There are a lot of opportunities to be had right now. That isn’t likely to go away with winter around the corner. Canadians are due for another economic downturn that will likely come on the heels of this round of COVID-19 spread. Unfortunately, we are due for even more crashes thanks to the virus, but also due to the economy throughout the world.

That means the volatile market won’t simply disappear overnight, even with a vaccine. In fact, for some companies, even industries, it could be years, even over a decade, before a return to normalcy.

So, while you might be looking for investment options right now, there is one company that falls into this category for at least the winter. That company is Air Canada (TSX:AC).

The good

Air Canada was in the midst of setting up for huge moves over the last few years. Since the company bottomed out about a decade ago, it’s risen from the ashes to be a powerhouse of air transportation. The company made necessary cuts, reinvigorated its flight paths, bought back Aeroplan, and is still in the midst of acquisition discussions with Air Transat. With WestJet also bought out, it leaves Air Canada as the main airline in Canada. In fact, it now controls 60% of air travel in the country.

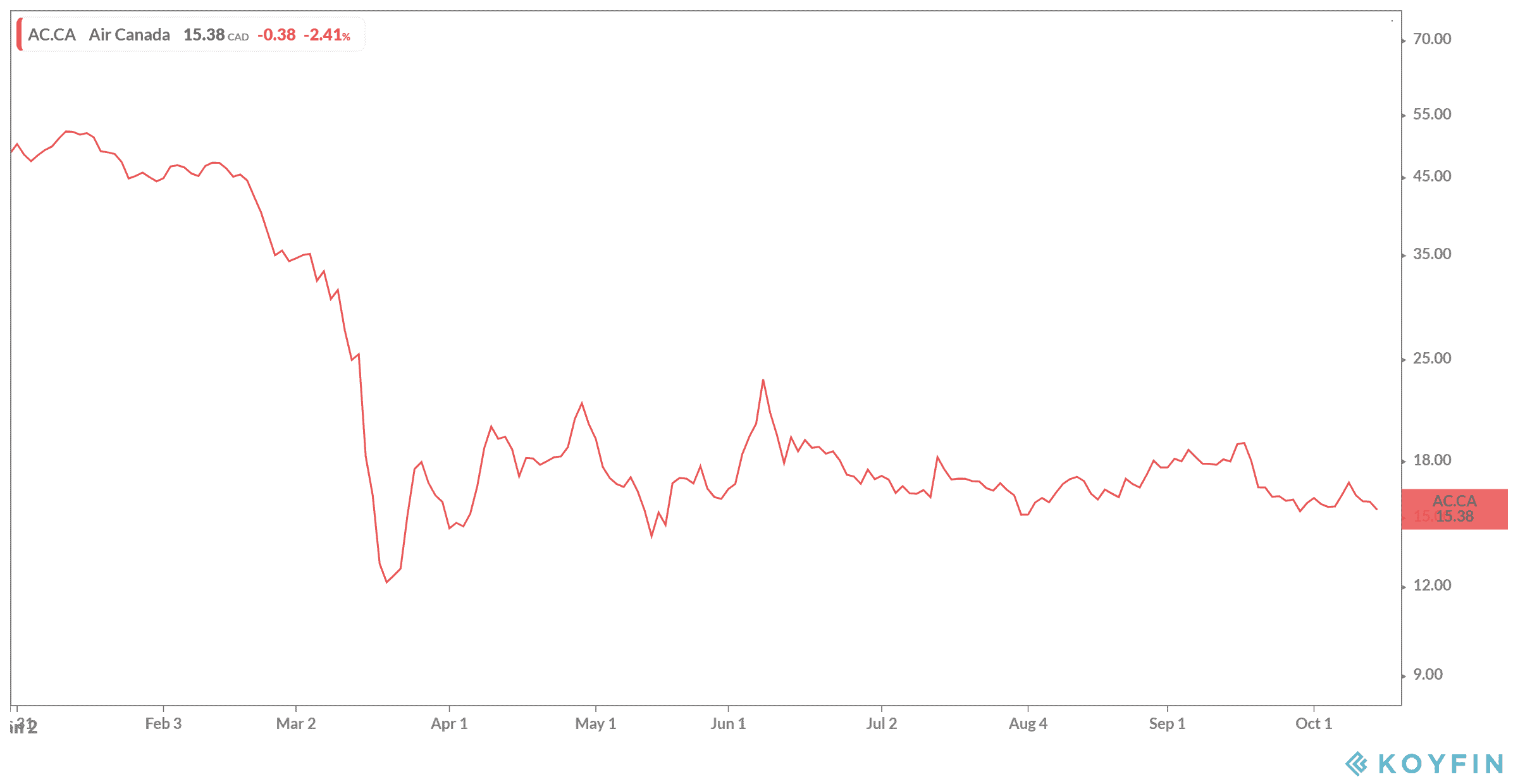

Beyond that, the company reinvested in its infrastructure. Air Canada bought a fleet of fuel-efficient airplanes to bring gas prices down. This would mean Air Canada could bring in as much revenue as possible, cutting way back on costs for gas. This all left Air Canada stock soaring to all-time highs around $50 per share!

The bad

Of course, then the pandemic hit. The virus meant a complete halt to air transportation, and that meant a halt to Air Canada stock. When the markets crashed, so too did Air Canada stock. But while other industries have made a comeback, Air Canada stock has struggled to get back to where it was.

The company now has total debt that reached $10 billion during the last quarter! That’s likely to continue soaring upwards, as the company still has flights grounded. Even with the company starting up some flights, it’s nowhere near where it was before the crash. Until the company can be up and running at full flight capacity, it won’t be able to even start cutting back on debt.

The ugly

Let’s say a vaccine came out tomorrow. The company would still have to wait until other countries get that vaccine. It would have to still make sure every person going on flights has the vaccine. It then will likely slowly introduce flights, not have everything online at once. Even then, it’ll take years to make up for the losses of having zero flights in the air.

It could take a decade to make up for the losses subjected to Air Canada. However, the company is strong. I don’t think it’s going to go under, but it’s going to take a long time to reach anything near normal. That makes right now an incredibly volatile time to pick up this stock. While any good news could send shares up, I would still stay away from Air Canada stock until it can start cutting back on debt.