As the TSX continues to show strength, despite the pandemic crisis, one cannot help but to be skeptical. The economic toll of the pandemic keeps rising. This makes a stock market crash seemingly inevitable. So, if you’ve got $3,000, here are three stocks to buy if and when the market crashes.

Canadian National Railway: A stock to buy for long-term stability and growth

Canadian National Railway (TSX:CNR)(NYSE:CNI) embodies most of what we should look for in a stock. The company has a wide moat, little competition, and a business that is essential to the functioning of the Canadian economy. The Canadian railways transport more than $250 billion of goods annually from a diversified list of sectors, such as the resource sector (grain crops), crude oil, manufactured products, and consumer goods.

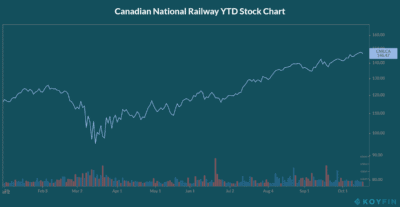

Today, Canadian National Railway stock is trading at 52-week highs. This is 15.5% higher than pre-pandemic levels, which seems unbelievable. I mean, revenue declined 10% in the first six months of 2020 and EPS fell 59%. And the pandemic has hit the economy hard, with a second wave threatening to hit it even harder.

But prior to this exceptional stock price performance, Canadian National Railway stock got hit in March as the pandemic hit. More specifically, CNR stock fell 24% to lows of below $96 in March. Check out the graph below for this price action.

Finally, I would like to highlight Canadian National Railway’s resiliency, which is part of what makes it a top stock to buy. These are extremely difficult times. Yet, CN Rail managed to generate $1 billion in free cash flow in the second quarter and $1.6 billion in free cash flow in the first six months.

Investing $1,000 in Canadian National Railway stock when the market crashes would be a solid move. $1,000 invested in the stock at March lows would have generated a return of 53%. In my view, investors will have the chance to capture this type of return again for CNR stock if the market crashes.

Canadian Pacific Railway: A stock to buy if the market crashes

Like Canadian National Railway stock, Canadian Pacific Railway (TSX:CP)(NYSE:CP) stock is trading at 52-week highs. It’s a similar story here, as the railways are behemoth companies with diversified revenues and wide moats. Also, the railways have become increasingly efficient over the years.

$1,000 invested in CP stock at its March lows of below $265 would have generated a return of 61%. If the market crashes again, I would snatch up this stock to buy for what I believe will be a similar return profile.

Toronto-Dominion Bank: A bank stock to buy if the market crashes

Canadian banks are the lifeline of the economy. They support businesses and consumers, and ultimately, economic growth.

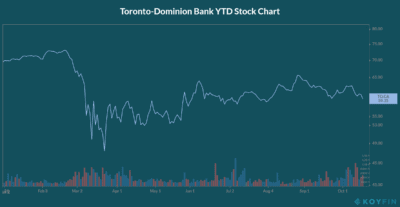

Toronto-Dominion Bank (TSX:TD)(NYSE:TD) is Canada’s second-largest bank by market capitalization and assets under management. It is a bank that has a stellar performance record with a strong dividend history of returning cash to shareholders. Today, Toronto-Dominion Bank stock is trading 22% lower than pre-pandemic levels. The stock hit a low of below $50 in March.

This kind of volatility is unusual for Toronto-Dominion Bank stock. This is because TD Bank is a high-quality bank, with an industry-leading ROE. It has a healthy risk culture, it offers stability, and has plenty of financial strength. But these are unusual times.

If the stock gets hit again in another market crash, I suggest buying. $1,000 invested in TD Bank stock at lows of $49.28 in March would have generated a 20.4% return, or a gain of $204. The next market crash will likely provide a similar type of opportunity.

Motley Fool: The bottom line

Investing $3,000 in Canadian National Railway stock, Canadian Pacific Railway stock, and Toronto-Dominion Bank stock when the market crashes would be a smart way to deploy capital. When the market is in a panic and in a market crash, buying these three quality stocks will prove to be a money-making move.