Air Canada (TSX:AC) stock has been among the hardest hit in this pandemic. Cancelled flights continue to take their toll. Travel restrictions leave little room for hope. And general chaos and uncertainty rule the day. Air Canada is bleeding hundreds of millions of dollars a month. How long can this continue?

Has Air Canada stock finally been dealt its death sentence?

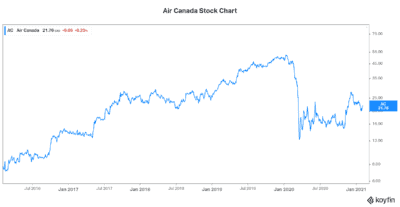

I’ve written about Air Canada stock before. I’ve highlighted a few things in my articles. Most importantly, the fact that Air Canada stock is only well suited for those investors who have a high tolerance for volatility. The stock is down more than 50% since the end of 2019. Yes, there have been pockets of hope in the last few months. But the second wave has hit with a vengeance. And the vaccine rollout across the world has hit stumbling blocks.

Air Canada came into this crisis armed with a very strong financial position. But the airliner is rapidly bleeding money. The longer this goes on, the more damage will be done. Passenger traffic is down more than 90%. Air Canada has cancelled flight routes. Some parts of the country have essentially been cut off. Without aid, more routes will be cut. More jobs will be lost. And the airliner will emerge from this crisis a shell of what it once was.

The value destruction is mind boggling. The government’s inaction is also mind-boggling. The aviation industry is a key part of a country. It keeps us connected to the world around us. It transports goods and services, boosting our economy.

The future of air travel and Air Canada

Air Canada has put all of its Rouge flights on hiatus. All flights to the Caribbean and Mexico have been halted. Aviation experts are warning that these new restrictions will likely trigger bankruptcies in the airline sector. And they will likely result in permanent closures of airports and travel agencies.

Air Transat would be at high risk here. Air Canada’s proposed acquisition of Air Transat might still go through. If it does, Air Canada will in effect save Air Transat. And in the long-run, this may very well end up to be an acquisition that will go down in history – for its perfect timing and perfect valuation.

But this is by no means a sure thing. The risk remains high. We hope that by the summer we will see a return to some normalcy. However, we have seen how this virus is brutal. This pandemic has taken a real toll. And the timing of its resolution is still very uncertain.

Government aid still lacking

Unifor, Canada’s largest private sector union, is calling for immediate financial support “to prevent a total industry collapse.” “You can’t have one without the other. Further travel restrictions without providing financial support for airline workers is a risk to the very future of Canada’s airline industry.” The union’s president, Jerry Dias has been very vocal about this.

But as of today, there’s still no government support. Canada is the only country in the G7 that has not offered financial support to its airline industry. This has to change. I would think that the government will not feed its airline industry to the wolves. Although this is what it has done so far.

Foolish bottom line

Air Canada stock has been left languishing in the low $20 range. Fourth quarter results will be released next week (February 12). This report and management conference call will be key. They will inform my opinion on the airliner’s future. The road has been long and difficult. Expect Air Canada stock to soar if the government announces a financial aid package soon. If not, expect continued pain for Air Canada stock.