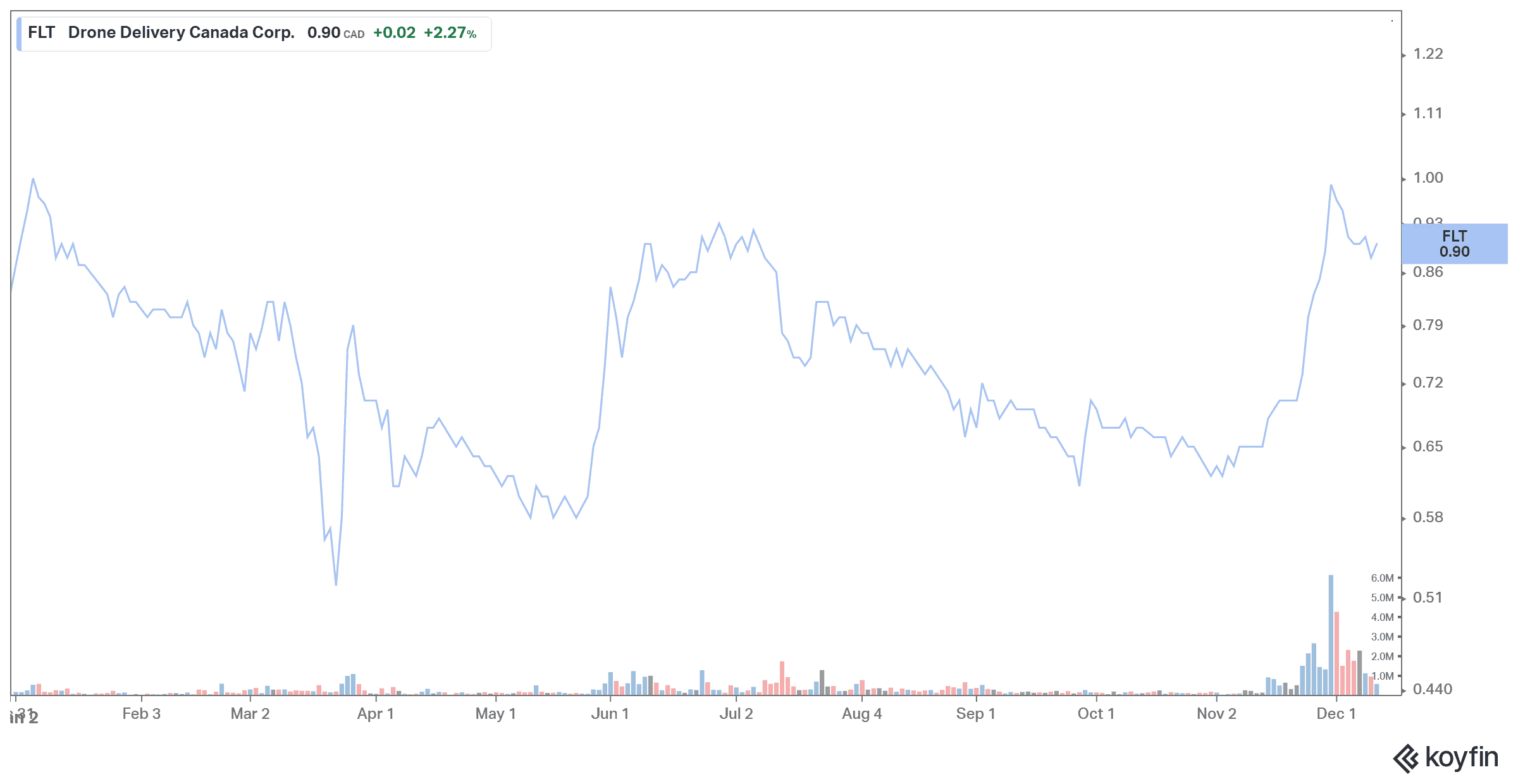

Drone Delivery Canada (TSXV:FLT) stock has skyrocketed recently. Investors may be wondering if there are more benefits to come. The stock could skyrocket in 2021, but be prepared for a lot of volatility.

Drone Delivery Canada stock recently took off

Drone Delivery Canada, which designs proprietary logistics software for drones, has worked hard for years on the regulatory and testing fronts to make drone delivery a viable model. The company has had success, including a trade deal signed two years ago to transport supplies to Moose Factory Island in northern Ontario. But those efforts don’t show in the stock, as its price has declined in the past two years.

But Drone Delivery Canada stock literally took off in November, apparently in response to a letter of intent for a multi-year, multi-route delivery contract to rural communities in Quebec. The company announced the letter of intent on November 24. This letter indicated that with the help of its sales agent Air Canada (TSX:AC), Drone Delivery Canada will work on a binding agreement with Drones Express for the use of its DDC Condor drones to serve coastal communities on several routes along the lower region of the North Shore of the province.

Drone Delivery said the deal is expected to last 10 years with total revenue of $3.6 million over that period, along with other potential service revenues and the potential for expansion to more routes and communities as the project progresses. Last year, Air Canada signed a 10-year agreement to market and sell drone services on behalf of Drone Delivery.

“Airlines could soon be operating unmanned drones in addition to aircraft flown by pilots, or serve as a logistics intermediary between shippers and third-party carriers,” reported American Shipper. “Air Canada is leveraging its knowledge moving cargo to support drone deliveries and expand business in the fertile e-commerce sector.”

With the rise of e-commerce in recent years and accelerating through 2020 and the COVID-19 pandemic, drone delivery may receive more attention. But as the technology is still in its early stages, Drone Delivery Canada stock is a speculative bet.

In addition to its proprietary Flyte software, Drone Delivery offers three types of drones, the Sparrow for shorter (maximum 30 km) and lighter (less than 4.5 kg) cargoes, the Robin XL for mid-range distances and payloads, and the Condor, with a maximum range of 200 km and a payload of up to 180 kg.

Last month, Drone Delivery provided an update on its Robin XL tests, which are expected to be completed within the next three months and could be used commercially to support COVID-19-related activities and deliveries to remote areas in 2021.

Last year, Drone Delivery announced a business agreement with DSV Air & Sea Inc. Canada, the Canadian arm of Danish transport and logistics giant DSV Panalpina.

The company still doesn’t deliver on revenues

Drone Delivery last reported its results in mid-November. The company earned revenue of $36,000 for drone services for the three months ended September 30, 2020. Analysts expected revenue of $516,000. The company incurred an operating loss of $3.8 million. Drone Delivery ended the quarter with cash and cash equivalents of $14 million. Revenue is expected to grow by 927% to about $11.7 million in 2021.

Despite the rise in share price, the return on Drone Delivery stock is flat for the year. As Drone Delivery is a nascent company with a new technology, it’s a speculative buy. So, while this stock could make you a millionaire, it would be prudent to not invest all your money in it.