Enbridge (TSX:ENB)(NYSE:ENB), the first operator of oil and gas pipelines in North America, announced Friday a 4% increase in its net profit in the third quarter, a result a little lower than what analysts expected.

Enbridge reports $990-million third-quarter profit

For the three-month period ended September 30, the Calgary-based group posted net income of $990 million, up from $949 million a year ago.

The pipeline company says the profit amounted to $0.49 per share for the quarter ended September 30, up from $0.47 per share a year earlier.

The group indicated in a press release that it has taken advantage of high utilization rates in the transport and distribution of gas and in renewable energies (wind and solar).

Enbridge notably reported on progress in the realization of two large offshore wind projects in France, those of Saint-Nazaire and Fécamp, with a respective capacity of 480 and 500 megawatts. It also plans to make a final investment decision for a third project in France in 2021.

Quarterly revenue was down sharply to $9.1 billion, from $11.5 billion a year ago.

In the third quarter, the pandemic led to a decrease in demand for oil in North America, which resulted in lower volumes transported on the group’s main pipeline between the provinces of Alberta and Ontario through the American Great Lakes states.

Volumes averaged 2.5 million barrels per day through this pipeline in the third quarter and are expected to remain below pre-pandemic forecasts in the fourth quarter.

Enbridge posts 14.5% drop in adjusted profit

Excluding special items, profit for the quarter stood at $961 million or $0.48 per share, down from an adjusted profit of $1.12 billion or $0.56 per share a year earlier. Analysts on average had expected a profit of $0.53 per share, according to financial data firm Refinitiv.

Enbridge, however, says it is on track to achieve $300 million in cost savings in 2020.

The group anticipates a gradual strengthening of energy demand in 2021. In its outlook, Enbridge says it expects its distributable cash flow per share to be near the midpoint of its initial range of $4.50 to $4.80.

It says the outlook reflects its strong performance in the first nine months of the year, cost savings, as well as some offsetting headwinds anticipated in the fourth quarter.

Al Monaco, President and Chief Executive Officer of Enbridge, commented on the third-quarter results: “While we are encouraged by the economic activity and recovery in energy demand, we are assuming a gradual pace of recovery over the balance of 2020 and into 2021.

Notably, the early and decisive actions we took to protect the health of our people and mitigate both the operational and financial impacts to our businesses have positioned us for the future.

Each of our core businesses performed well in the third quarter. Utilization levels in our Gas Transmission, Gas Distribution, and Storage and Renewable Power businesses all remained strong and their robust commercial underpinnings continue to deliver reliable cash flows which reflect the low-risk pipeline-utility business we’ve been talking about.”

The company also said it is setting new environmental, social, and governance goals.

It includes an interim target to reduce GHG emissions intensity by 35% by 2030 and achieve zero net GHG emissions by 2050.

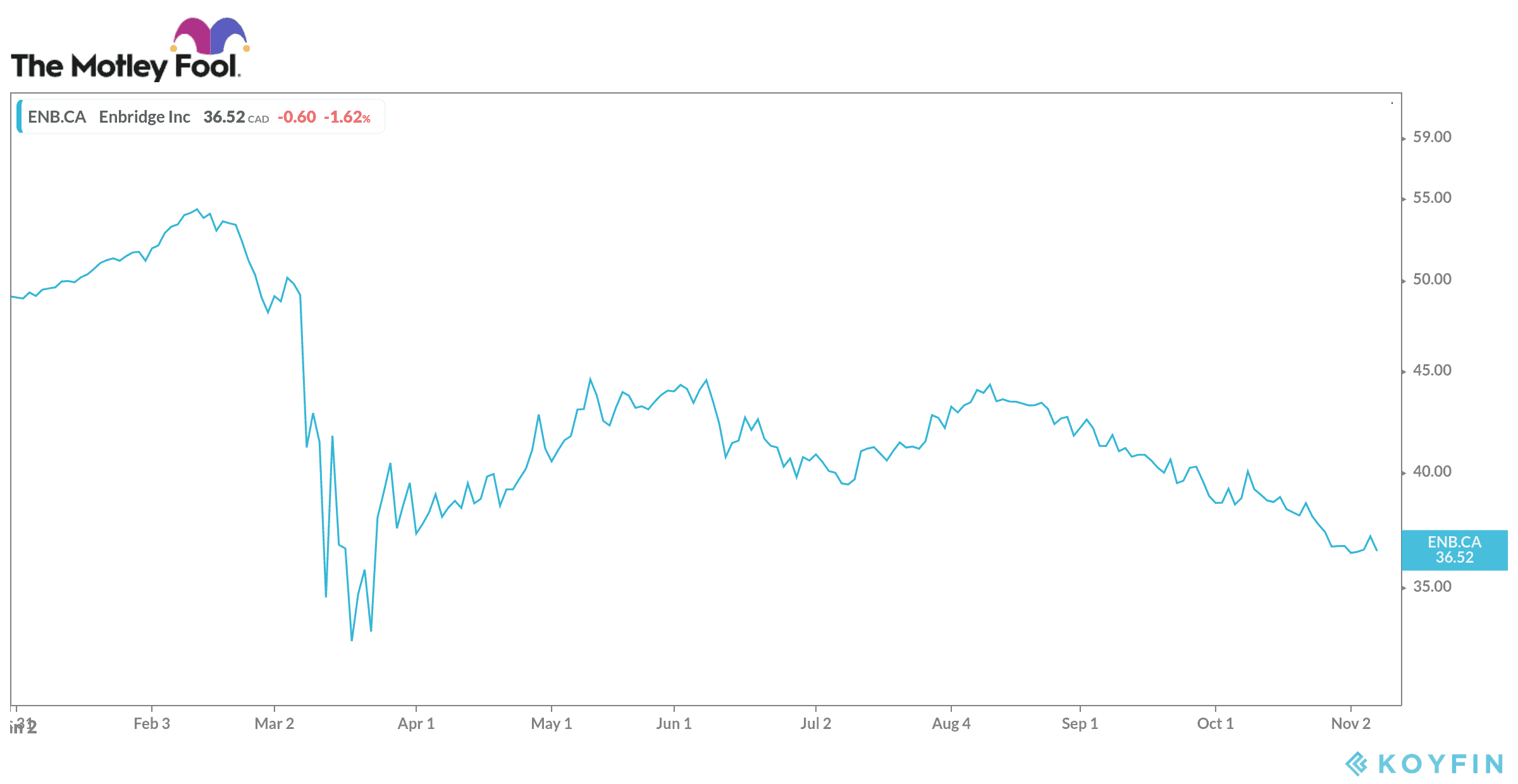

The pipeline stock is a bargain

2020 was a tough year for Enbridge, but things should improve in 2021. Enbridge is a buy in my opinion. Plus, investors can count on an interesting dividend yield of 8.8% while they wait for the stock to recover. Enbridge stock is a bargain, having dropped almost 30% year to date.