The Canada Revenue Agency (CRA) has just launched the new $2,000 Canada Recovery Benefit (CRB). The CRB, coupled with a revised Employment Insurance (EI) benefit, have been put in place as the new support for Canadians, as the Canada Emergency Response Benefit (CERB) ended.

Although the CRB will give unemployed Canadians $500 a week for up to 26 weeks over the next year, and there are several improvements this time around, there are certain consequences you’ll have to be mindful of.

Improvements in the new CERB replacements

When CERB was first introduced, we were still learning about the pandemic, but the economy was already suffering mightily. So, the main purpose of CERB was to get money in the hands of Canadians as soon as possible to prop up the economy.

Now, after we have learned more about the virus and the economy has recovered significantly, the CRB will be an updated and more efficient version of the CERB.

For starters, Canadians can now do a bit of long-term planning, as you know you’ll have support for up to 26 weeks and a total of $13,000 should you need it ($500 per week times 26).

It also allows you to earn more than $1,000 a month and still receive the benefit — something that the CERB never did, which was a little questionable.

Consequences to be mindful of

This time around, the CRA created a penalty for anyone who refuses reasonable work offered to them. And the penalty is quite stiff, too. The CRA could reduce your CRB term by 10 weeks, leaving you just 16.

The CRA has also added a 10% tax, which it will deduct from your CRB amount. On top of that, all the CRB cash you receive will be added to your income for whichever year you receive it.

It’s also worth noting that if you make more than $38,000 in a taxable year, the CRA will come for even more of this CRB money. That’s also new when compared to CERB.

So, you can now make more than $1,000 in a month. However, if you apply for the CRB and end up making more than $38,000 that year, the CRA will take back $0.50 of every dollar earned over that amount.

Use the CRB if you’re eligible

It’s crucial to be aware of the support that exists; that way, if you have cash on the sidelines because you’re worried about a rainy day, you can take it and invest knowing the government has the support you need.

If you’re eligible for any of the new CERB programs and have cash on the sidelines, one of the top stocks I’d consider buying today is a tech stock like WELL Health Technologies (TSX:WELL).

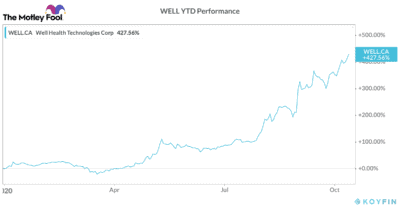

WELL Health gives investors exposure to two of the top industries during the pandemic. Tech stocks have exploded in value and become crucial to the productivity of our economies as we limit our physical contacts. Furthermore, healthcare is always a defensive industry and is made even more essential when living in a global pandemic. So, it’s no surprise that one of the top growth stocks, even before the pandemic began, would be up more than 400%.

WELL continues to be one of the most exciting stock on the TSX. It’s shown it can grow both organically or through acquisition.

If you have extra cash lying on the sidelines that you may not need, especially if you’re eligible for one of the new CERB programs, WELL is a top tech stock I’d consider buying today.