Over the last six months, investors have seen a considerable rally in Canadian stocks. Even those who have been impacted quite substantially have started to see their share prices recover. Then there are the devastated businesses like Air Canada (TSX:AC) stock and Cineplex Inc (TSX:CGX).

There are those companies that have been impacted substantially by the pandemic, and then there are businesses like these two.

Both companies have faced some of the most severe headwinds through the pandemic, so it’s understandable that their shares are still so cheap. And because they are still so cheap, and some of the only stocks on the market at a discount, investor interest around these stocks continues to remain high.

However, as I mentioned a few weeks ago, both stocks are that cheap because there is so much risk involved in making an investment.

For that reason, I told investors to avoid both stocks, but if I had to choose, Cineplex is the better investment today.

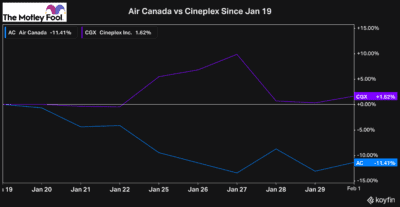

As you can see, Air Canada stock has gotten 11% cheaper since then. At the same time, Cineplex has had a bit of a rally. Despite Air Canada getting cheaper, I would still avoid Air Canada first and foremost. There’s just way too much risk right now to be comfortable owning the stock.

Avoid Air Canada stock

Below $20 a share, investors might start to think Air Canada stock has value. However, with recent developments making the situation worse for the company and not better, the risk has only increased.

It’s not the fault of the company, either. It’s just unfortunate the second wave has been so devastating. And with new variants causing more problems, the risk around Air Canada’s business is as high as ever.

Management was hoping for a recovery in the second half of this year. So far, though, the news has only been negative. Many thought that with vaccinations Canadians could get back to traveling again. That hasn’t been the case, though.

In many ways, things have only gotten worse. In the fall, many thought that by the middle of 2020, the economy would be in full recovery. Now, though, some think we may not fully get out of the pandemic until 2022. Furthermore, new travel restrictions continue to be put in place. This is taking Air Canada further from recovery, not towards it.

So while we can all hope Air Canada stock and the economy will recover by the second half of the year, that’s looking increasingly less likely.

A lot of the problems that Air Canada faces will impact Cineplex too. However, its path to recovery won’t be as long, and it won’t lose as much money in the meantime. That’s why if you had to pick one or the other, Cineplex is a much better choice.

Buy energy stocks to play the recovery

If you’re focused on finding a stock with considerable value and recovery potential, I would encourage investors to look in the energy sector.

Energy has been one of the worst impacted industries due to lockdown restrictions. That’s resulted in several top Canadian energy stocks offering incredible value for investors.

These stocks offer similar discounts to Air Canada and Cineplex. However, the business operations are in much better shape.

That’s why these stocks are so appealing today. Many energy stocks will offer the same recovery potential when the economy finally begins to open up for good. However, if that recovery is delayed, these stocks will hold their value a lot better.

This makes them ideal for long-term investors today. And because there are so many high-quality value stocks to choose from, there is no reason to consider Air Canada or Cineplex until we see big changes from the pandemic.