Over the last few weeks, TSX stocks have been reporting their earnings for the third quarter of the calendar year. This earnings season is especially important to get an idea of how the pandemic is impacting a variety of businesses. Some stocks, such as those in the tech sector, have seen a tailwind from the pandemic.

While it will be crucial to see how all companies are faring, investors have been especially eager to see which tech stocks have been using this opportunity to grow their businesses.

The coronavirus pandemic has impacted life as we know it in almost every way imaginable. However, one way we have found to work around these issues caused by the pandemic is through technology.

These companies have the perfect opportunity to grow their market share and attract new users — users that these tech stocks will hope to retain, even after the pandemic is behind us.

Here are three TSX tech stocks that have smashed earnings already this quarter.

Payment-processing tech stock

The first stock on the list is one of the hottest tech stocks on the TSX: Lightspeed POS (TSX:LSPD)(NYSE:LSPD).

Lightspeed is a payment company that predominantly works with restaurants and retailers all around the world. In fact, the company has business operations in more than 100 countries worldwide.

While some investors were worried that its exposure to restaurants and retail might substantially impact the company, Lightspeed proved everyone wrong with blowout earnings last quarter.

The tech stock grew revenue 66% year over year and 26% quarter over quarter. It also acquired ShopKeep, a U.S. company with a payment business much like Lightspeed, which could create several opportunities for growth going forward.

All in all, the takeaway from earnings was strong, which is why the stock hit a new 52-week high in the aftermath of earnings.

Software stock

Constellation Software (TSX:CSU) is another popular tech stock that recently smashed earnings. The $30 billion company serves a wide variety of businesses and organizations, both in the public and private sector.

Constellation has long been one of the go-to tech stocks on the TSX. As with any company, though, the bigger it gets, the harder it becomes to grow as quickly. These days, the stock doesn’t offer as much growth potential as it used to. However, it’s a much lower-risk stock.

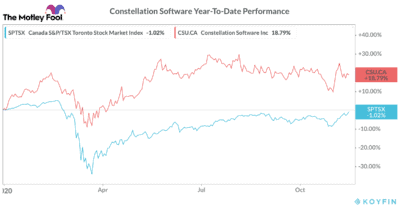

As you can see from its year-to-date performance, Constellation is a high-quality stock that investors can count on. Plus, it has the capabilities of posting impressive earnings like it did just a few weeks ago.

Despite being impacted by the pandemic, the tech stock still delivered 15% revenue growth and a whopping 50% increase in fully diluted earnings per share, showing just how strong its operations are.

E-commerce tech stock

The last stock on the list is none other than Shopify (TSX:SHOP)(NYSE:SHOP), the most popular tech stock on the TSX. If you’ve wanted to buy Shopify, this may be the perfect time to buy the dip.

The tech stock again showed why it’s one of the best Canadian growth stocks during its most recent earnings report. The company reported a massive year-over-year jump in revenue that came in just shy of 100% growth. It also pretty much matched the degree of growth Shopify saw in the second quarter (the first full quarter of the pandemic).

What’s even more impressive than Shopify’s revenue growth is the tech stock’s rapidly improving margins. This means that Shopify continues to become more profitable every time it grows its sales.

The stock has been under a little bit of pressure during the vaccine rally, now trading roughly 20% off its all-time high. However, as we’re on the brink of the holiday season and the second wave of the virus continues to get stronger, it looks as though Shopify still has a tonne of short-term potential to go along with its long-term growth prospects.

Bottom line

All three of these stocks once again confirmed their long-term potential with another strong quarter of earnings. They have the potential to earn investors huge returns in the long run. Plus, you maybe be able to get them at a discount, as they are temporarily sold off during the vaccine rally.