Airline stocks continue to offer investors massive discounts and have subsequently been some of the most popular stocks on the TSX over the last few months as savvy investors scour the markets for deals. In addition to Air Canada (TSX:AC), investors have also considered other airline stocks, even the potential to gain exposure to WestJet.

WestJet, of course, no longer trades as a stock. The company was acquired by ONEX Corporation (TSX:ONEX) back in late 2019.

Since ONEX trades on the TSX, though, investors can gain exposure to WestJet and the eventual rebound the airline stock will have when the economy finally turns around.

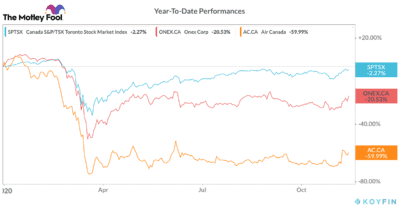

As you can see, ONEX stock has significantly underperformed the TSX this year, in large part due to WestJet weighing down its consolidated operations. It’s also clear, though, that the stock has held up much better than Air Canada, doing a better job at protecting investor’s capital.

This is the trade-off investors will need to decide on if you want to try and play an airline recovery. An investment in ONEX will almost certainly see a strong rally as the sector rebounds. However, it likely won’t be as big as Air Canada’s rally.

However, on the flip side, if things don’t pan out in the airline sector, and these businesses continue to suffer, investors in ONEX will see more of their capital protected.

There may be better options than Air Canada

Since the start of the pandemic, there is no question that the airline stocks of Air Canada, and ONEX due to WestJet, have been some of the worst-performing stocks on the market.

Not only did they see huge selloffs back in February and March, but the recoveries have been significantly less pronounced than many other TSX stocks that were impacted by the pandemic.

Because of this, airline stocks like Air Canada have been at the top of investors’ buy lists for months. And while the best option up until now for investors has been to take a wait and see approach, these stocks are some of the top candidates to outperform in the ongoing vaccine rally.

You could buy Air Canada, given that it’s the biggest company in the Canadian airline industry. However, while size can usually be a benefit, during the pandemic, it has weighed heavily on Air Canada. This is because it has more planes sitting idle than any of its Canadian competitors, meaning it’s losing more money each day the pandemic stretches on.

That’s why investors may want to consider exposure to WestJet through ONEX stock.

Should you buy ONEX stock for WestJet?

Investing in ONEX stock could pay dividends for investors, quite literally. In addition to gaining exposure to WestJet through the stock, investors will also be buying a diversified asset management company with a long track record of impressive returns.

ONEX owns several big-name companies in various industries, including ASM Global, Advanced Integration Technology, Celestica, etc. This portfolio of high-quality companies is crucial for investors. It’s what’s allowing the stock to perform much better than Air Canada.

These businesses are all being impacted less than air travel. So while WestJet’s operations struggle, ONEX’s stock doesn’t see the full extent of that. That’s why ONEX is a much safer investment and the top option for many investors today.

Bottom line

With the announcement of a second highly effective vaccine this morning, these airline stocks will almost certainly see some of the biggest gains on the market.

The only question is, do you want to own Air Canada for the maximum risk and reward? If not, then owning ONEX stock is your best option to take advantage of WestJet’s operational rebound in 2021.