On Wednesday, Suncor Energy (TSX:SU)(NYSE:SU) — the Calgary-based integrated energy company — reported its dismal Q3 2020 results. The event triggered a massive sell-off in its stock as it fell by 5.2% for the day.

Suncor Energy stock

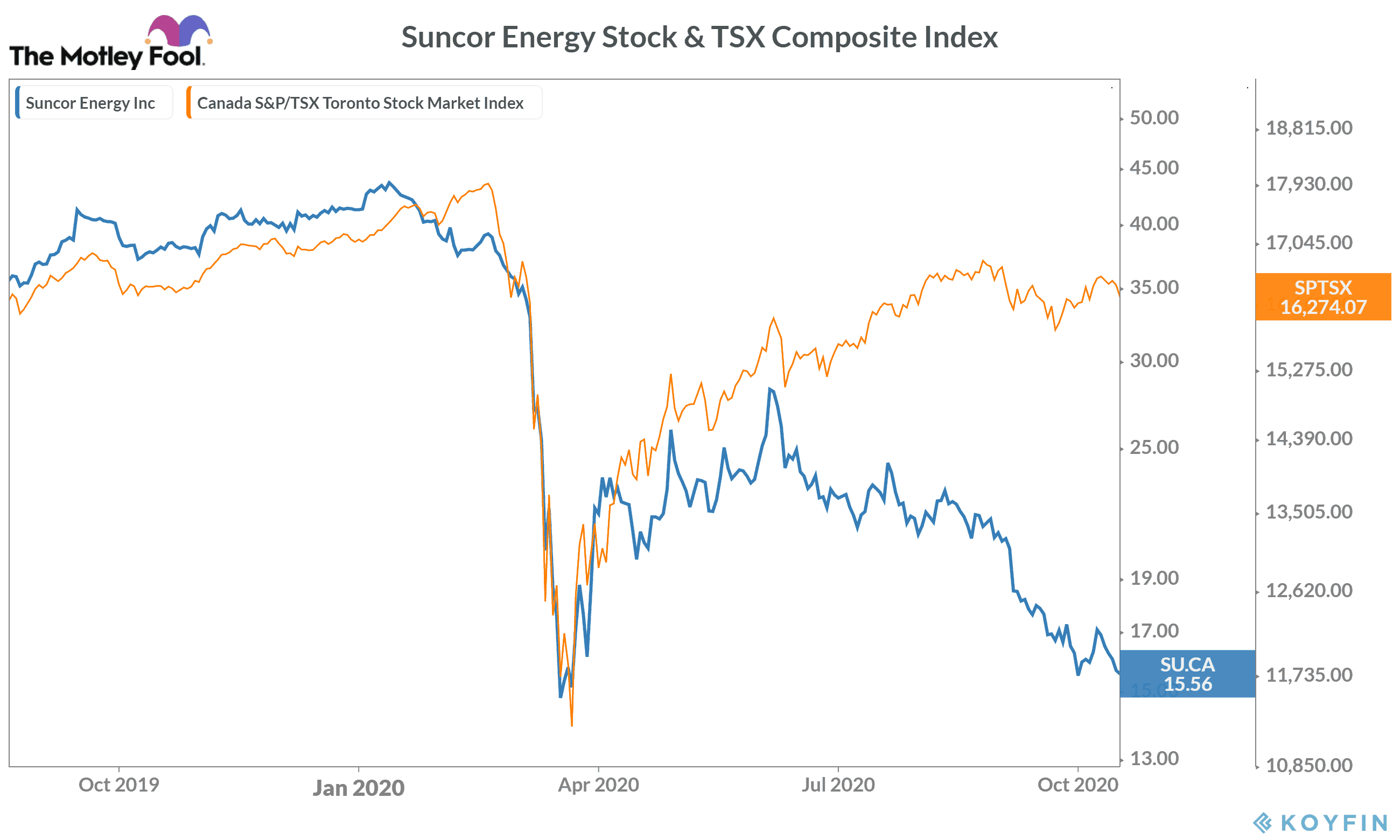

The year 2020 is proving to be terrible for Suncor Energy investors, as its stock has tanked by about 65% so far. The stock has underperformed the broader market as well as most of its peers.

The S&P/TSX Composite Index is currently trading with about 8.2% year-to-date losses. The shares of other energy firms such as Whitecap Resources and Seven Generations Energy have slipped by 56% and 47%, respectively. During the same period, its other peer Tourmaline Oil has risen by 13%.

Disastrous Q3 results

In Q3, Suncor Energy posted an adjusted net loss of $0.20 per share against a profit of $0.72 per share in the same quarter last year. Bay Street analysts were expecting the company to report a less steep loss of around $0.12 per share.

Notably, it was the sixth consecutive quarter when the company’s earnings missed analysts’ expectations and the third quarter in a row when its earnings fell on a year-over-year (YoY) basis.

In the quarter ended September 2020, Suncor’s revenue was at $6.5 billion — about 35% worse than $9.9 billion in Q3 2019. The revenue also missed Bay Street’s expectation of $7.2 billion.

Similarly, the company’s adjusted gross profit of $2.33 billion was about 64.1% worse than the $6.49 in the same quarter of the last year.

Big losses

Suncor Energy continues to report massive quarterly losses. In Q3, it posted an adjusted net loss of $302 million compared to a $1.1 billion profit in the same quarter of 2019. Lower energy demand amid the pandemic — along with narrowing cracking margins — took a big toll on Suncor Energy’s bottom line in the last quarter.

No hopes of an immediate relief

Due to its ongoing struggle, Suncor plans to cut its total workforce by 10-15% in the next 18 months. However, these layoffs aren’t likely to have an immediate positive impact on the company’s financials.

While Suncor Energy’s management expects its operating performance to improve in the fourth quarter, most analysts don’t see that happening. Analysts estimate Suncor Energy to post a $212 million loss in the fourth quarter, which would lead to a massive $2.1 billion losses for the full year 2020.

The stock could fall below $10

As of October 29, Suncor Energy stock is trading at $15.09 per share. It’s currently hovering right above the major support level around $14.20 — formed back in 2002. A violation of this support level could trigger a massive sell-off in the stock and take prices further down towards the next support level of $9.60.

On the macro side, a prolonged pandemic along with predictions of a major economic slowdown are some of the factors that could keep energy demand low — at least in the coming few quarters. Low energy demand would certainly make Suncor Energy’s financial recovery plan more challenging. These are some of the reasons why I believe Suncor Energy stock could be headed towards $10.

It would be wise for investors to keep a close eye on the $14.20 support level and exit Suncor Energy stock position if it falls below this level. Instead, you can invest in any of undervalued TSX stocks right now.