If you’re new to cannabis stocks, it’s a great time to consider buying. While you may have missed out on the cannabis bubble of 2017 and 2018, you can get in on the second bubble, if you can call it that. Whereas before pretty much any cannabis stock did well, today it’s far different. You can now buy cannabis stocks that have proven the company will eventually make it and make a much safer choice.

If there are two choices that provide that security for long-term holders, those cannabis stocks have to be Canopy Growth (TSX:WEED)(NYSE:CGC) and Aphria (TSX:APHA)(NASDAQ:APHA).

Canopy Growth

Canopy Growth is the top choice for investors seeking to benefit from United States legalization. Granted, we aren’t there yet. However, that doesn’t mean Canopy Growth isn’t seriously preparing. While a Trump win would have seriously hurt the company, he didn’t win. A Biden administration sent cannabis stocks like Canopy Growth through the roof to 52-week highs. That’s still happening today.

Why? Biden’s administration has promised decriminalization of marijuana. While that isn’t legalization, it sure is a stepping stone. Meanwhile, four states legalized recreational use of marijuana, bringing the total to 11. On top of that, 34 states have made medicinal marijuana legal. Canopy Growth thinks it’s just a matter of time.

The company’s deal to acquire Acreage Holdings when the U.S. legalizes cannabis would make Canopy Growth the largest cannabis producer in the world. That would be enormous in an industry worth about US$73.6 billion by 2027, according to Grand View Research. Meanwhile the company hopes to meet demand by expanding cultivation into Latin America and lower production costs. And while other industries stick mainly to one cannabis area, Canopy Growth has everything from infused products to topicals.

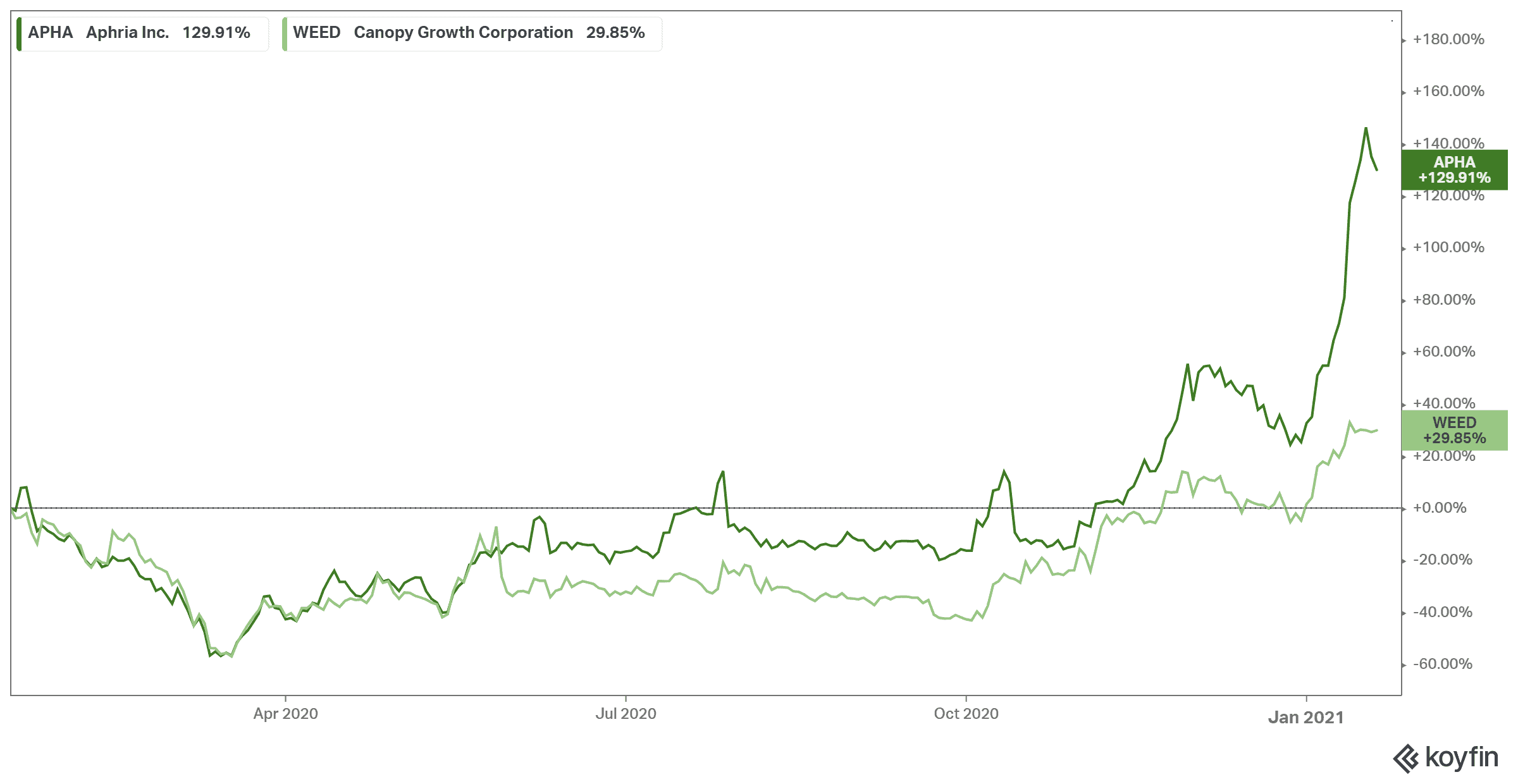

Granted, shares are expensive when looking at sales. But if you’re a long-term investor, hold out. This company is up 30% in the last year alone and well on its way back to all-time highs.

Aphria

What is the one thing that Canopy Growth is still missing that Aphria has? Profit. In fact, most cannabis stocks still haven’t made a profit, but that doesn’t include Aphria. The company has made the biggest comeback story among cannabis producers, losing shares after a short-seller inquiry, only to have them come right back up with profits.

Mix in a new U.S. president, and you’ve got a recipe for success for Aphria. That’s especially since the company merged with U.S. producer Tilray. Once that deal is finalized, the company will have the Tilray name for business and likely even more shareholders. That’s due to the enormous U.S. footprint, market share, and lean business model Aphria will then have. Keeping costs down and making great deals seems to be what Aphria is all about, and investors love it.

The stock has soared 130% over the last year, and closing in on all-time highs after reaching a 52-week high recently. The stock is up 1,269% as of writing in the last five years. So, if you’re looking for a stock that is still a great deal before a merger jump, definitely consider Aphria.

Foolish takeaway

Cannabis stocks are just like any other company: you invest for value. Now that the cannabis bubble has burst, investors need to look at what company is going to be around a decade or more from now. That answer is easy if you’re going to invest in only two of these companies. Both Canopy Growth and Aphria have the staying power needed by cannabis stocks to practically guarantee a continued rise. That’s especially once more countries, including the U.S., legalize the product.