One of the top Canadian banks — Toronto-Dominion Bank (TSX:TD)(NYSE:TD) — will announce its Q4 of fiscal 2020 results on December 3 before the market opening bell. Just like most of its peers, TD Bank stock has been rising sharply in November. Let’s take a closer look at its recent stock movement before discussing what to expect from its upcoming earnings event.

Recent stock price movement

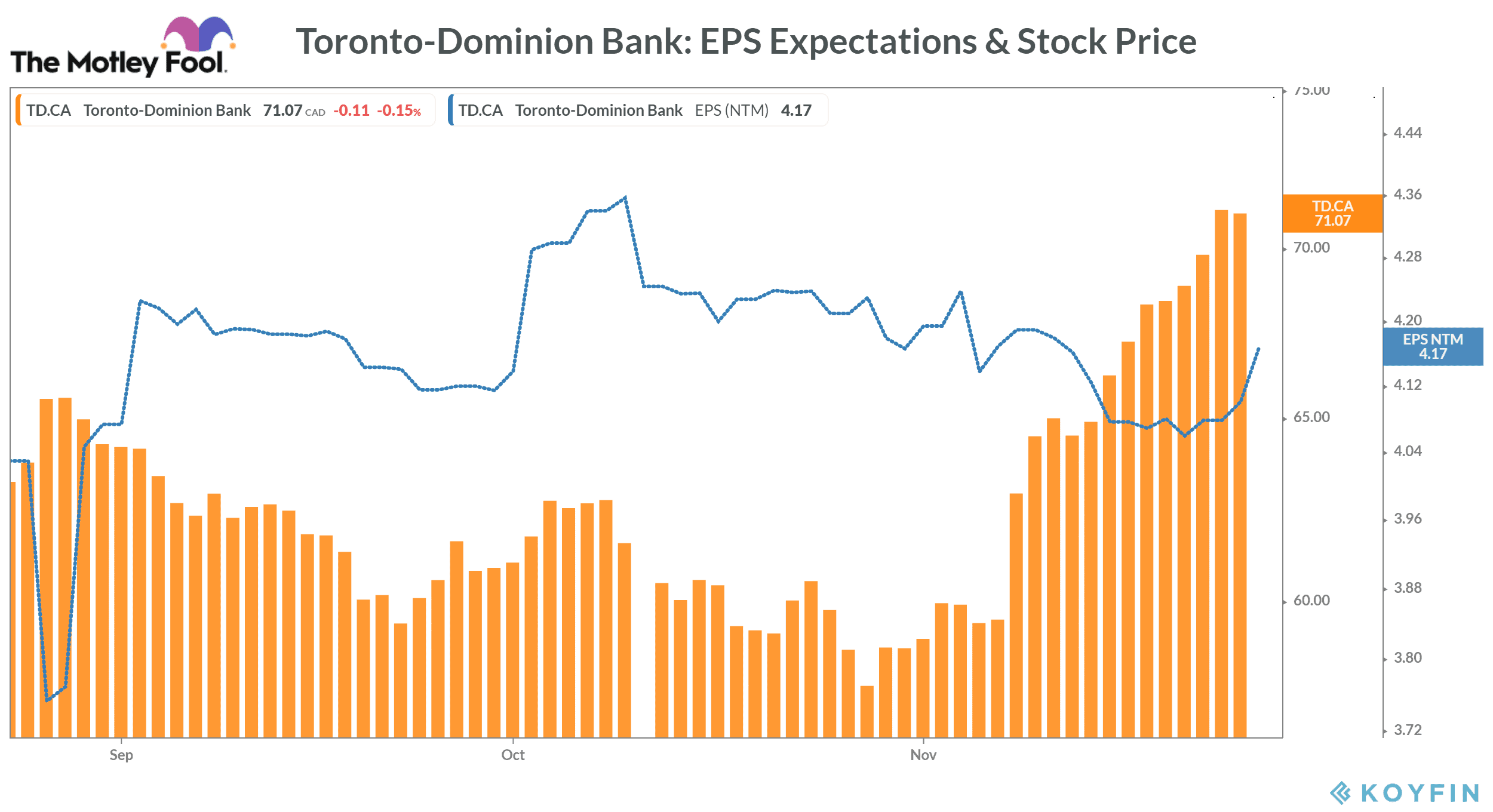

As of November 25, TD Bank’s stock has gone up by 21.1%, outperforming the broader market by a wide margin. The S&P/TSX Composite Index has gone up by 10.9% so far this month. In comparison, other bank shares such as Royal Bank of Canada, Bank of Nova Scotia, and Canadian Imperial Bank of Commerce have seen 15.6%, 16.4%, and 11.8% gains, respectively, in November.

Apart from increasing hopes of COVID-19 vaccines, investors’ high hopes from the upcoming Canadian bank earnings season could be driving these massive gains in these stocks.

Toronto-Dominion Bank’s Q4 estimates

Bay Street expects the trend in Toronto-Dominion Bank’s earnings to improve in the fourth quarter. According to their consensus estimates, the bank is expected to report earnings of $1.27 per share in the fourth quarter — down 19.9% on a YoY (year-over-year) basis but better than its earnings of $1.25 per share in the previous quarter.

In the third quarter of fiscal 2020, TD Bank reported a 30.2% YoY drop in its adjusted earnings. However, this YoY decline rate was better than its earnings fall of 51.4% in Q2 of fiscal 2020.

Will retail sector performance improve?

COVID-19 has taken a massive toll on many industries, including the banking sector. Within the banking sector, the major banks’ core banking operations have heavily suffered due to the pandemic. For example, Toronto-Dominion Bank’s Canadian retail sector profits worsened by 33% in the last quarter, while its retail segment profits in the United States tanked by 48% YoY.

During its fourth-quarter earnings event, investors would keep a close eye on TD Bank’s retail performance in the U.S. as well as in its home market.

Eyes on wholesale segment

Another key factor that experts would be watching in TD Bank’s upcoming earnings is its wholesale banking performance. Notably, the bank reported record net profits of $442 million from its wholesale banking operations in the Q3 of fiscal 2020, as it jumped by 81% YoY.

That’s the reason consistency in its excellent wholesale banking performance could boost investors’ confidence and keep the rally in its stock going in the coming months.

Foolish takeaway

Despite its sharp recent gains, Toronto-Dominion Bank stock is still trading within the negative territory on a year-to-date basis. In 2020 so far, it has lost 2.3% against 1.2% gains in the TSX Composite Index.

I expect TD Bank to report key improvements in its retail banking performance in the fourth quarter — along with a minor negative sequential change in its wholesale banking performance. If the earnings come in line with these expectations, you should definitely consider buying it.