Royal Bank of Canada (TSX:RY)(NYSE:RY) — Canada’s largest bank — reported its fourth quarter of fiscal 2020 results on Wednesday last week. Since then, its stock has been largely trading on a mixed note.

Let’s take a closer look at the recent trend in its financials and find out whether its stock is a good buy right now.

Royal Bank of Canada’s stock

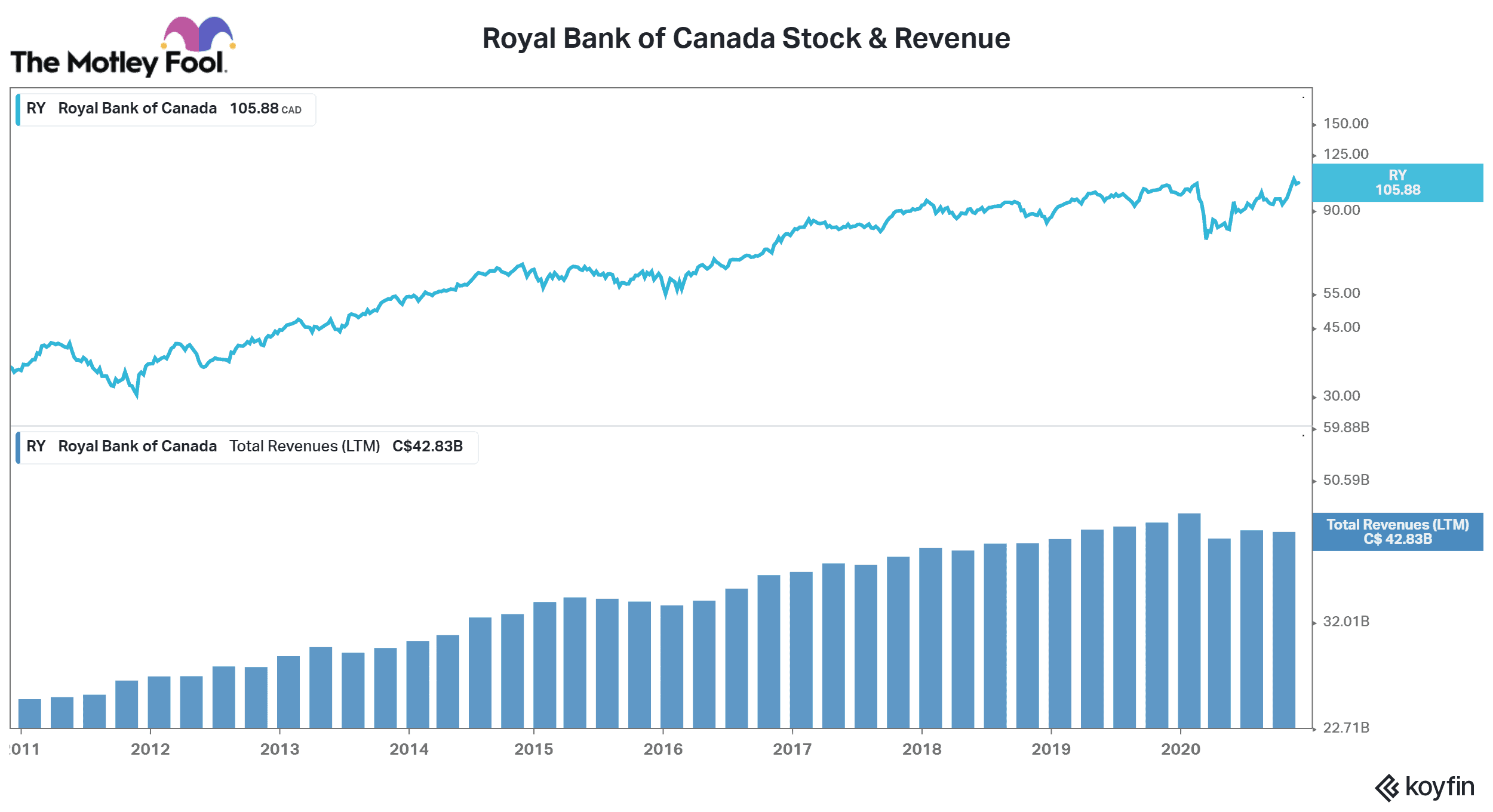

Last week, the shares of Royal Bank of Canada fell by 2.8%, but they seem to be recovering this week. After posting a sharp 13.8% gains in November, its stock is currently trading within the positive territory on a year-to-date (YTD) basis.

As of December 7, the stock has risen by about 3% in 2020. The S&P/TSX Composite Index has outperformed RY by a wide margin with 14.3% YTD gains.

By comparison, many other Canadian bank stocks such as the National Bank of Canada, Canadian Western Bank, and Bank of Montreal are still trading within the negative territory on a YTD basis.

Q4 earnings highlights

In Q4 of fiscal 2020, Royal Bank of Canada reported adjusted net earnings of $2.21 per share — better than analysts’ consensus estimate of $2.05. The bank reported positive year-over-year quarterly earnings growth in the last quarter after registering declines in a previous couple of quarters.

On the flip side, its total revenue of $11.1 billion couldn’t meet Bay Street’s expectations of $11.5 billion. The bank also registered a drop in its net interest income in the October quarter to about $5 billion compared to $5.1 billion in the same quarter of fiscal 2019.

A negative trend in core banking operations continued

The overall trend in the Royal Bank of Canada’s core banking operations remained weak in the fourth quarter. The bank reported a 21% year-over-year drop in its personal and commercial banking segment earnings. Similarly, its wealth management segment earnings fell by 15% in the last quarter.

Nonetheless, higher income from capital markets, insurance, and investor and treasury services segments helped RBC report better-than-expected total net earnings.

The key reason for my worries

As I’ve argued in some of my recent articles, a massive rise in most Canadian banks’ capital markets segment earnings could be temporary. This argument proved to be right after the Royal Bank of Canada reported only a 4% year-over-year rise in its capital markets segment compared to a massive 45% year-over-year increase in the previous quarter.

But this wasn’t something I was primarily focused on. I was looking forward to seeing an improvement in the Royal Bank of Canada’s core banking segment. In contrast, the bank reported a 21% year-over-year decline in its personal and commercial banking segment earnings in the fourth quarter — even worse than an 18% drop in the third quarter.

Foolish takeaway

Royal Bank of Canada’s stock is currently trading at $105.94 per share on the TSX — not far away from its all-time high. While long-term investors — with expectations of consistent dividends — might continue to hold RY stock at the moment, it might not be wise to buy its stock at current levels, at least not before getting some signs of a significant recovery in its core banking operations.