People around the world had a few major events this weekend. The world was introduced to the next president-elect when Joe Biden won the United States election. But there’s even bigger news that came out, with a new COVID-19 vaccine potentially coming available in the new year.

The vaccine could potentially be 90% effective. While it’s unclear when it could be available, and to Canadians in particular, it sent investors into a flurry. A COVID-19 vaccine could mean a return to normalcy. While many stocks soared at the news, there were a few that sunk. While the news is great for everyone, those able to take advantage of a work-from-home economy might see a shrink in revenue.

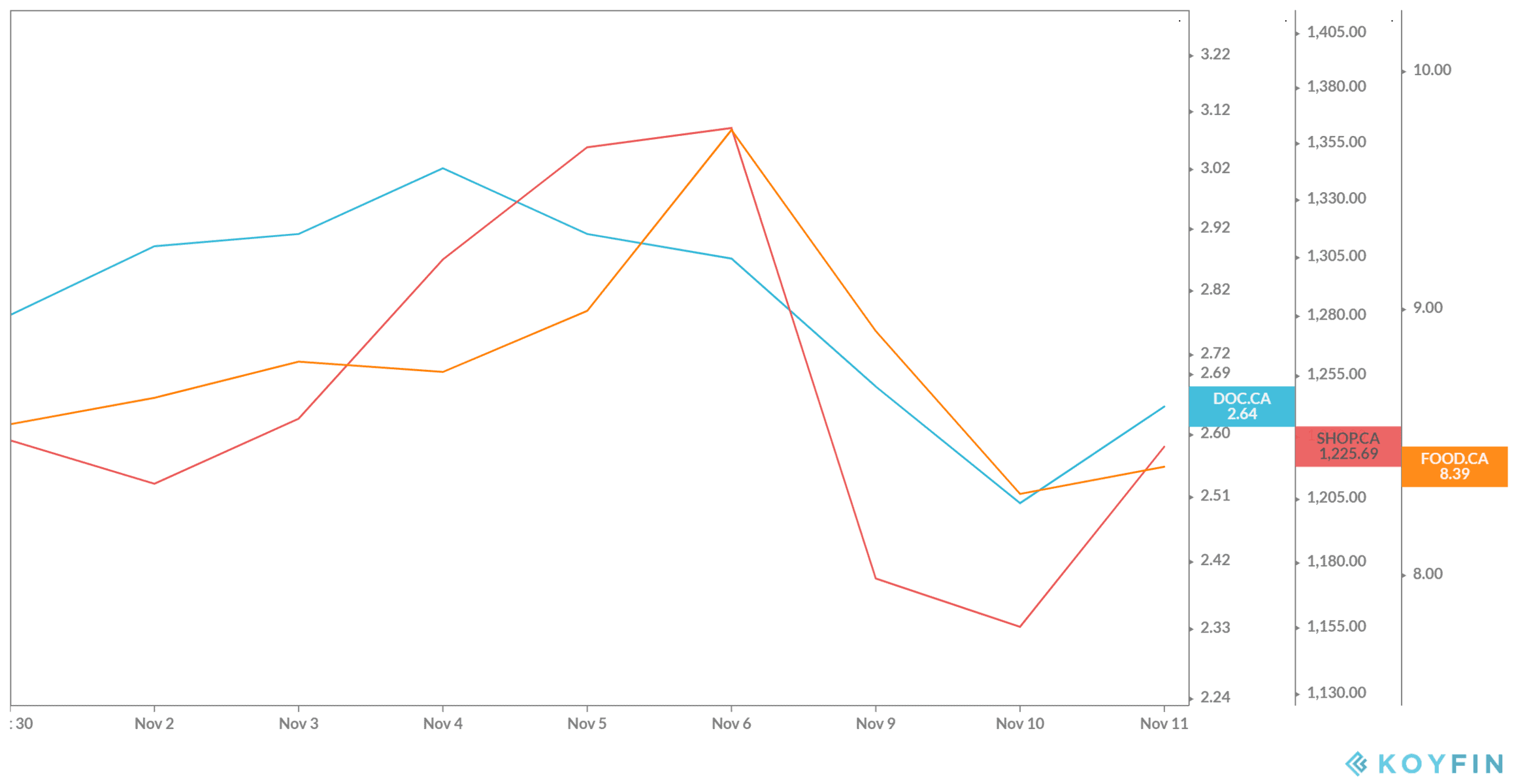

This could be the reason behind a slump from companies like Shopify (TSX:SHOP)(NYSE:SHOP), Goodfood Market (TSX:FOOD) and CloudMD Software & Services (TSXV:DOC).

Shopify

Shopify

Canadian e-commerce giant Shopify has had a banger year. The company was already soaring before the pandemic. However, after a brief drop in share price, the company just kept growing and growing in share price. Even analysts who predicted a crash in share price to around $200 had to up that amount. It looks like the triple-digit days are behind this company.

However, shares in Shopify stock sunk by about 15% from the COVID-19 vaccine news. While many businesses have moved more business online, it’s likely that there will be a shrink in subscription revenue moving forward. However, let’s not forget the company hasn’t had problem with revenue before. In fact, most recently that revenue hit a year-over-year increase of 74%!

And while it might not be that high in the future, it could very well continue in those high double digits for some time to come. In fact, this could be the chance to buy up this booming stock before the next share price jump — especially with more enterprise clients coming on all the time.

Goodfood

Another company that saw a boost in subscriptions is the meal-kit industry. As Canada’s top meal-kit delivery service Goodfood has seen its shares double during the crisis. But with people looking to the future and potentially not needing the service anymore, shares sunk by about 18% with the news of a COVID-19 vaccine.

But again, Goodfood wasn’t born out of a work-from-home economy. It’s part of a multi-billion-dollar industry that is still in its infancy. In fact, with a market cap of $542 million as of writing, it still has plenty of room to grow to reach its peers across the world. Revenue was up another amazing 79% year over year during the recent quarter, and it’s very likely this will continue to grow, as more people move towards meal-kit delivery, pandemic or not.

CloudMD

Finally, CloudMD provided a service that was pretty much essential during the pandemic. Instead of going to a doctor, a doctor could come to you. Virtually, that is. Not just physicians but residents, physiotherapists, mental health experts; everything you need for healthcare. The company has been acquiring virtual businesses ever since, with an annual return of 595% as of writing.

Yet this company, too, saw a drop with a COVID-19 vaccine. That’s because people think they might actually return to the doctor after this is over. But will they? It’s far more convenient to ask a simple question of a doctor within minutes from a variety of experts from your home. And it’s safer for everyone involved. So, it’s likely the company will continue to grow for years to come.