The current vaccine rally looks to be one of the best opportunities for investors to make money in 2020, after the recovery rally back in the spring. Investors have been scouring the market looking for any and all companies that may see a major rally as a result of the positive vaccine news. One of the most popular stocks Canadians have been considering is Air Canada (TSX:AC).

It’s been watched carefully by investors because it’s one of the top companies in Canada, in addition to being extremely cheap. So it’s understandable that Air Canada’s stock has been so popular throughout the pandemic.

Unfortunately for investors, the stock has never offered an attractive proposition from a risk to reward perspective. Of course, the stock has been ultra-cheap throughout the pandemic, but that’s because there has been enormous uncertainty.

Now, almost instantaneously, as we have gotten more clarity on several questions with the positive news from the vaccine, the stock has instantly rallied.

So although there is less uncertainty in markets now, there’s also less potential for the stock to increase. And while there could be significant potential for investors who invest in Air Canada today, there is still a tonne of risk. The company continues to lose at least $12 million in cash every day.

Instead of Air Canada, here are two TSX stocks with much more short-term potential.

A TSX stock that’s even cheaper than Air Canada

There are several reasons why investors have been interested in Air Canada. One of the most common reasons is because the stock is so cheap. If that’s why you’re interested in Air Canada, then one even cheaper stock with a lot less risk is Cineplex Inc (TSX:CGX).

The entertainment company has experienced impacts very similar to Air Canada. In the second quarter, its revenue dropped by roughly 95% year over year. While that improved slightly in the third quarter, it still came in down 85%.

However, Cineplex’s business allows the company to cut a significant amount of costs while the pandemic is ongoing. So although it has to bide its time while we all try to curve the spread of the second wave, Cineplex is already planning for its eventual reopening.

This is crucial, and Cineplex’s management has made sure it has the necessary liquidity to survive the pandemic. Given that the company is already positioning itself now for the reopening and doing whatever it can to limit the pain in the short-run, it’s a top stock to own if you want to bet on the reopening of the economy.

And because of the nature of its business, you can expect Cineplex to return to normal operations long before Air Canada’s stock will recover.

TSX energy stock

You may also want to consider a top income stock with significantly less risk than Air Canada. The stock is in the energy industry, and just like airlines, energy has been impacted considerably. That’s why Freehold Royalties Ltd (TSX:FRU) is such a high-quality investment today.

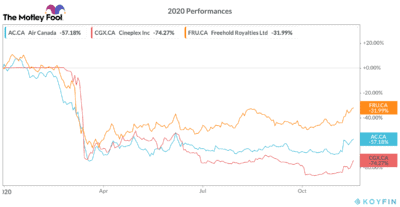

As you can see, Freehold royalties has been the best performer of the three. However, it remains an underperformer for the year, down more than 30% year to date. It’s also clear that after the initial fall, despite being exposed to the energy industry, it’s had a much stronger recovery than Air Canada or Cineplex’s stock.

Freehold was one of the three dividend stocks I recommended for November. Since then, the stock is up roughly 25% in just a few weeks. Part of that is due to the vaccine news, which nobody could have predicted. However, part of it is also because Freehold just raised its dividend for the first time since the pandemic began.

The company’s financial position gives it a tonne of safety. And because it’s a royalty company and not a producer itself, its business operations have significantly less risk as well.

As I mentioned, Freehold had to trim its dividend early in the pandemic as a cautionary measure. As we start to see a recovery, though, Freehold has already started to increase its payouts. That dividend yields roughly 5.2% today.

Bottom line

The vaccine rally is just another opportunity in 2020 to buy high-quality stocks before they rally. So make sure you don’t miss out.