If you’re following the markets today, there’s a good chance you’re a little confused. Twitter is replete with posts talking about a dreadful crash, yet the actual losses in the major indexes are miniscule. As of this writing, the Dow Jones Industrial Index was down 0.59% for the day, with the S&P 500 down only 0.95%. This is hardly a March 2020 scenario, however. Yet financial news sites and social media ripe with people talking about 10% losses and the sky falling.

Objectively speaking, what we’re seeing today is just a minor pullback. Yet some people feel like it’s something more. In this article I’ll explore why that’s the case–and discuss what you can do to protect yourself against market volatility.

It’s not so tiny if you’re all-in on “meme” investments

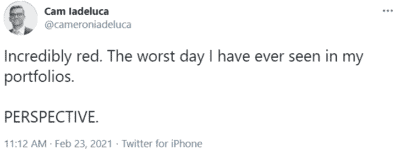

As it turns out, today really is a pretty bad day for a certain subset of investors. If you bought “meme” investments that had been promoted heavily on social media in the month or two prior to today, your portfolio is probably down nearly 10%. The Twitter post below is a pretty good example of someone who had that experience.

Basically, today’s small pullback disproportionately affected stocks that have become social media favourites. If you owned a diversified portfolio you probably didn’t suffer too much today. But if your entire portfolio consisted of things like those listed below, you got crushed:

- Palantir.

- Tesla

- Bitcoin

- GameStop

- AMC

- ARKK

This is all entirely predictable. Rallies built on hype and speculation tend not to last long. Possibly, some of the assets listed above will be long term winners. But the volatility they experienced today is to be expected. When investments are built on hype, it’s not hard for a little pullback to spiral out of control.

Word to the wise: diversify

If you’re one of the people who got caught up in meme assets and are suffering today, I have some advice for you:

Diversify.

There’s nothing wrong with having a small portion of your portfolio in things like Bitcoin. It adds a little fun to the experience and spices things up. But you need to keep it to a minimum. Your total portfolio should be broadly diversified so it can withstand negative market conditions.

A great way to get started with diversification would be to buy index funds like the iShares S&P/TSX 60 Index Fund (TSX:XIU). These ETFs are built on ready made portfolios that track the major market indexes. As a result, they are far less risky than individual stocks. Diversification reduces risk by spreading your eggs across more baskets.

Over time, it reduces your chances of losing it all. It’s quite possible for a meme stock to go to $0, but that will never happen to the broad market indexes–barring some kind of apocalyptic scenario.

As for XIU, it’s one of the best Canadian ETFs you can buy. The TSX 60 has a pretty high dividend yield–around 2.9%–and the fund has a low fee of just 0.18%. So you can earn an average return without fees taking too much of a bite out of it.

Overall, it’s a great Canadian ETF to buy and hold–an extremely powerful buffer against the kind of volatility some investors experienced today.