There’s no question that two of the biggest and best Canadian stocks trading at a discount are Air Canada (TSX:AC) and Cineplex Inc (TSX:CGX). Throughout 2020, these stocks gained a tonne of investor interest. So it’s no surprise they continue to be at the top of investors’ watch lists in 2021.

Both stocks have been at attractive discounts for months now. This hasn’t gone unnoticed, with many investors keen on buying these stocks for a big recovery. The question is, when will that happen?

When it comes to the stock, nobody knows the answer. When it comes to the business operations recovering, that should be clearer, but the uncertainty about the pandemic is so high there isn’t really much clarity on that either.

One thing’s for sure, though: investors are eager to buy the stocks. Air Canada was even the third most popular search term for news on Google in Canada during 2020.

So if you’re one of the investors waiting to play the recovery of the coronavirus pandemic, here’s which stock I would choose between Air Canada and Cineplex.

Air Canada stock

Air Canada may be one of the most impacted stocks in Canada. Its sales have been down over 85% since the pandemic began, creating several issues for the airline.

Even in the best of times, one of the top priorities for airlines is keeping their planes in the air and making money. Any time a plane sits on the ground, it’s not only not making the company money, but also costs money.

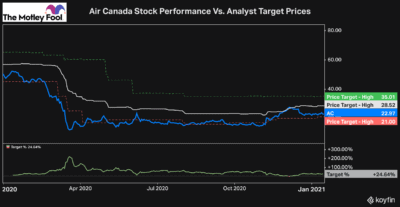

That’s part of the reason why Air Canada is bleeding so much cash and why the stock still has so much risk for investors. Analysts aren’t exactly bullish either. Analysts have a low target price of $21, an average target price of $28.50, and a high of $35.

While Air Canada is still at the low end of analyst target prices, this chart shows that the stock is not as discounted as investors think it is.

Many investors are targeting a return to $50 a share when Air Canada can finally turn its business around.

That’s going to be considerably difficult for Air Canada, which will emerge from the pandemic after diluting shareholders and taking on much more debt.

Cineplex stock

Cineplex stock is in much of the same position Air Canada is in. The coronavirus pandemic has completely derailed its business. Despite repeated efforts by Cineplex to operate through the pandemic, coronavirus restrictions have hurt the business considerably.

Even over the past years, Cineplex has diversified away from the theatre business, opening up more Playdium and The Rec Room locations. These businesses have been just as impacted, though, resulting in Cineplex’s stock being decimated over the past year.

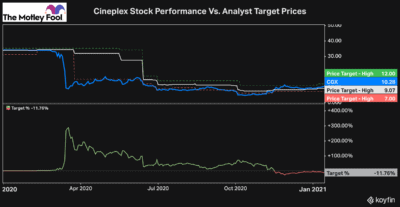

Cineplex, like Air Canada, saw its revenue fall by more than 85% year over year in the second and third quarters of 2020. So it’s not surprising that analysts aren’t exactly optimistic about Cineplex either.

Cineplex is currently trading above its low and average target prices of $7 and $9, respectively. It still trades below the highest analyst estimate, however, without much upside for investors.

Bottom line

Neither stock offers that much value today. That said, if I had to choose today, I would buy Cineplex over Air Canada.

In my view, the damage to Air Canada’s business will be a lot longer lasting than Cineplex. Cineplex will be able to turn its business around a lot faster than Air Canada and will have a much easier time reaching profitability once than pandemic is behind.

I would still be considering other more attractive stocks, today though. There are several stocks that are better positioned to start growing your money now.

However, if the choice were solely between Air Canada and Cineplex, I would choose the latter.