Over the past few years, tech stocks have been some of the best-performing stocks. Several high-quality tech stocks, such as Lightspeed POS (TSX:LSPD)(NYSE:LSPD), have been growing their businesses rapidly, and their stocks have been following suit.

Growth stocks are some of the best stocks to own in bull markets, and Lightspeed is one of the top Canadian stocks.

Growth stocks also tend to have more risk, though, because they are more volatile. So, you need to make sure you pick the best companies you’re sure will outperform expectations.

When you do find stocks you are confident in, you have a great opportunity to grow your money. Oftentimes, top tech stocks like Lightspeed can grow investors’ money several 100% or even 1,000%.

Some of the most significant growth in tech companies the last few years has been e-commerce, and LightSpeed is key to that.

E-commerce was already naturally increasing in popularity over the last decade. However, the pandemic provided a significant tailwind, and Lightspeed, along with many of its peers, have reaped the rewards as a result.

The company’s impressive performance is not all down to macroeconomic factors, though. It, too, has performed well and capitalized on the opportunity.

Analysts have recognized this and are pretty positive on the stock. Here are just some of the bullish reasons to buy Lightspeed.

Why to buy Lightspeed stock

Lightspeed is attractive, because it’s a rapidly growing point-of-sale platform provider for small- and medium-sized businesses. The company provides a range of solutions that integrates software as well as payment processing. For the most part, these businesses are in discretionary industries like retail and hospitality.

Those industries have been most impacted by the pandemic, which is why Lightspeed’s omni-channel solution is so important. In just the last year, its gross transaction volumes from e-commerce have doubled.

On top of an already strong and impressive business, Lightspeed has also made some attractive acquisitions. This should help improve the product it provides to clients while also bringing in new customers, increasing the stock’s long-term potential tremendously.

With such strong stock performance over the last year, though, many may think Lightspeed is becoming overvalued. Here’s what the analysts think.

Valuation and target prices

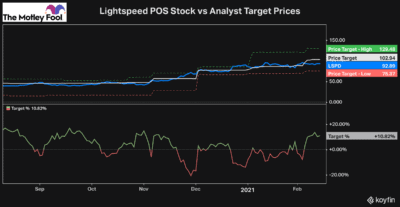

The analysts who currently cover Lightspeed are split on the stock, with just under half rating it a hold and the rest with a buy rating. As you can see below, the average target price is about $103 — roughly 10% upside from here.

While the analyst’s target prices generally reflect where they think the stock will be a year from now, it doesn’t mean developments in the meantime can’t improve the outlook. As you can see over the last six months, as Lightspeed’s stock has been increasing, analyst target prices have increased along with it.

So, while it’s near the high end of analyst target prices today, that doesn’t mean there isn’t still growth potential over the short term. In other words, if Lightspeed were to announce a new, highly attractive acquisition tomorrow, several analysts would immediately change their outlook.

While Lightspeed is pretty fairly valued at the moment, if you’re confident in the company and management, taking a long-term position today may be the prudent choice.

These days, investors need exposure to the tech sector. Not only does it offer some diversification from the effects of the virus, but it’s one of the highest-potential sectors there is.

As long as you have confidence in the stocks you are buying long term, then taking a position today would be prudent.

The need for Lightspeed’s software only continues to grow, and the company will continue to offer substantial growth for investors for years to come. This makes Lightspeed one of the top stocks to consider buying on a pullback.

However, due to the minimal upside in share price, if you’re looking to buy a stock today, there are better stocks to consider.