Momentum investing can be a very profitable way of investing. Riding positive sentiment has made many fortunes over the years. Jamieson Wellness Inc. (TSX:JWEL) and Northland Power Inc. (TSX:NPI) are two TSX stocks that are trading at 52-week highs. These momentum stocks show no signs of stopping.

But price action is by far not the only consideration when determining whether to buy a momentum stock. Both Jamieson Wellness stock and Northland Power stock have so much more going for them. Here’s why you should consider buying these momentum stocks now.

JWEL: Positive earnings revisions

One clear indicator of a momentum stock is positive revisions in earnings expectations. This shows that expectations are too low. It also shows that the fundamentals are strong.

Consensus earnings estimates for Jamieson Wellness, for example, are on the rise. In 2022, Jamieson is expected to earn $1.53. This is up almost 8% from the previous earnings estimate. It shows us the momentum that this company is experiencing in its business. And it shows us that expectations — and therefore valuations — are too low.

Northland Power: Positive and sustainable macro trends

As a maker of vitamins and natural health products, Jamieson is benefitting from a consumer shift toward alternative medicine. This business has had a steady rise in the last decade. Jamieson’s 10-year compound annual growth rate (CAGR) is 7.4%. Recent years have seen an acceleration of this growth. In its most recent quarter, Jamieson posted a 15.6% increase in revenue.

Jamieson is taking this success and bringing its products to international markets. In fact, between 2014 and 2018, international sales grew at a CAGR of 26.5%. This momentum stock will continue to benefit from further international expansion, and the increased scale will continue to drive EBITDA margins higher.

Northland Power is another company experiencing positive and sustainable macro tailwinds. Northland Power owns and operates renewable facilities that generate 2,681 megawatts of electricity. It also has an additional 130 megawatts of capacity under construction and 1,044 megawatts in advanced development.

In all of its 33-year history, there has never been a better time for Northland Power. Global leaders and industry are finally all on the same page. This means that the general consensus has shifted. The world is motivated to find clean energy solutions. That’s where Northland Power comes in. Sales at Northland increased 30% in the first six months of 2020.

The revolution to clean energy is gaining steam. Northland Power has clean and green power operating assets in Canada, Europe, and more.

Technical indicators look good for these momentum stocks

Finally, a stock’s price performance is a clear indication of a momentum stock.

Jamieson Wellness stock has soared 122% in the last three years. The chart below demonstrates an added technical bullish sign. The stock’s 50- day moving average has broken through its 200-day moving average. In technical analysis, this is a major buy signal.

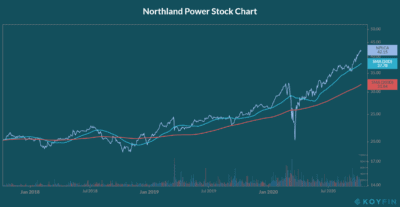

Similarly, Northland Power stock has soared 80% in the last three years. Its 50-day moving average has also broken through its 200-day moving average and remains well above it.

The bottom line

If all the ingredients are in the right place, momentum stocks are good stocks to add to your portfolio return. In this article, I have looked at why Jamieson Wellness stock and Northland Power stock are stocks to buy right now.