock to rise in the future, giving you a great opportunity to benefit from just not just the dividend income but also capital gains down the road.