It looks like oil and gas stocks have finally been put to task. It’s been years in most cases since oil and gas companies in Canada performed in an upward direction. Shares have plummeted since about 2017, when a glut in oil and gas sent prices plummeting.

Fast forward to today, and things are even worse. You have a country plagued by a pandemic. This has caused multiple problems for energy companies. These companies cannot produce at full capacity, which means any oil they can sell is still sitting in the ground. Meanwhile, any government funds that would have provided a bailout are going towards the health of Canadian citizens. So, it could be years until the sector sees any real help.

What’s happening instead is pretty much forced consolidation in Canada. Whether companies want to or not, each will have to find a way to survive. That is likely to turn into a wave of acquisitions in the near future. And it’s already begun.

Cenovus

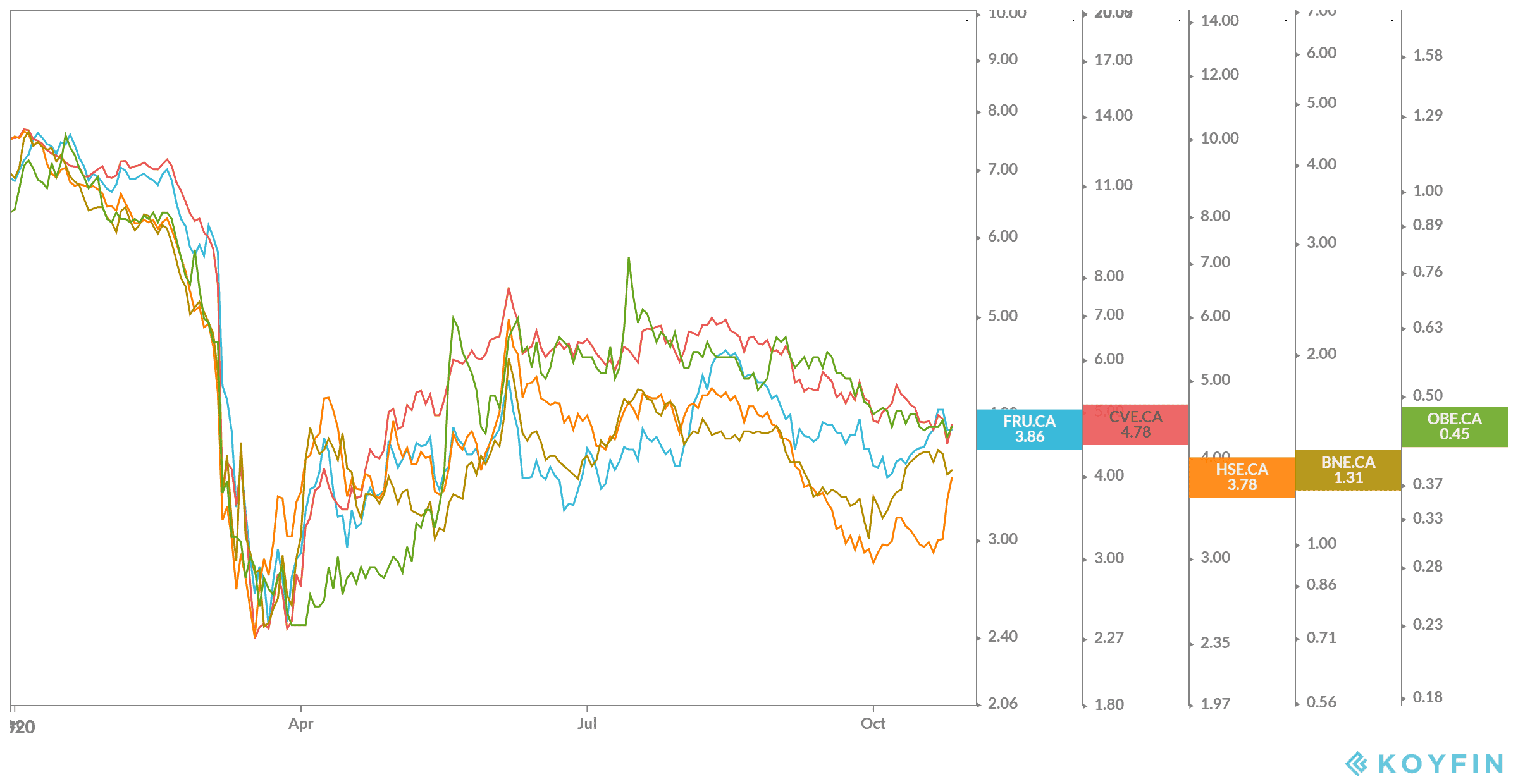

Canadian oil and gas producer Cenovus Energy (TSX:CVE)(NYSE:CVE) agreed to buy rival Husky Energy (TSX:HSE) in a deal for $3.8 billion. To deal would create Canada’s third-largest oil producer. The deal is the latest in a series of deals both in Canada and the United States as oil and gas companies consolidate.

The acquisition created a solution for Cenovus to also acquire refineries, pipelines and storage, removing exposure to West Texas Intermediate and Western Canada Select differentials. This would create huge discounts in the future for the company.

The news didn’t send Cenovus any higher, as the company is taking on debt in a risky situation, but Husky stock went up by 20% after the news. If Cenovus can prove what it’s saying will work, this share movement may only be getting started.

Obsidian

While Cenovus has already made an acquisition, there are other companies that are ripe for the picking. Another company that could be next on the acquisition table is Obsidian Energy (TSX:OBE)(NYSE:OBE). Obsidian has been talking about acquiring Bonterra Energy (TSX:BNE) since August, with an update coming out on Oct. 14.

The goal is similar to the Cenovus merger, where Obsidian and Bonterra would share costs, but Bonterra would become a part of Obsidian Energy. This would be to drive down cost and synergize production. Obsidian believes shares in Bonterra will drop 375% as management takes on more debt, unless the company agrees to Obsidian’s offer. It could be very soon that we see the offer finally go through.

Freehold Royalties

Finally, another company up for acquisition is Freehold Royalties (TSX:FRU). Freehold doesn’t keep it a secret that it mainly grows through acquisition, managing the royalties it acquires. This has kept risk lower for investors, while remaining one of the largest portfolios of royalty lands in Canada at 6.7 million gross acres.

As royalty interest owners, the company doesn’t pay capital costs for drilling and equipment or even operations and maintenance. The company simply receives a percentage of production. There are many wells out there where smaller producers will need a company like Freehold. So, expect this company to be around for years to come.