National Bank of Canada (TSX:NA) — the Montreal-based bank — is scheduled to release its Q4 of fiscal 2020 earnings on December 2. National Bank is among a couple of major Canadian banks — apart from the Canadian Imperial Bank of Commerce — trading within the positive territory on a year-to-date basis as of November 25.

Positive stock movement

National Bank stock has risen 7.1% in the last 10 days compared to a 4% rise in the S&P/TSX Composite Index. During the same period, other major bank stocks such as Bank of Nova Scotia, Bank of Montreal, and CIBC have risen by 11.1%, 10.4%, and 5.3%, respectively.

In this article, we’ll analyze the existing trend in National Bank’s recent financials and take a closer look at Bay Streets’ expectations from its upcoming earnings.

National Bank of Canada’s Q4 earnings expectations

National Bank of Canada derives most of its revenue from investment banking operations. In 2019, 35% of its total revenue came from financial markets — while its wealth management operations accounted for the other 35% revenue. During the same year, 29% of its revenue came from personal and commercial banking operations.

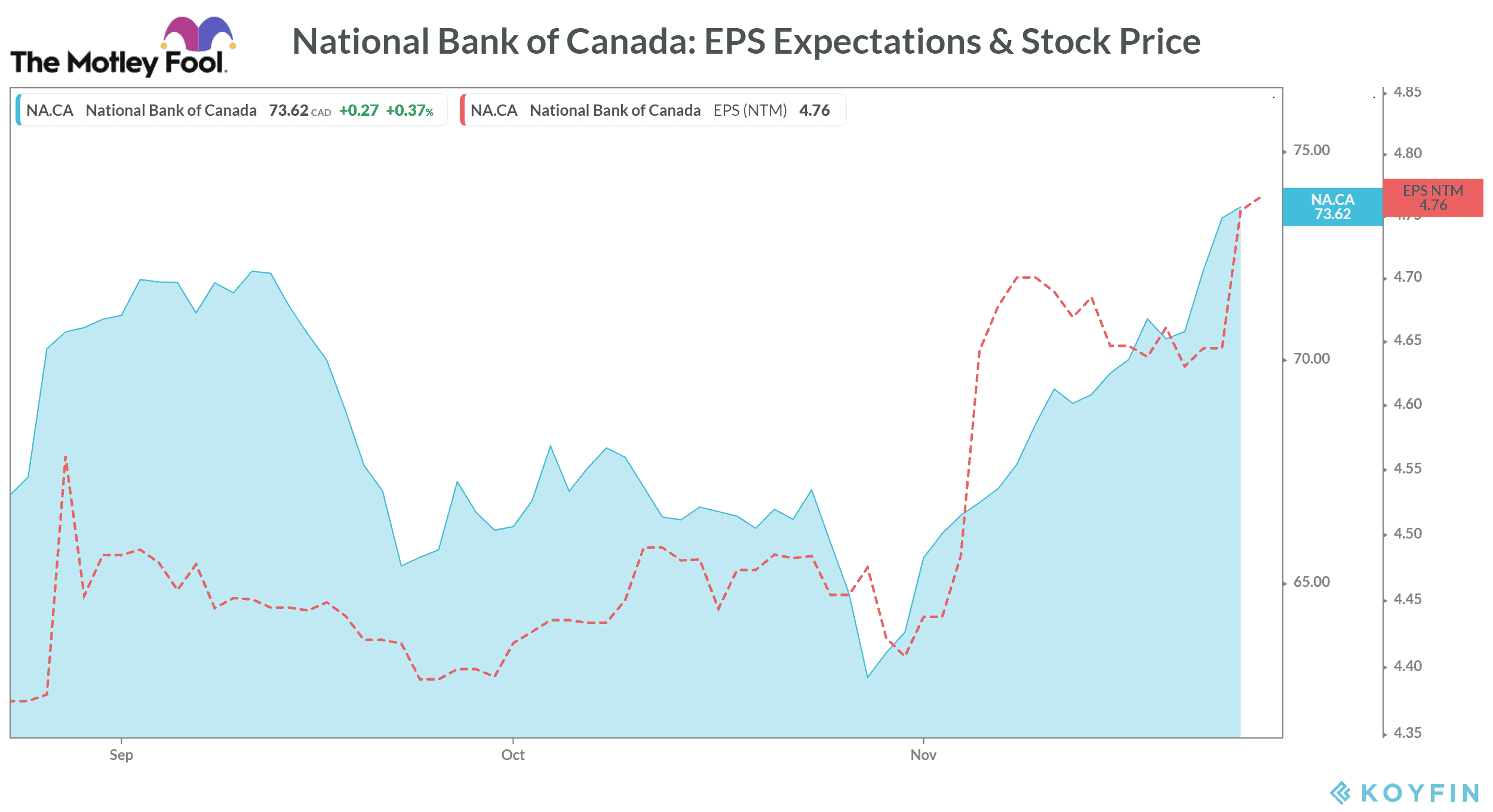

Analysts expect National Bank’s Q4 of fiscal 2020 earnings to fall by 10.4% YoY (year-over-year) to $1.51 per share. It would also be lower from its earnings of $1.66 per share in the previous quarter.

Interestingly, it’s one of the very few Canadian large banks that haven’t missed any quarterly earnings expectations this year despite COVID-19’s negative impact on the overall banking sector in the recent quarters.

In the fourth quarter, the National Bank of Canada could post a nearly 12% YoY drop in its bottom line to $501.8 million, analysts expect. It would also be much lower than its adjusted net profit of $560 million in the previous quarter.

Analysts also expect the bank to maintain its quarterly dividend of $0.71 per share as well.

Recent segment -wise trends

In the quarter ended July 2020, National Bank’s net profit from its personal and commercial banking sector suffered from the ongoing pandemic. On the positive side, its total pre-tax, pre-provision profit (PTPP) — which is a key financial metric for banks — rose by 5% YoY to $947 million.

Segment-wise, the National Bank of Canada’s personal and commercial banking PTPP — during the quarter — fell by 8% to $395 million. Nonetheless, its PTPP from wealth management and financial markets segments increased by 4% and 17%, respectively. Similarly, its PTPP from the U.S. specialty finance and international segment saw a solid 25% rise to $131 million in Q3.

What to watch for ahead?

During its fourth-quarter earnings event, investors should be looking for any signs of recovery in National Bank’s personal and commercial banking segment. Personal and commercial banking is the largest segment for the bank based on its pre-tax, pre-provision profits.

The bank already has a stronghold on wealth management and financial market segments. That’s why the National Bank of Canada’s stock could outperform its peers next week if it manages to report any improvement in its personal and commercial banking operations.