Investing is not easy, and you’re inevitably going to make mistakes. The key, though, is learning from both your mistakes and others around you. Each time an investor makes a mistake when buying or selling TSX stocks, it’s going to cost money.

One of the biggest mistakes I see investors make all the time is holding a stock because it goes down. This strategy usually always follows the idea of buying the stock to sell it quickly. Then when the investment doesn’t work out, investors figure that “you can’t lose money if you don’t sell.”

First of all, you should try your best to avoid buying TSX stocks in hopes of flipping them quickly for a big price gain. It’s tough to do this once, let alone consistently.

But even if these investors had made that choice and the investment doesn’t work out, switching to a long-term investment plan also doesn’t make sense. If they had believed in the long-term prospects of the stock, they would have invested for the long-term in the first place.

So when a speculative investment doesn’t work out, investors need to move on. Hope is not an investment strategy, so hoping that the TSX stock will go back up and you can eventually break-even will likely lead investors to only make worse decisions. Nobody wants to lose money. However, investors need to know when to call it quits.

GameStop should be a lesson for investors

There are legitimate times to double down or continuing holding a stock that’s fallen. Of course, in a market crash, you never want to sell your high-quality TSX stocks.

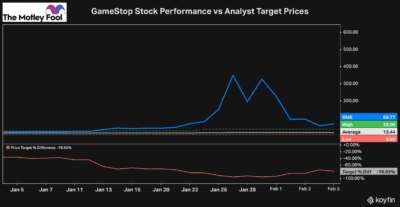

But lately, I have seen many investors talking about holding onto their big losers, such as shares of GameStop (NYSE:GME), for example. This is a poor idea because GameStop, specifically, is extremely overvalued.

As you can see, even after coming down from over $300 a share, the shares are still 80% overvalued, according to analysts. The stock is even roughly double the price of the highest analyst target price.

GameStop is a perfect example because it’s a struggling business that was bid up by speculative trading. Investors who are down 50% and holding their shares in hopes the price will one day recover are just wasting both their time and capital.

There are TSX stocks in the same boat as GameStop

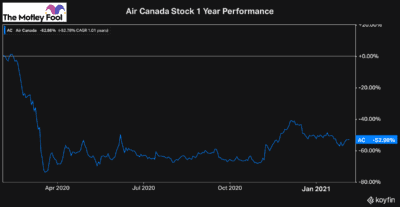

One popular TSX stock that is a great example of this is Air Canada (TSX:AC).

Back at the start of the pandemic, when it was clear a global virus would impact air travel the most of all industries, investors should have been selling the airline stock.

It’s true that ideally, you should never sell stocks in a market crash. However, that goes for high-quality businesses whose long-term potential hasn’t been impacted. That wasn’t Air Canada last February. So the second that investors had any doubt in the stock’s medium to long-term outlook, it’s time to sell.

But even if investors are too slow to react and the stock sold off substantially already, it’s a big mistake to continue holding the TSX stock.

Investors who were stuck holding Air Canada at the bottom and who have been waiting for a recovery since it tanked last February have missed rallies in almost every other stock on the market.

I’ve been warning investors against holding Air Canada for this reason. Due to the uncertainty and significant risk of its business in the short and medium-term, several TSX stocks are a much better buy today.

Bottom line

Nobody wants to sell a stock for a loss. But it’s even worse to continuing holding onto losers and missing out on significant gains elsewhere.

So anytime your long-term outlook of one of your investments changes, if you can find better value elsewhere, it’s probably time to sell the stock.