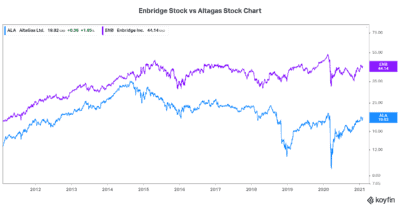

Enbridge Inc. (TSX:ENB)(NYSE:ENB) stock is one of the best known energy infrastructure stocks in Canada. It has many strengths. But Enbridge’s path doesn’t include much in the way of growth. Altagas Ltd. (TSX:ALA), on the other hand, does.

Altagas Ltd. is also an energy infrastructure company. Now that might seem boring to some investors. But read on and I just might change your mind. Altagas stock has really made a comeback over the last two years. It’s up more than 40% in the last two years.

Now let’s take a look at some of Altagas’ numbers that will blow you away. They might change what you think you know. This “boring” energy infrastructure stock is not so boring. It certainly has more upside than Enbridge stock.

Altagas expects a 20% increase in 2021 EPS

Energy infrastructure companies are well known for their stable earnings. They’re known for their cash flow generating prowess. And they’re known for their slow and steady returns. So how is Altagas expecting a 20% increase in EPS?

Well, a solid performing utilities segment is helping. The utilities segment accounts for 60% of Altagas’ EBITDA. This is the defensive segment. It is benefitting from rate base growth and lower operating costs.

Also, strong growth in Altagas’ midstream segment is also helping big-time. The midstream business is located in Western Canada. It includes processing and export facilities. These assets are located in some of the fastest growing markets in North America, including the Montney and Marcellus/Utica basins.

Enbridge, on the other hand is expecting EPS growth in the 8% range. While Enbridge has a solid business model, its growth profile is not as compelling.

60% growth in RIPET volumes expected

Yes, that reads 60%! The Ridley Island Propane Export Facility (RIPET) is a very bright spot. This facility is part of Altagas’ midstream business. It’s connecting Canadian producers to global markets. It is a strategic advantage for Altagas. In fact, it’s key at this time when access is lacking. Simply put, the propane business is booming. The Ridley facility is seeing strong interest from producers. This can be seen in its rising utilization and also in its volumes that are ramping up quickly.

RIPET experienced a 20% growth in volumes in the latest quarter. Altagas sees volumes growing another 60% in the near term, bringing the terminal to its capacity of 80,000 barrels per day. Management views this progression as a certainty. Canadian National Railway even highlighted this growth at RIPET as one of its growth drivers.

Altagas expects 2021 EBITDA to increase 12%

In Altagas’ latest quarter, normalized EBITDA increased 23%. Enbridge’s EBITDA was down slightly in its latest quarter. Altagas’ EBITDA growth was boosted by solid returns in the utilities and the midstream segments. Its midstream business is unique as it offers exposure to domestic and international markets. And there are still significant low cost expansions that can be made at all facilities, which translates to strong EBITDA growth. It translates to a prosperous present and future.

The Montney area is seeing a revitalization. Increased investment in the areas speaks to improving fundamentals in the natural gas market. Altagas is positioned for strong growth here as increased volumes take hold. Yet, Altagas stock remains undervalued. It is the underdog. Enbridge stock, on the other hand, is trading at much higher valuation levels.

Foolish bottom line

In my view, Altagas’ numbers will blow investors away — and they’ll cause investors to revalue the stock. Therefore, Altagas stock should continue to climb higher. I believe its upside will surpass that of Enbridge stock. This will happen as the company continues to prove itself over the next year. Its strong growth will likely surprise the market. And this, mixed with a rising tide for the energy sector as a whole, will play right into Altagas stock’s hands.