Warren Buffett is considered one of the greatest investors of all time due to the high returns the “Oracle of Omaha” has generated for his Berkshire Hathaway company over the years.

Warren Buffett uses a disciplined investing strategy. He has rules in place to maximize gains and reduce risk. Here is an overview of some of Buffett’s investing principles. Following his principles could help you achieve better returns over the long term.

Warren Buffett owns stocks for the long term

Warren Buffett’s investing principle is to buy and hold stocks for several years.

Buffett bought his first stock at age 11 at US$38 a share. Buffett sold the stock later for US$40, making a gain on his purchase.

The stock would climb to over US$200 later. He cites this event as the moment he learned a lesson about patience in investing.

Buffett once said, “If you aren’t thinking about owning a stock for 10 years, don’t even think about owning it for 10 minutes.”

He buys stocks at reasonable prices

Warren Buffett believes in investing in companies that have reasonable valuations and are profitable.

Buffett invests in companies that have easy to understand business models, predictable, and proven profits, and an economic moat. Buffett buys what he knows. He said, “Never invest in a business you cannot understand.” He invested in Coca-Cola as a fan and consumer of the product.

In 2016, Buffett invested in Apple after years of avoiding the technology sector.

Buffett believed that Apple’s business was the best in the world and that the valuation was just right to start buying some shares. Apple is now the largest stock by value in Berkshire Hathaway’s portfolio.

While Buffett’s principle of investing is to buy and hold stocks forever, he’s willing to sell them if the valuations aren’t in line with what he envisions for the future.

Buffett bought shares of airlines, an industry he avoided for years, and then sold them in early 2020 during the pandemic, believing that it would take years for the airline industry to recover.

A TSX stock Warren Buffett would like

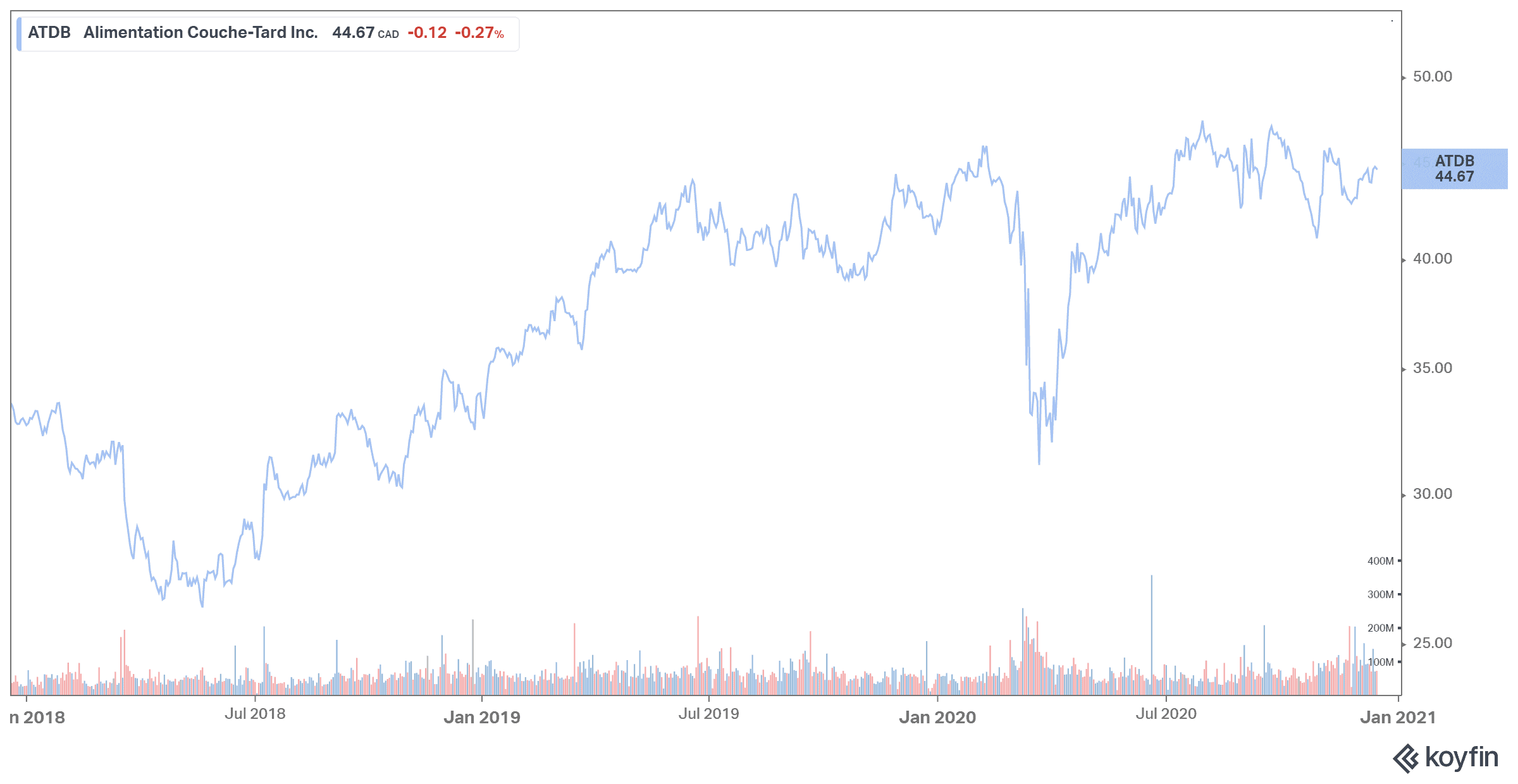

Alimentation Couche-Tard (TSX:ATD.B) is a Canadian stock that Warren Buffett could like. Couche-Tard has first-class leaders, a recipe that works, and is one of the few leaders in its industry.

Couche-Tard has become the second-largest operator of convenience stores in the world over the past decade and has done so primarily through consolidation. Its largest transaction in the M&A market closed in 2017, when it acquired CST Brands Inc. for US$4.4 billion and added 2,000 more stores in the U.S. and eastern Canada to his books.

And general manager Brian Hannasch didn’t end up there. While a recent US$7.7 billion bid for Australia-based Caltex Australia Ltd. was rejected, there will certainly be more on the way.

Couche-Tard stock has a P/E of 18.1. Profit growth of 19.5% is expected for the next five years on an annualized basis. The stock has a five-year PEG of 0.79, so it’s quite cheap. The company pays a small dividend, which currently yields 0.78%. With a payout ratio of only 8% and a strong profit growth, there is room for the dividend to become much higher in coming years.