This last year has been a volatile one, and we are still living in a strange world with an even stranger marketplace. So it feels almost necessary this year to look back and see what top stocks did well on the TSX Composite Index. With a market crash behind us, and potentially multiple ahead, it’s a great time to consider where you can reinvest, especially with another $6,000 being added to the Tax-Free Savings Account (TFSA) on January 1, 2021.

So when it comes to companies that outdid themselves on the stock market this year, and over the last few years for that matter, there are three that stick out. Let’s take a look at whether these top stocks belong in your TFSA portfolio.

Shopify

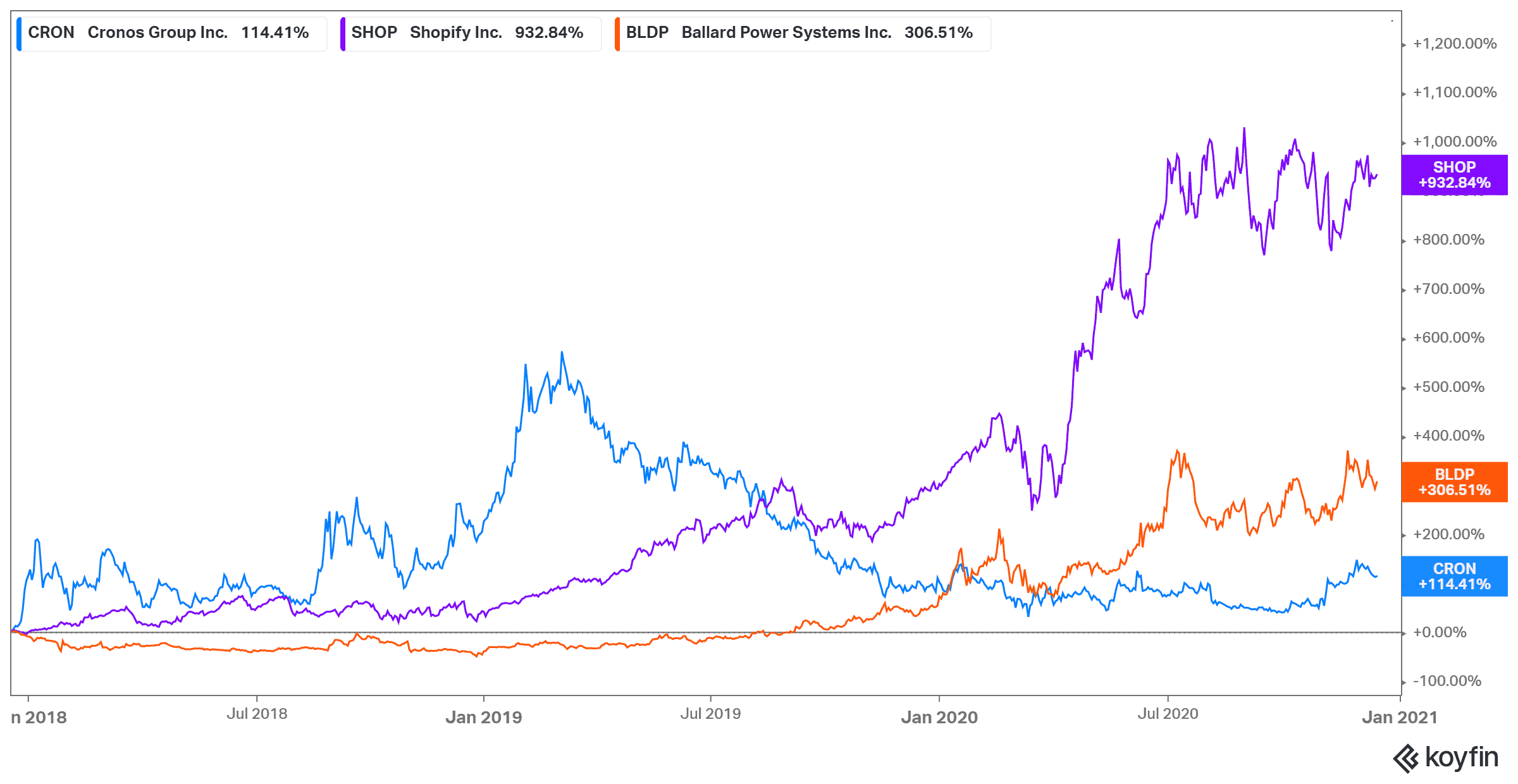

Let’s first start with the obvious. Shopify Inc. (TSX:SHOP)(NYSE:SHOP) had a banger year this year, but also over the last three years. Since the company came onto the scene, shares have grown an unbelievable 3,785%! But even just looking at the past year, shares of Shopify have grown an incredible 165%.

The market crash had many worried Shopify was doomed for failure, but the pandemic saved this stock. E-commerce became a necessity overnight, making Shopify increase revenue by record-breaking numbers again and again. Most recently, revenue grew by 96% year over year, with subscriptions up 48% year over year as well. That’s recurring revenue coming in from a surge of new merchants.

While there could be another dip in share price with a market crash, see that as an opportunity to pick up this top stock. You may not get the chance again.

Ballard Power

Another stock that’s more of a surprise is Ballard Power Systems Inc. (TSX:BLDP)(NASDAQ:BLDP). The fuel cell provider is up 306% in the last three years — and 193% in the last year alone! While the stock beat Shopify even this year by share growth, there might be a bit more wariness involved in this top stock.

The growth simply isn’t backed by the record revenue we saw with a stock like Shopify. Total revenue only increased by 4% year over year in its third-quarter report. Cash operating costs continue to rise, bringing down adjusted earnings before interest, taxes, depreciation and amortization (EBITDA) by almost $1 million. So it looks like this company could start to fade into the red in the year to come, bringing its share price down with it.

Cronos

A big surprise? Cronos Group Inc. (TSX:CRON)(NASDAQ:CRON) was also a major player during the last few years. The stock is up 114% during the last three years. Sure, that’s only 5% this year, but this could be one stock that surprises investors in the years to come. Especially in the cannabis sector.

Cronos continues to grow within the United States, selling more and more recreation marijuana throughout North America. This drove net revenue up by 96% year over year! With a new White House administration seeking the decriminalization of marijuana in the near future, this could mean that Cronos continues to be a winning top stock in 2021 and beyond.

Bottom line

When looking at these top stocks, it’s definitely best to see which, if any, fit into your portfolio. Each comes with its own risk. However, if you take the Motley Fool advice of buying and holding these stocks for the long term, it leaves little change that you see a loss decades down the road.