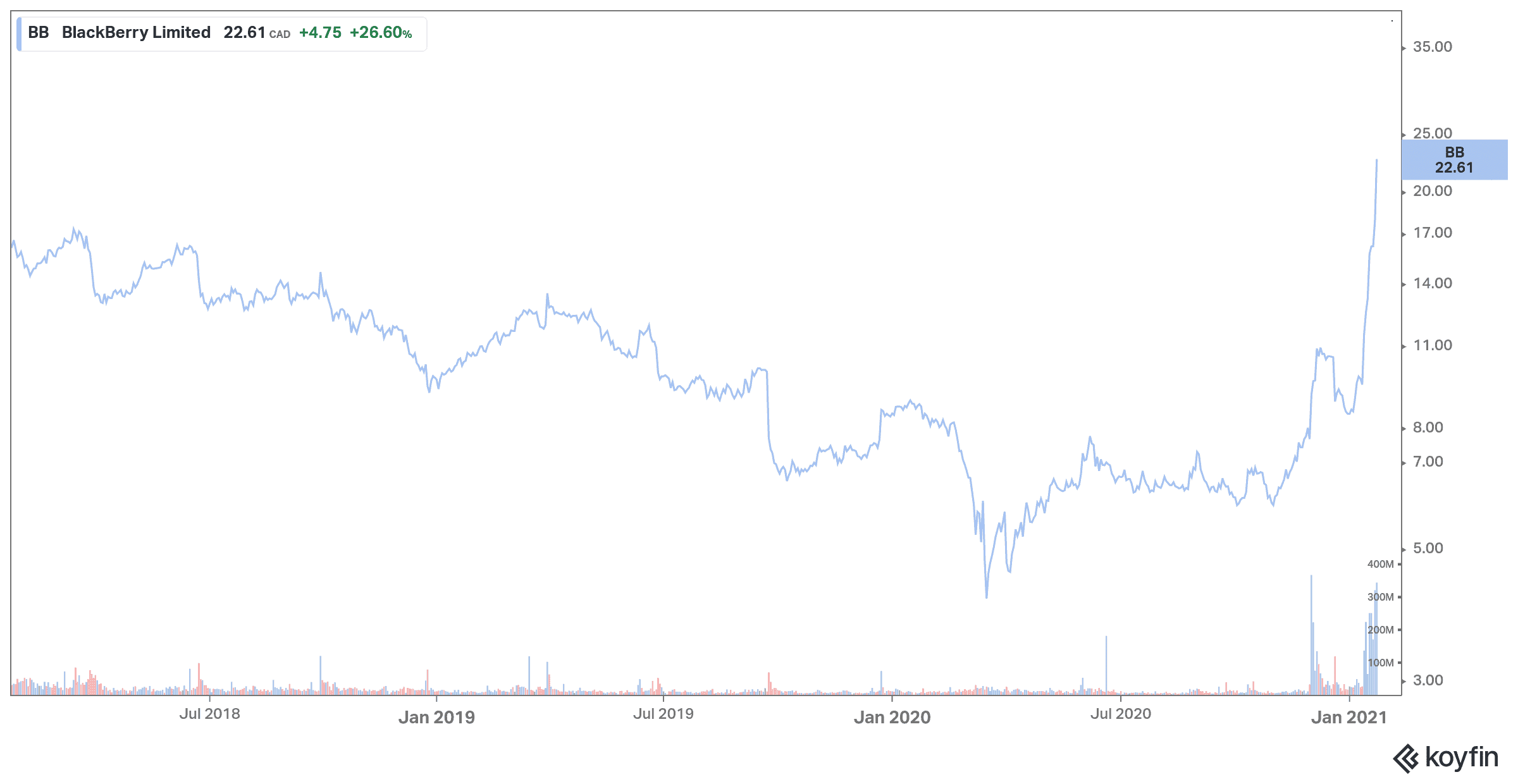

BlackBerry (TSX:BB)(NYSE:BB) stock popped 40% on Monday morning. This is the highest increase in the tech company’s share price in nearly a decade. Let’s take a look at what could have driven this rally and if more upside is to come.

BlackBerry stock has tripled in value year to date

BlackBerry stock was trading at nearly $25 a share when the Toronto Stock Exchange opened on Monday, up more than $7 or more than 40% from Friday’s level. The company now has a market cap over $13 billion.

BlackBerry stock has been rallying for several days before skyrocketing on Monday. At the start of 2021, the company was worth just over $8 per share. It is now worth about three times as much.

This rally doesn’t seem to be explained by fundamental changes in the business. BlackBerry has had a number of good news in recent weeks, but nothing that would explain the share price rise on Monday. The movement is most likely driven by investors’ enthusiasm, according to experts.

On October 16, BlackBerry announced its partnership with Zoom. Zoom will use BlackBerry Dynamics cybersecurity software from BlackBerry in its mobile platform to protect businesses from cyberattacks and data breaches. BlackBerry Dynamics software also provides secure video conferencing, which BlackBerry believes will become more and more necessary as businesses move away from in-person meetings.

BlackBerry signed last month a deal with Amazon to work on connected cloud software for cars. Earlier this month, it was reported that BlackBerry had sold 90 patents to Chinese telecommunications company Huawei. BlackBerry owns more patents than any other company in Canada, many of which are applicable to smartphones that BlackBerry will no longer focus on.

Although BlackBerry is moving away from smartphones, BlackBerry announced last August that it would partner with OnwardMobility to help the tech startup produce BlackBerry-branded smartphones with 5G technology. The phones are expected to be released in the first half of this year.

In mid-January, the tech company favourably settled a patent dispute with Facebook.

Enthusiasm about the tech stock is coming back

Those pieces of news might have helped to boost BlackBerry’s stock price to a certain extent, but what could have helped increase the share price further is enthusiasm from retail investors on popular online discussion forums such as Reddit. Other stocks have unexpectedly risen in recent weeks.

The current recovery in the stock market has boosted the valuation of large companies. Investors are now hunting for bargains.

There is a shift in market sentiment about BlackBerry stock. Investors are becoming more bullish about the tech stock outlook. It seems investors are starting to realize the value of what BlackBerry has been working on for the past decade as tangible partnerships have come to fruition.

The company growth prospects look promising. But you might want to wait for a more attractive entry point, as the stock has become overvalued after the strong rally. The forward P/E is close to 200, which is way too high even for a growth stock like BlackBerry. If you own BlackBerry stock, you might want to take some profits off the table before the rally fades out.