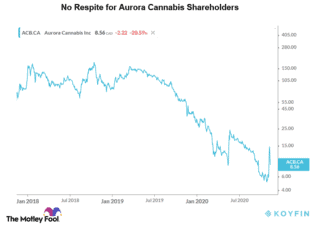

Top cannabis stocks were on a roll last week. One of the giants, Aurora Cannabis (TSX:ACB)(NYSE:ACB) stock, surged big on U.S. election results. However, the euphoria waned after the company reported its quarterly results this week. The stock tanked more than 26% on November 10 after soaring a massive 110% in the earlier three sessions. Worryingly, the weakness seems far from over.

Aurora Cannabis: FY 2021 Q1 earnings

Aurora Cannabis reported net revenues of $67.8 million for the quarter ended September 30, 2020. This was flattish growth compared to the prior quarter but a considerable drop compared to the year-ago period.

During 2017 and 2019, the leading pot grower was doubling revenues every few quarters. However, its top-line growth has become more unstable in 2020. Net loss from continuing operations came in at $107 million in comparison to $11 million profit in the comparable quarter last year.

Peer cannabis company Canopy Growth (TSX:WEED)(NYSE:CGC) also released its quarterly report early this week. It reported record revenues of $135 million — a 77% increase year over year. Canopy Growth reported a net loss of $96.5 million for the quarter, improving from the year-ago loss of $225 million. The stock has fared relatively better, gaining 25% thus far in 2020.

The pot giant aims to turn cash flow positive in FY 2021

Aurora Cannabis management certainly faces the moment of truth, as the company aims to turn EBITDA positive in the next quarter. It has been working on several cost-cutting measures to achieve the same. However, with dwindling revenues and limited avenues to cut costs, turning EBITDA positive seems like an uphill battle for Aurora Cannabis.

Many cannabis players are jumping into the emerging U.S. market to recoup the historical revenue growth. However, how Aurora manages to grow south of the border remains to be seen, especially when it has limited avenues to raise capital.

The company has raised funds through public offering numerous times in the recent past. This has significantly diluted shareholder wealth in the last few years.

What’s next for ACB stock?

Aurora Cannabis stock has lost nearly 65% so far in 2020. It is currently trading at a price-to-sales valuation of five times based on the next 12-month estimates. This seems overvalued considering the lacklustre revenue growth in the last few quarters. In comparison, Canopy Growth stock looks exorbitantly overvalued with its price-to-sales ratio beyond 20 times.

In the last three years, Canopy Growth stock has returned almost 87%, while Aurora has lost 70%.

Certainly, there is a higher possibility of cannabis legalization in the U.S. under President-Elect Joe Biden. However, cannabis players like Aurora will have to tackle more severe challenges like the dominating black market and high cash burn rate till then.

Aurora Cannabis stock has been trading at a sizeable premium for a long time now. The stock looks far too risky, given the underlying uncertainties and concerns over its profitability. The recent gains might evaporate soon, and the stock could continue to trade weak in the short to intermediate term.