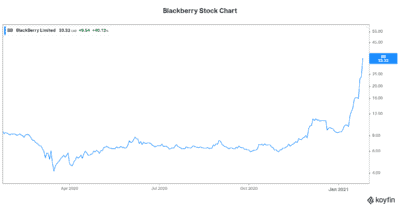

BlackBerry (TSX:BB)(NYSE:BB) stock continues to skyrocket! Up 35% yesterday, there seems no end in sight. I’m glad about it, because I have been recommending this stock for a while now. But personally, I did not participate in this rally, as I was waiting for some cash to free up to buy it. In hindsight, I should have bought this stock on margin. But hindsight is 20/20. And I’m not serious; I would not recommend buying stocks on margin.

Anyway, so I have been practicing what I preach. I refuse to make a decision that is riddled with emotion. I don’t want to do anything that will harm my long-term return potential. It’s always best to look at the situation rationally. When will BlackBerry stock stop rising? Is this rise based on fundamentals? Or is it based on investor overreaction? In short, has BlackBerry stock risen too high, too fast?

BlackBerry stock is fueled by real fundamental realities and promise

I’m glad to say, BlackBerry is a quality company. Therefore, BlackBerry stock is a quality stock. BlackBerry’s technology is second to none. The company has won countless industry awards for its cybersecurity technology. Similarly, it has won awards for its technology geared for connected cars. In short, BlackBerry has gained the respect and admiration of its peers.

This is the very first important point. So, you see, the only question now is not whether BlackBerry stock is a good stock to own. Essentially, we must decide if BlackBerry stock’s valuation has gotten ahead of itself. Is it trading way out of whack with reality? This is not an easy question to answer, but let’s try.

BlackBerry stock factors in success for many years to come

BlackBerry stock does not exist in isolation. It is, of course, part of the bigger markets. It trades base on its company-specific factors. But it also trades based on market sentiment, investor sentiment, and on the general macro environment.

So, we’re coming off of unprecedented stimulus being pumped into the economy. Markets are still benefitting from record-low interest rates. And the coronavirus vaccine is injecting confidence that the end of the pandemic is near. All of this has set us up with an extremely robust stock market. BlackBerry stock is not the only one to soar to new heights. The market in general has gone higher for longer than many of us imagined.

That’s all fine, but that’s in the past. What do we do now? Well, I, for one, am still waiting for the market to correct. I believe it will. I think that investors may be feeling too optimistic right now. And I think that as herd immunity is reached, the market may be in for a shock. There are probably some systemic issues looming in the background.

Yes, governments have eased the pain of the pandemic. But there will be longer-term consequences of this record stimulus. Maybe inflation will rear its ugly head. Maybe the “growth” that we will return to might not be as great as the market is pricing in.

Motley Fool: The bottom line

In conclusion, I believe that there will be a better time to buy BlackBerry stock. I want to own it. I have wanted to own it for a while now. But now is not the time. I am expecting to be able to buy it at lower prices. I don’t want to buy when everyone else is buying. The price is being bid up to levels I’m not sure I can justify at this time. Wait for BlackBerry stock to trade lower. If the market corrects 30%, BlackBerry will fall by more. I would buy BB stock below $20.