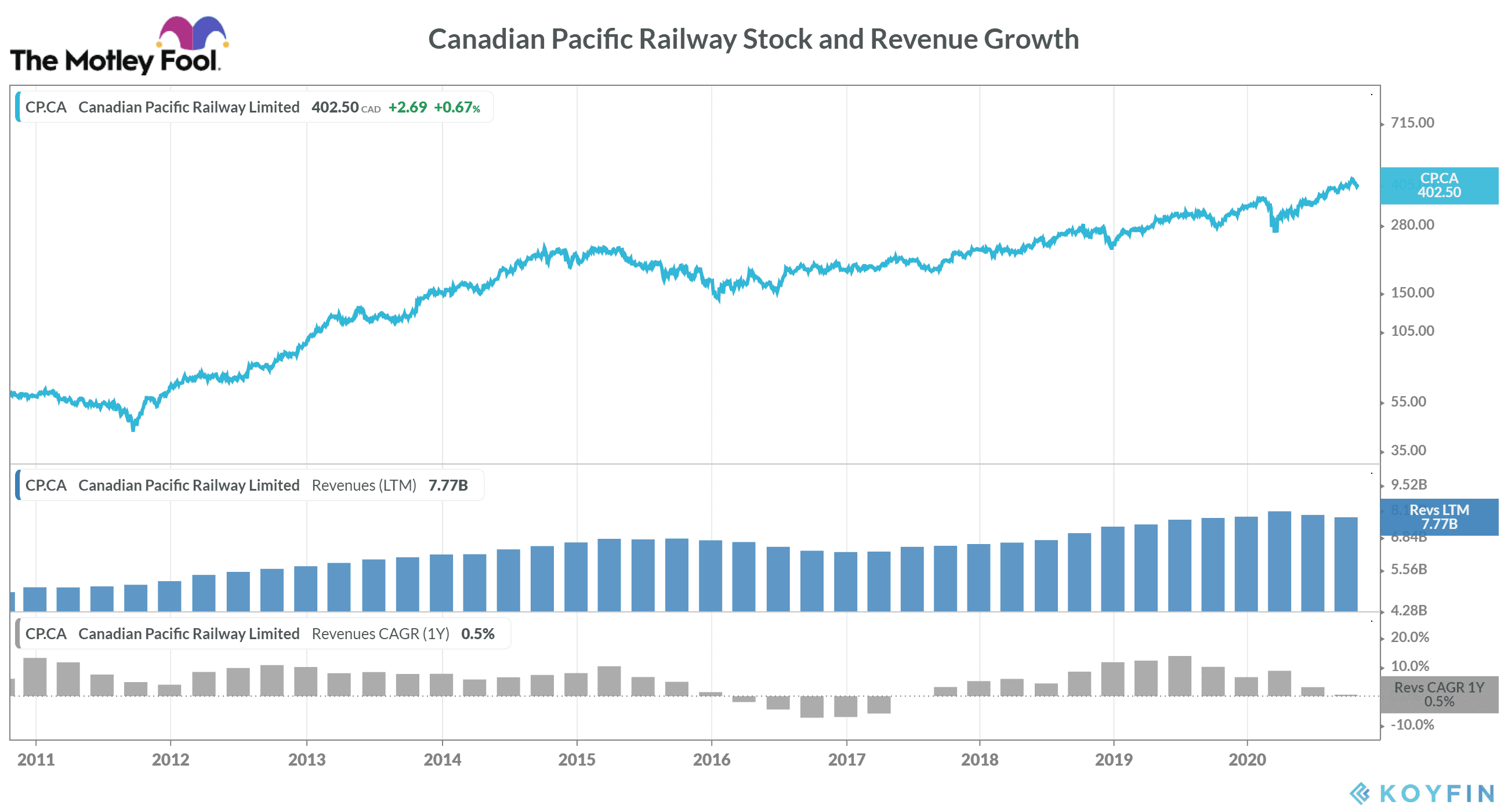

Canadian Pacific Railway (TSX:CP)(NYSE:P) has impressed investors by yielding a solid positive return in the last few months. Earlier this month, the shares of this key transcontinental freight railway operator were trading with about 70% gains from its March 2020 low.

However, CP stock seems to have reversed its positive trend as it has lost nearly 8% in the last 10 days. The company released its Q3 results last week. Let’s find out what possibly might have hurt investors’ sentiments during the event and turned its stock downward.

Canadian Pacific Railway’s Q3 results

In Q3 2020, Canadian Pacific Railway posted $4.12 earnings per share — with a 1.2% rise from $4.07 in the previous quarter. However, it was 10.6% lower than its $4.61 EPS in the third quarter of 2019. The company’s earnings also missed analysts’ consensus EPS estimate of $4.23.

In the quarter ended September 2020, the YoY decline rate in Canadian Pacific Railway’s doubled compared to the previous quarter. Previously in the quarter ended in June, its EPS fell — at a comparatively slower pace — by 5.3% YoY. These results disappointed investors, and its stock fell by 1.3% on the day of its Q3 earnings release.

Interestingly, Canadian Pacific’s home market peer TFI International registered a handsome 20.2% YoY increase in its third-quarter earnings and also managed to beat analysts’ estimates by a wide margin.

What affected CP’s earnings?

In the third quarter, the Canadian Pacific Railway reported a 23% decline in coal volumes revenue, while its revenue from energy, chemicals, and plastics portfolio fell by 16%. The company’s revenue from metals, minerals, and consumer segment also tanked by 25% YoY. As a result, its total sales were down 6% YoY — affecting its overall financial performance for the quarter.

Also, a sequential rise in its expenses added to investors’ worries. During the quarter, CP’s operating expenses rose by 6.1% sequentially to $1.08 billion, and these expenses were also slightly higher than analysts’ expectations.

Weakening profitability

In the third quarter, Canadian Pacific Railway posted an adjusted EBITDA of $974 million — down 7.6% YoY. It was the second consecutive quarter when the company’s adjusted EBITDA fell on a YoY basis.

As a result, its Q3 adjusted net profit margin contracted to 30.1% from 32.3% a year ago.

CP stock rally might be over

During its third-quarter earnings event, Canadian Pacific Railway’s management slightly raised its 2020 outlook. However, the overall outlook still remains dismal as the company still expects a low single-digit decline in revenue ton-miles for the year.

Given that many of its peers — including TFI International — have also recently raised their 2020 outlook, I don’t see a minor improvement in Canadian Pacific’s outlook to be a big positive factor. The declining revenue and rising struggle on the profitability side could potentially halt its stock rally — at least for the near term.

It would be wise for investors with short to medium-term goals in mind to exit their CP stock position and rather buy some other undervalued TSX stocks.