TFI International (TSX:TFII) — the Montreal-based trucking and logistics company — released its third-quarter earnings report on October 22. Investors largely reacted positively to its quarterly results as its stock rose by 3.8% the next day. Let’s take a quick look at its recent stock price movement before finding out if its stock is worth buying after its latest report.

TFI International’s stock

After falling by 29% in the first quarter, TFII stock rose by 55% and 15% in the second and third quarters, respectively. Interestingly, the stock posted its all-time high of $66.57 earlier this week on Monday.

While the company’s stock seems to be on a downward trajectory in the last couple of days, it’s outperforming the broader market by a wide margin on a month-to-date basis. In October, TFI International has risen by 18.6% compared to a 0.9% drop in the S&P/TSX Composite Index. Its stronger than expected third-quarter earnings and raised 2020 outlook could be two key reasons for this optimism.

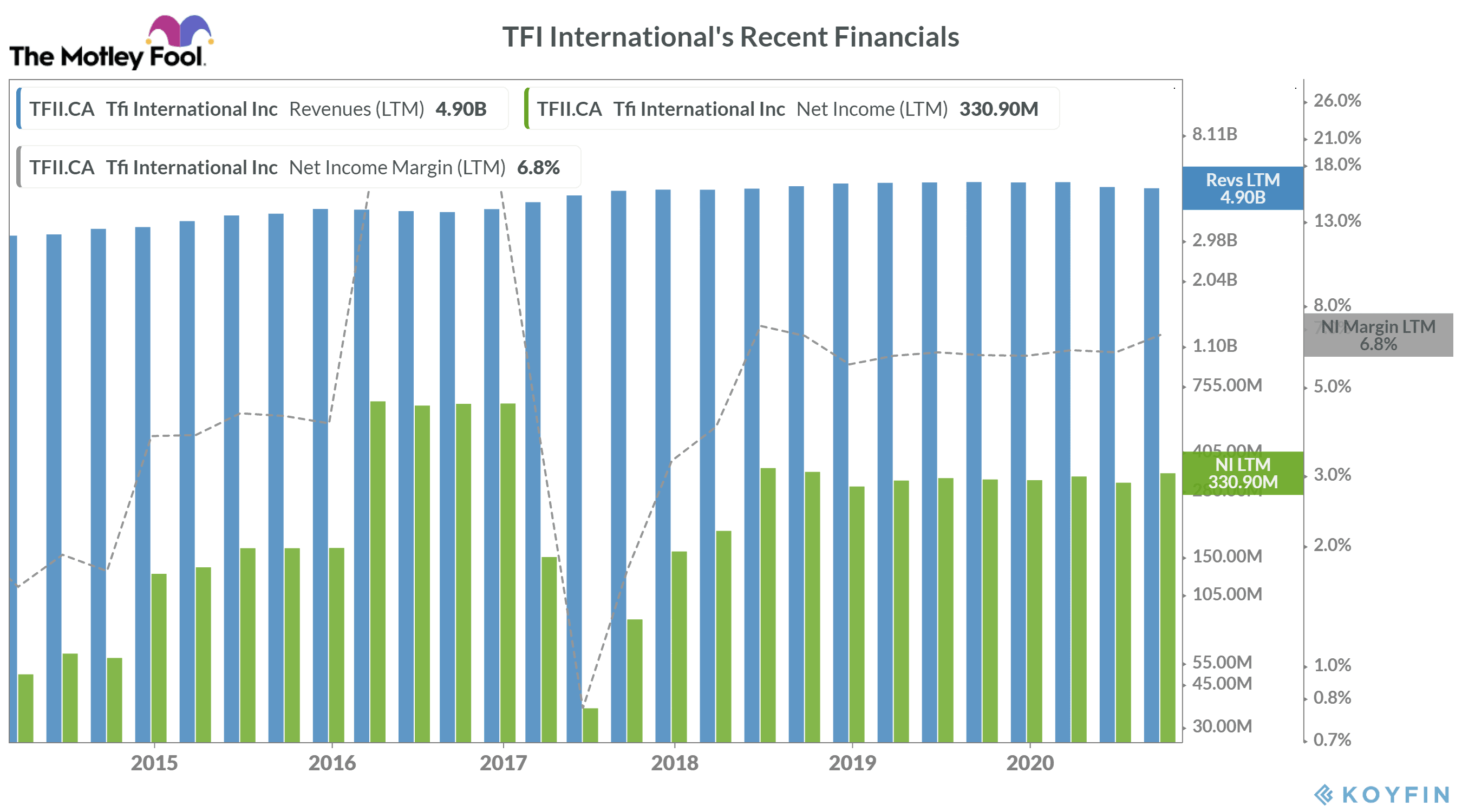

Trend in financials

In Q3 2020, TFI International posted earnings per share of $1.25 — with a rise of 20.2% from $1.04 in the previous quarter. It was 20.2% better than the earnings per share of $1.04 a year ago and much higher than Bay Street’s EPS expectation of $0.91.

The company reported a 12.7% sequential rise in its total revenue to $1.3 billion during the quarter, but it fell by 4.4% on a year-over-year (YoY) basis. It was the second consecutive period when its quarterly revenue fell.

Rising profits could help boost investors’ confidence

TFI International’s operating income rose by nearly 18% YoY to $156 million on the positive side. Similarly, it posted adjusted EBITDA of $252.3 million — up 8.7% from the previous quarter and 13.9% higher than a year ago. As a result, its adjusted EBITDA margin stood at 20.2% in the last quarter. In Q3, TFI International’s adjusted EBITDA rose sequentially for the second consecutive quarter.

More important, TFI International’s bottom-line margin rose to 9.3% in Q3 2020 compared to just 6.1% in the third quarter of last year. Its plan to drive operating efficiencies and the government wage subsidy of $8 million positively impacted its overall profitability in the last quarter.

Outlook optimism

Despite experiencing COVID-19 related headwinds in the first quarter, TFI International raised its 2020 outlook last week. Now, the company expects its full-year earnings to be at least $4 per share — higher than $3.94 in 2019 and its previous guidance range of $3.40 to $3.75 as its 2020.

Moreover, the management expects the company to achieve a minimum of $600 million of free cash flow, which is also significantly higher than its previously given expected range of $425-$460 million.

Is its stock worth buying right now?

On a year-to-date basis, TFI International stock has risen by over 48% so far — outperforming the broader market as well as many of its peers. After touching its all-time high earlier this week, its stock seems to be heading downward to test a support level near $60.40. Nonetheless, the overall price trend still remains strongly positive. Medium to long-term investors may consider buying its stock on dips.