Unfortunately, the time to buy Canopy Growth (TSX:WEED)(NYSE:CGC) stock was a few months ago. Right now, there is a perfect storm happening for stocks. This simply means that this is not the time to buy most stocks. Canopy Growth stock is hitting new 52-week highs. In fact, most cannabis stocks are as well. For example, Aphria is also trading around new 52-week highs of almost $21.50. This is the reflection of a few factors.

Let’s look at these factors to help us decide whether now is the time to buy Canopy Growth stock.

Canopy Growth stock has come a long way

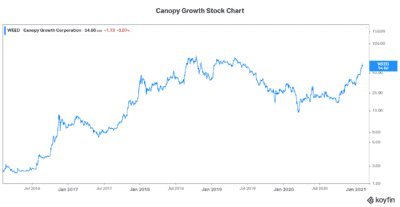

Remember when the marijuana bubble burst? If you’re like me, you’re feeling like that was a lifetime ago. But it was actually only a little over a year ago. The trading action that has gone on in cannabis stocks in the last few years feels like a lifetime’s worth. Cannabis stocks have soared to new highs and plummeting to soul-crushing lows. This has been a real ride. Hopefully, you have made some money through it all.

Canopy Growth stock has been the leader of the cannabis stocks. It’s arguably the biggest and most established cannabis company today. Momentum is building and is being led by record revenue in the Canadian recreational business. Canopy has improved execution. And the company is seeing an accelerating path to profitability.

New cannabis beverages, gummies, and other products are being launched. This opens the door to additional revenue opportunities. It will increase the company’s market size and opportunities. Further to this, Canopy has been more focused on the bottom line since the days of the cannabis bubble. The company has achieved significant cost savings. In turn, this will translate to positive EBITDA sometime this year. Finally, investors will have a real business to analyse in Canopy Growth.

Canopy Growth stock is benefitting from investor sentiment

At the end of the day, we cannot escape the fact that Canopy Growth stock is up big in 2021. That’s more than 80% in 33 short days. This is amazing for Canopy shareholders. But not so much for those of us who were considering buying the stock. For us, the best advice right now is to sit still. Just watch the market and be patient.

While there are good things happening at Canopy Growth, valuations are getting out of control again. The market in general is feeling good. The COVID vaccine is being administered and the end of the pandemic is in sight. These are quickly turning into hopeful times.

But Canopy Growth stock is still losing money. It’s trading at 41 times sales and 200 times 2024 EPS estimates. Clearly, there is much uncertainty. And clearly, the market is valuing the stock extremely optimistically again.

Foolish bottom line

The bottom line here is that Canopy Growth stock is once again in high demand. It has shot up far and fast. This leads me to back off on the stock. This is our chance to practice patience. Wait for the stock to settle. You don’t want to buy it in the midst of an unrealistic, euphoria-filled rally. The market in general seems ready for a pullback. That is, there will be better days ahead for buying.