Real Matters (TSX:REAL) is a network management services provider for the mortgage lending and insurance industries. Its clients include the majority of the top 100 mortgage lenders in the United States and some of the largest insurance companies in North America. The tech stock reported its fourth-quarter and fiscal year earnings on Friday morning. Its financial results are solid, as the company benefits from the low-interest-rate environment.

Real Matters posts strong growth in Q4 and in the full year

Real Matters’s consolidated net revenue grew 36.6% to US$124.4million in the fourth quarter. Its U.S. Title business continued to outperform its other segments and for the second consecutive quarter delivered higher net revenue and adjusted EBITDA than its U.S. Appraisal segment. Fourth-quarter U.S. Title net revenue was up 69.7%, while U.S. appraisal net revenue was up 4.6%.

Real Matters posted consolidated adjusted EBITDA of US$22.2 million, an increase of 57.5% from the fourth quarter of fiscal 2019. For the fourth quarter, its adjusted EPS increased by 63.6% year over year to US$0.18. The company added two new lenders in the appraisal segment and two new lenders in the title segment during the fourth quarter.

For fiscal 2020, consolidated net revenue increased by 58.8% to US$455.9 million. U.S. Title net revenue was up 91.8%, while U.S. Appraisal net revenue was up 34.1% for the year.

Consolidated adjusted EBITDA more than doubled to US$72.2 million, while consolidated adjusted EBITDA margins increased to 44.6% from 28.4% in fiscal 2019. Adjusted EPS grew by 143.5% year over year to US$0.56 for the full year. The company added 13 new lenders in the appraisal segment and 13 new lenders in the title segment during the year.

The company exceeded the majority of its targets for fiscal 2021 one year ahead of its timeline. It has set new performance targets through the end of fiscal 2025.

Executive leadership changes

Real Matters also announced executive leadership changes along with its financial results. The company’s board of directors appointed Jason Smith as executive chairman and Brian Lang as chief executive officer of the company. Mr. Lang has also joined the board.

“Brian is a proven leader whose experience and track-record of working with leading financial institutions will provide a steady hand in continuing to expand our market share in the U.S. mortgage industry,” said Real Matters executive chairman Jason Smith.

“This is an exciting time for our company. Mortgage market tailwinds are at our backs and we see significant runway for market share growth in our existing businesses. Beyond the expected surge of mortgage market volumes over the next two to three years, there are new opportunities on the horizon to build out a third pillar of growth for Real Matters,” said Real Matters CEO Brian Lang.

The tech stock pullback is an opportunity

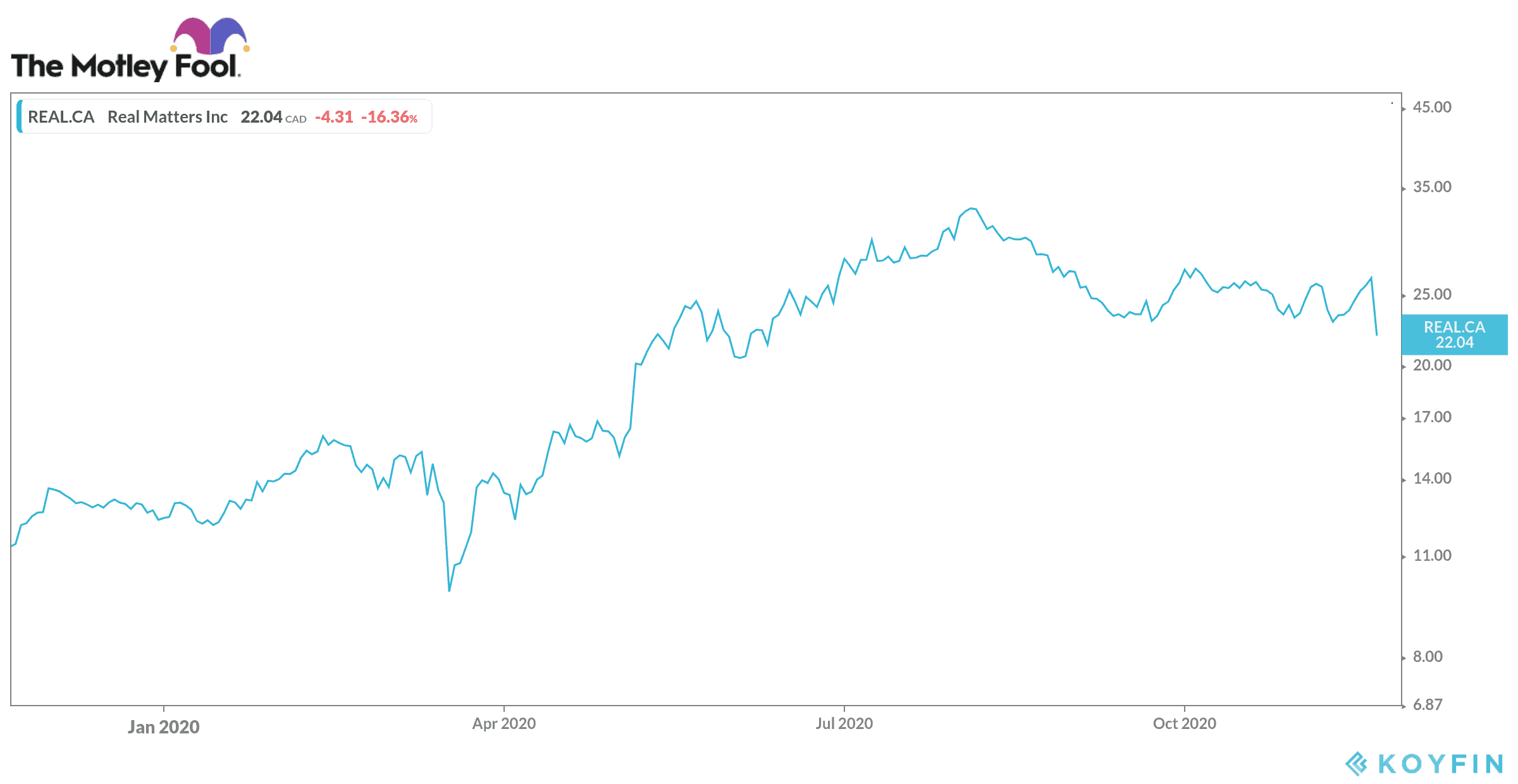

After soaring by more than 160% in the first seven months of the year, the tech stock has dropped by about 30%.

This pullback is a good opportunity to buy shares of Real Matters at a lower price. As strong growth is expected in the next few years, shares could easily double over the next two or three years. It’s even better if you buy the tech stock in your TFSA, so your capital gains are tax-free. You might want to add this high-growth tech stock to your shopping list.