Air Canada’s (TSX:AC) fiscal year 2020 results illustrate just how disastrous the COVID-19 pandemic has been for air travel.

Air Canada posted bleak financial results

The Montreal-based airline reported a net loss of $4.64 billion, or a loss per diluted share of $16.47, in 2020, while in 2019, Air Canada posted a net profit of $1.476 billion, or diluted EPS of $5.44.

Total revenue was $5.83 billion in 2020, down 70% from $13.29 billion in fiscal 2019. In addition, as of December 31, net debt was $4.97 billion, up from $2.13 billion on December 31, 2019.

In the fourth quarter of fiscal 2020, the company incurred a net loss of $1.16 billion, or a loss per diluted share of $3.91, while a year earlier, it reported a net profit of $152 million, or $0.56 per diluted share. The airline’s operating revenue fell to $827 million in the fourth quarter from $4.43 billion in the same three months of 2019 as the COVID-19 pandemic hampered air travel.

Analysts polled by financial data firm Refinitiv had expected Air Canada to lose $735.67 million, or $2.84 per share, on revenue of $885.36 million.

The earnings close what the chief executive of the company has called the bleakest year in the history of commercial aviation.

Over the past year, Air Canada has had to downsize more than 20,000 employees, or more than half of its workforce, due to the crisis caused by the pandemic.

As the pandemic reduced demand for air travel, Air Canada’s passenger count declined 73% in 2020 after several years of record growth for the airline.

There is some light at the end of the tunnel

Despite the losses, Air Canada president and CEO Calin Rovinescu said on a call to analysts Friday morning that he was encouraged by the progress of recent talks with the federal government over a bailout, which has been going on for months without resolution. Any deal would include a resolution on passenger reimbursement, a plan to return service to regional markets, and financial support for the aerospace industry.

As for the proposed acquisition of Transat A.T., Air Canada received approval from Canadian regulatory authorities on Thursday, but the transaction remains subject to further approvals. Air Canada maintains that the transaction was to be closed by next Monday at the latest but recalls that the deadline can be extended at any time by agreement of the parties and remains in effect, unless terminated by one of the parties.

Transport Minister Omar Alghabra said last night that the proposed purchase of Transat A.T. by Air Canada will bring greater stability to the Canadian air transport market amid the devastating effects of the COVID-19 pandemic on the industry.

Rovinescu, who has been at the head of Air Canada since April 2009, said in his last earnings call before his retirement on February 15 that he was confident in the long-term future of the company, despite the challenges of the pandemic:

“As we move into 2021, while uncertainty remains as a result of the new variants of the virus and changing travel restrictions, the promise of new testing capabilities and vaccines is encouraging and presents some light at the end of the tunnel. As our success raising significant liquidity throughout 2020 indicates, investors and financial markets share our optimistic long-term outlook for our airline. I am also very encouraged by the constructive nature of discussions that we have had with the Government of Canada on sector-specific financial support over the last several weeks. While there is no assurance at this stage that we will arrive at a definitive agreement on sector support, I am more optimistic on this front for the first time.”

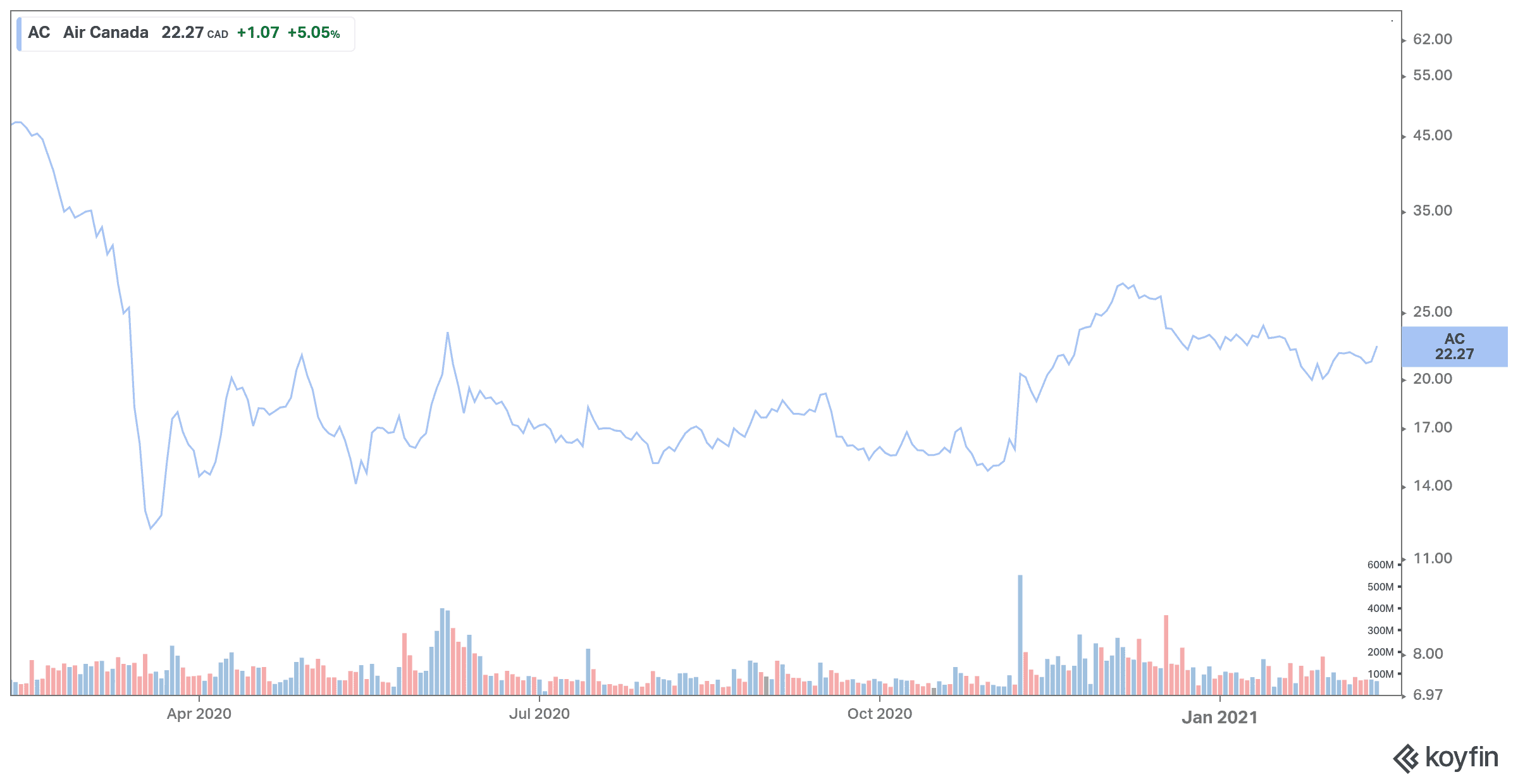

Investors appear optimistic too regarding Air Canada’s future, as the stock rose more than 5% in early trading Friday.

While risky, buying some share of Air Canada could bring great returns in the near future, as the company recovers from the pandemic. Air Canada is one of the cheapest companies trading on the TSX, and analysts are bullish on the stock.