Warren Buffett-led Berkshire Hathaway disclosed its stake in Canadian miner Barrick Gold (TSX:ABX)(NYSE:GOLD) in August. It’s turning out to be one of the best-performing stocks in the conglomerate’s investment portfolio.

Barrick Gold reported its third-quarter earnings yesterday. Driven by higher gold production and higher prices, the miner’s adjusted earnings increased by a massive 175% compared to the same quarter last year. Barrick Gold stock surged more than 7% after beating consensus estimates for Q3.

Barrick Gold: Another solid quarter

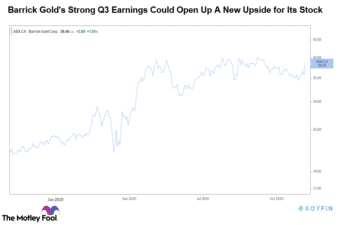

It seems like the legendary investor, the long-time disdain of the yellow metal, entered the gold play at the right time. Barrick Gold stock is up more than 25% since June this year. Global investors turned to safe-haven gold this year amid broad market uncertainties and pandemic-driven recession fears.

Gold prices have soared around 30%, while gold-miner stocks at large have gained 40% so far this year. Barrick Gold stock has outperformed both by a wide margin, gaining 60% in the same period.

Interestingly, Barrick Gold CEO Mark Bristow thinks the precious metal could continue to rally. As more and more developed economies continue to print money, gold will rally to new peaks, he added. Higher gold prices will likely boost miners’ earnings for the next few quarters, ultimately increasing their stock prices.

Warren Buffett and Barrick Gold

Warren Buffett invests in companies with sound fundamentals and stable earnings and dividends. Barrick Gold precisely fits into those categories. The gold miner has been aggressively repaying its debt in the last few years and strengthening its balance sheet.

At the end of the third quarter of 2020, Barrick had net debt of $417 million, substantially decreasing from over $10 billion in 2014. Mining is a capital-intensive business, and Barrick Gold’s solid net-debt position is a big positive for shareholders.

A record amount of cash generation triggered yet-another generous payout hike for Barrick Gold shareholders in Q3. The company declared a dividend of $0.09 per share for the fourth quarter of 2020. This marked an almost 140% dividend increase in 2020 compared to the last year.

Peer miner B2Gold stock has soared 75% YTD

Notably, almost all the gold miners are reporting record profits this year. Another Canadian miner, B2Gold (TSX:BTO)(NYSE:BTG), a relatively smaller peer, posted a 320% increase in its net income for the third quarter.

It operates three mines in West Africa and aims to produce over 1 million ounces of gold this year. In comparison, Barrick Gold intends to produce 4.6 million to 5 million ounces of gold in 2020. Both are on track to meet the production guidance for 2020.

Interestingly, B2Gold also has a strong balance sheet with a small amount of debt. It has been aggressively increasing dividends for the last few quarters. It yields 2.4%, higher than Barrick Gold and peer miners.

Gold miner stocks have significantly outperformed broader markets this year. Many of them look expensive from the valuation standpoint after their steep rally recently. Notably, Barrick Gold stock looks overvalued compared to B2Gold and even to the industry average.

However, a company that’s growing at an above-average rate and that has solid fundamentals validates a premium valuation. The legendary investor could continue to reap significant benefits on this gold play at least for the next few quarters.