A market crash is a fickle beast. It’s quite hard to predict when one will happen. However, a market crash provides you with an opportunity to up your stake in solid stocks.

The number one mistake you can make, then, is not being prepared. This means having a Tax-Free Savings Account (TFSA) and maxing out your contributions. Keeping your investments in cash rather than dividend payers and exchange-traded funds (ETFs) that offer security and growth is a huge mistake.

Of course, having cash available for short-term payments is one thing. But keeping your nest egg in cash is actually costing you money through taxes and inflation. So, what you’ll want are long-term stocks that will see you through a market downturn and allow you to pick up more when there’s a pullback.

Couple a market crash with dividends

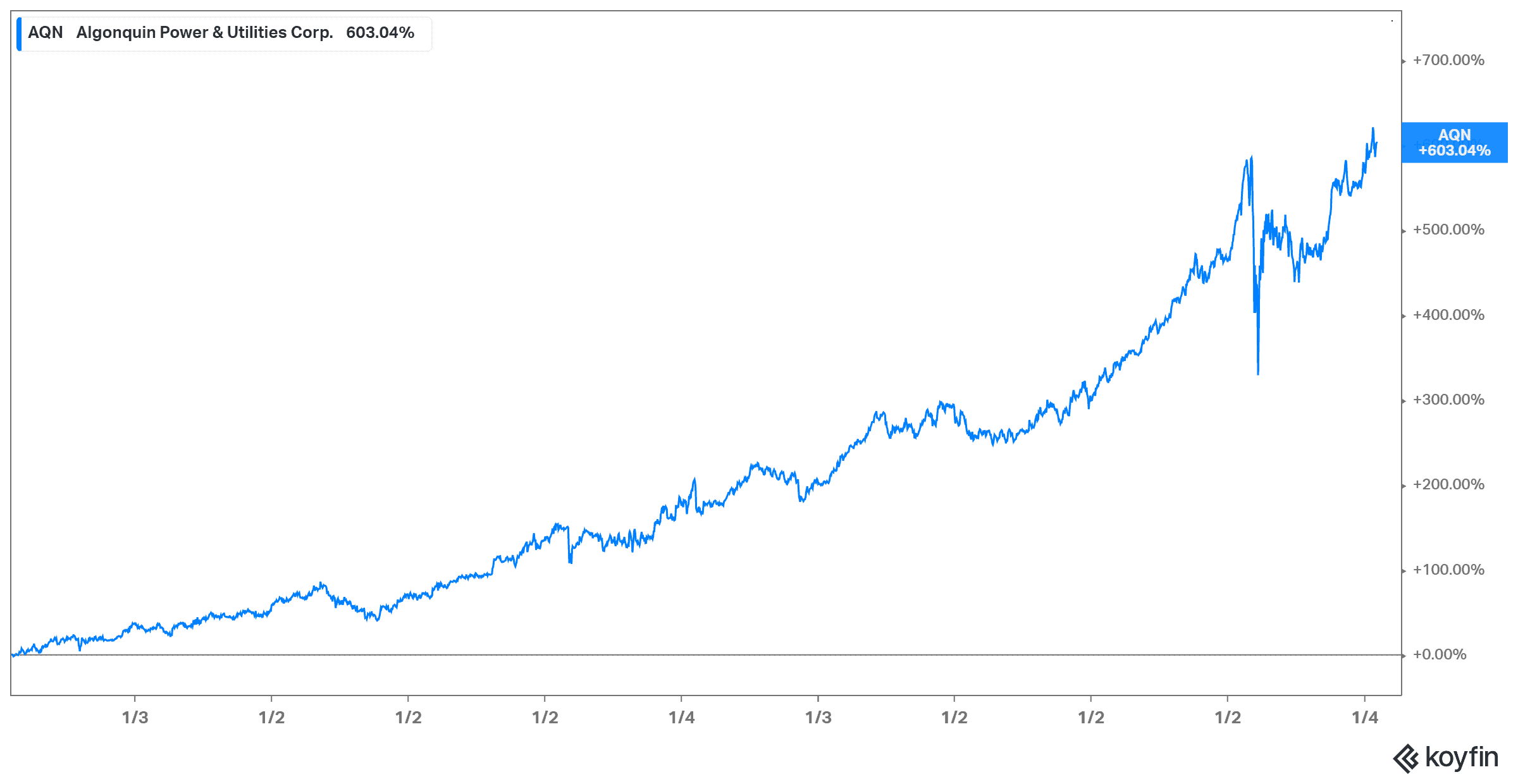

You don’t have to be risky to get to $1 million in your TFSA portfolio. Investors should trust the long-term potential of a stock like Algonquin Power & Utilities (TSX:AQN)(NYSE:AQN). The company has a strong history of performing well, even during a market crash, providing stable returns and dividends to match. Apart from the market crash in March 2020, you can see the stock has grown on a stable trajectory.

Right now, Algonquin trades at a fairly valued $22 per share, with a dividend yield of 3.6%. Given that this company can continue positive returns, even during economic crises, increasing dividends while others slash them, investors would be wise to stock up on this stock.

The company trades at a strong price-to-book (P/B) ratio of 2.2, which is almost exactly the industry average of 2.3 as of writing. The P/B ratio compares the price of the stock to the company’s net assets. So, you can see that this company’s market valuation is fairly valued at the moment. However, that could change as the company also invests in renewable energy. The Joe Biden administration is putting billions aside to invest in renewable energy. This stock could soar, as it uses those funds to continue its growth-through-acquisition strategy.

Foolish takeaway

I’m not saying you should wait for a market crash to buy this stock. As I mentioned, the stock is fairly valued, so now is a great time to pick it up. But if there is a pullback in the future, increasing your stake is a wise choice — especially if it means maxing out your TFSA.

Once you’ve done your own research, you’ll see exactly why Algonquin is the perfect long-term option. For example, if you were to have invested your $6,000 contribution room in the stock and reinvested dividends during the market crash, today you would have $8,405 in your portfolio in just a few months!

But looking back at performance, say you invested just five years ago during the period of stability. Today, that $6,000 would be worth a whopping $58,281.46! There are no guarantees that will happen again, but this is a strong stock to help you on the way to millionaire status.