Warren Buffet would surely agree that natural gas has been a very controversial energy source. On the one hand, it’s hurting the environment. This is why energy stocks have underperformed. On the other hand, natural gas is relatively cleaner than many other fossil fuels. For example, coal is notoriously dirty. And the oil sands also have a much bigger environmental footprint than natural gas.

Certainly, investing in natural gas stocks is not a very popular thing to do. But Warren Buffett doesn’t care. He doesn’t concern himself with what’s popular. Nor with whatever is the hot thing of the moment. He buys value. That is, he finds companies that will generate shareholder value today and well into the future. And he sticks with them for the long-term.

Warren Buffett has taken notice as natural gas prices soar

Natural gas prices have increased 57% in the last year. This has gone largely unnoticed. Until recently, it seems. Natural gas stocks have been on fire. But they don’t really reflect the positive outlook yet. So that brings us to the opportunity that we are presented with today. Natural gas prices are rallying. This rally appears to be fundamentally sound. And natural gas stocks have yet to reflect this shift.

Warren Buffett was early to this party. Last year, he purchased the natural gas assets of Dominion Energy Inc. Natural gas is cheap, reliable, and plentiful. It will help bridge the gap in the transition to renewables. As Warren Buffett states, “widespread fear is your friend as an investor because it serves up bargain prices”. This is what we’re seeing today in natural gas stocks. The fear is clear. And it’s been driving down valuations to the point where we have some major bargains.

An energy stock Warren Buffett would surely like

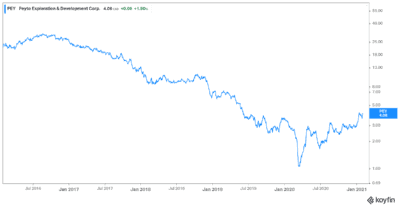

Peyto Exploration and Development Corp. (TSX:PEY) is a top tier intermediate natural gas producer. Its competitive advantage is its low cost operations. Peyto has managed this advantage well over the years. This has resulted in strong cash flows and strong financials. Peyto has always operated with the goal of maximizing shareholders returns. In the oil and gas world, this has not been the usual practice. These are all things that Warren Buffett looks for. They’re things that we should all look for too. Because of all of this, Peyto stock was my top stock pick for February

So here we are today, with Peyto stock up 40% in 2021. But it’s not too late for investors to get in on this rally. Peyto is one of the highest quality natural gas stocks out there. And if natural gas fundamentals continue to improve, it will continue to soar.

Enbridge stock is the safer energy stock

For those investors who would like to minimize their risk, maybe Enbridge Inc. (TSX:ENB)(NYSE:ENB) is the answer. It certainly would more closely fit Warren Buffett’s investing strategy. Enbridge is a leading North American energy infrastructure company. It has its hands in many different areas. For example, Enbridge is into natural gas transmission. It also owns and operates oil pipelines. And finally, Enbridge has a substantial stake in renewable energy.

So with Enbridge stock, investors get greater diversity. The potential upside return is lower than with Peyto stock. But Enbridge has less downside as well. And it gives investors a 7.5% dividend yield. So the choice is yours. If you want higher upside potential but more downside risk, buy Peyto stock. If you want lower upside potential but less downside risk and a dividend, buy Enbridge stock.

Foolish bottom line

Warren Buffett became interested in natural gas as valuations got too cheap to ignore . Finally, in the summer of 2020, he made a move. His purchase of Dominion’s natural gas assets signified two things to the market. Valuations of natural gas assets are cheap. And the long-term outlook for natural gas is strong.

Some of my readers undoubtedly also want to participate in this. This article highlights two Canadian natural gas stocks to buy, Peyto stock and Enbridge stock. Buy them and just sit and wait. Natural gas is rising. These energy stocks will rise with it.