Bank of Montreal (TSX:BMO)(NYSE:BMO) and Scotiabank (TSX:BNS)(NYSE:BNS) on Tuesday kicked off first-quarter results for Canadian banks with better-than-expected earnings, boosted by the decrease in the amount of money set aside for bad loans.

BMO and Scotiabank are optimistic about the economy

Canada’s third- and fourth-largest lenders, who, like the rest of the industry, have so far avoided a surge in impaired loans due to a pandemic with a series of aid measures, are optimistic for the remainder of 2021.

The Canadian economy “is expected to rebound strongly in subsequent quarters as vaccines become more widely available and restrictions are relaxed,” BMO said in a shareholder report.

As the U.S. recovery has slowed, the passage of a support bill late last year “will likely propel the expansion forward,” it said.

“All businesses performed well, particularly in our U.S. segment, which remains a key driver of diversified earnings growth now and in the future,” BMO CEO Darryl White said in a press release.

While many Scotiabank Latin American markets saw the effects of the pandemic later than North America, it also cited a “favourable macroeconomic outlook” as a factor in reducing bad debt provisions, particularly abroad.

A rebound in net interest margins (NIMs) of six basis points in Canada and 17 basis points in the United States, after several quarters of stagnation, also helped BMO to exceed expectations. Scotiabank’s international banking NIM also rose six basis points, but its Canadian NIM remained stable.

Loan write-downs climbed in some of Scotiabank’s overseas retail markets, most notably in Peru, where payment deferrals expired, offsetting year-over-year declines in Canada and elsewhere.

BMO also saw an increase in bad debt from a year ago, largely due to an increase in retail write-downs, although they improved from the prior quarter.

Strong profit growth in capital markets and wealth management

Both banks posted higher profits compared to a year earlier, thanks to strong profit growth in capital markets and in wealth management, which helped offset more moderate increases in their Canadian units and a decline in Scotiabank’s international operations.

BMO net profit for the three-month period ended Jan. 31 was about $2 billion — a 27% increase from the previous year. After adjusting for some acquisition-related costs, profit was still up 26% to around $2 billion.

On a per-share basis, BMO reported adjusted earnings of $3.06, up 27% from the previous year. Analysts expected $2.15.

BMO also benefited from a sharp increase in the share of its U.S. personal and commercial banking business, which saw net income rise 66% from a year earlier, to $582 million. The lender said this was due to higher income as well as lower spending and lending costs, the latter “mostly due” to lower commercial provisions.

Meanwhile, Scotiabank first-quarter profit was nearly $2.4 billion, up 3% from a year earlier.

After adjusting for various items, net income was $2.4 billion and earnings per share was $1.88, which was also a 3% increase over the previous year. Analysts had expected adjusted EPS of $1.57.

Scotiabank’s results were also supported by a strong quarter in its Wealth Management and Global Banking & Markets divisions, which reported profit increases of 37% and 46% respectively year over year.

Wealth management results were fueled in part by higher brokerage and mutual fund fees, while the capital markets business saw strong fixed-income trading, mergers and acquisitions, and underwriting of share sales for clients.

However, the bank’s international unit’s net income fell 21% from a year ago to $389 million as the lender’s results were affected by its sales of overseas operations and by increasing credit costs.

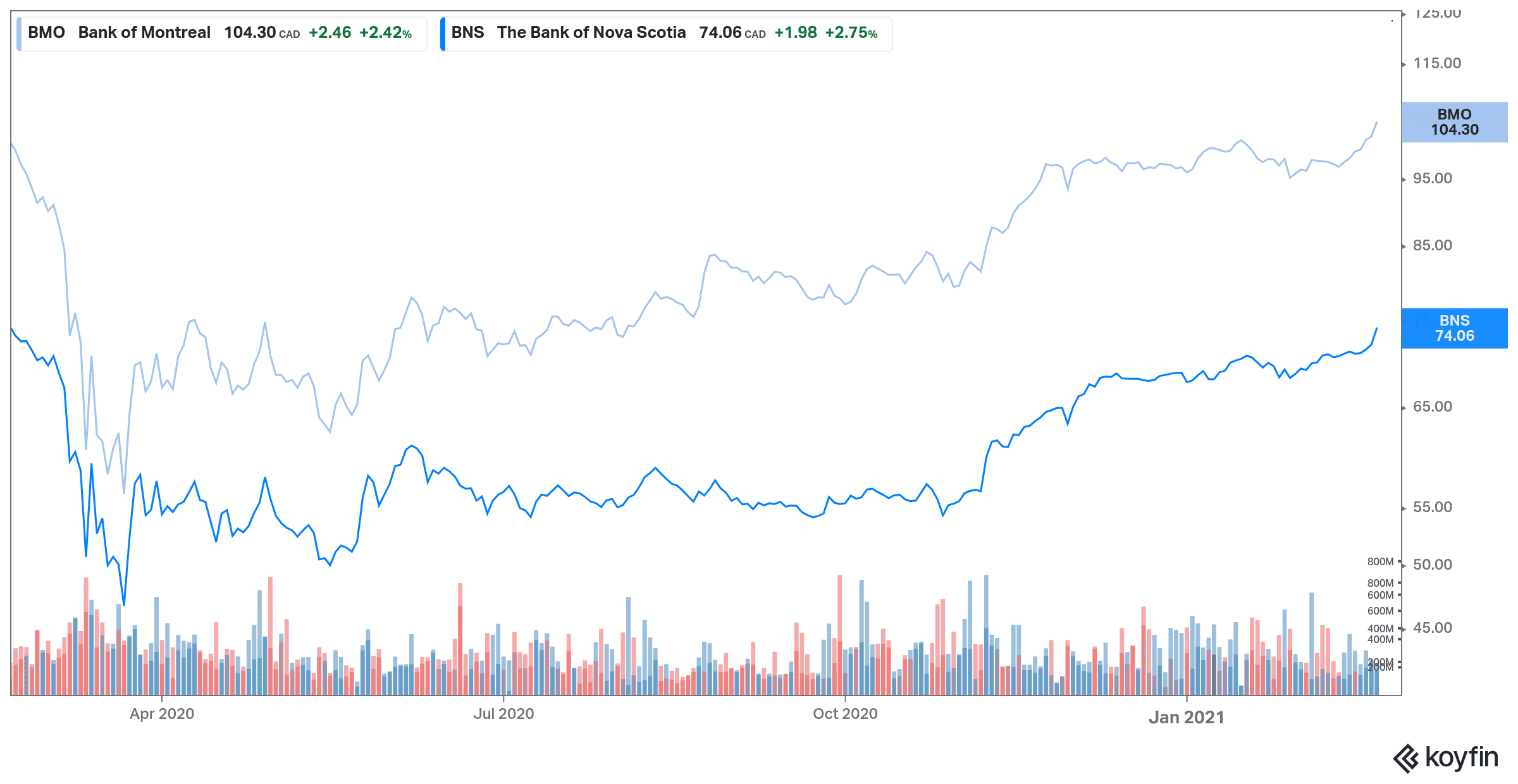

Those strong results drove BMO and Scotiabank shares higher. Both banks stocks soared more than 2% following their earnings release. BMO and Scotiabank are cheap and pay high dividends, so they are a great inclusion in a diversified portfolio.