Bank stocks are an essential part of a well-diversified portfolio. This is true for many reasons. The most important being that they offer investors attractive dividend income. This dividend income is not only generous, but also resilient. And this resiliency sets investors up with dependable income. In an uncertain world, this stability is everything. Toronto-Dominion Bank (TSX:TD)(NYSE:TD) and Royal Bank of Canada (TSX:RY)(NYSE:RY) stock provide dividend yields of approximately 4%.

So let’s look more closely at bank stocks. Where are they trading today? What’s the outlook for tomorrow? And should we add to our holdings?

Bank stocks are trading at highs today — is it really time to buy?

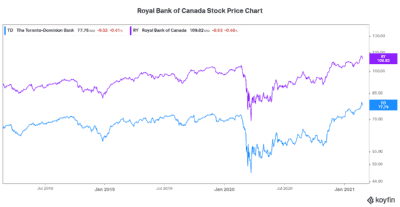

Yes it’s true. Bank stocks are trading at or around all-time highs today. TD Bank and Royal Bank are Canada’s two biggest banks. TD Bank stands out for its years of success in driving efficiencies. The bank has an industry leading ROE, and a conservative approach that mitigates risk. TD Bank’s stock price has rallied almost 8% in 2021. Royal Bank boasts leading operating efficiency and a dominant market share in many of its segments. Royal Bank’s stock price has rallied 5% in 2021.

Banks in general are reflecting the optimism that has taken hold. For example, there’s optimism around the coronavirus vaccine. The vaccine spells an end to the pandemic crisis. It’s the light at the end of the tunnel. And it’s what will get us back to the business of business. We dream of re-openings and booming demand taking us to new levels of wealth.

But is there too much optimism priced into the bank stocks? Is there too much optimism priced in markets in general? Stock markets are emotional. They are impacted by feelings. When investor sentiment is fearful, it will tank markets. By contrast, when investor sentiment is optimistic, is drives markets higher. Sometimes these feelings are all it takes to move markets. There doesn’t necessarily have to be any fundamental data to back it up – in the short term at least. In the long-term, markets and stocks will always trade in line with fundamentals.

So let’s look at this further. Is it really time to buy bank stocks?

Latest bank quarterly results were strong

There’s no denying that the latest quarterly results at the banks were strong. Earnings were significantly higher across the board. And revenue growth is recovering nicely. Areas like wealth management and capital markets have been especially strong. For example, Royal Bank’s wealth management segment reported a 19% sequential increase in earnings.

But the key factor that I would like to focus on is the provisions for credit losses (PCLs). PCLs are simply an estimation of potential losses due to credit risk/defaults. As we know, these estimates were skyrocketing as the pandemic set in. Billions of dollars were provisioned as credit risk escalated. Businesses were in big trouble.

Thankfully, fiscal and monetary stimulus altered the situation significantly. It supported businesses so that they can make it through unprecedented times. And it worked. As a whole the impact on the economy and banks was greatly reduced.

The problem is as follows. Bank stocks are trading at or near highs. Yet it seems highly likely that a third wave of the virus is coming. And the third wave will hit an already fragile economy once again. According to news outlets, this risk is rising as infections rise and variants are spreading. So there’s a disconnect between the optimism that’s priced into bank stocks (and the market in general) and what’s coming.

The bottom line

Bank stocks are one of the most solid investments that we can make. They’re the backbone of the economy. The industry has huge barriers to entry. And they consistently provide solid shareholder returns through dividend income and capital appreciation. Buy bank stocks for the long-term. But expect weakness in the short-term.