Shopify’s (TSX:SHOP)(NYSE:SHOP) stock price is in a sustained fall since the company released its market-beating earnings report on February 18. Shares in the e-commerce giant traded more than 15% off their all-time high on Thursday as a sell-off on large tech names continues this week. Could this be the time to buy more Shopify’s stock on the dip for future capital gains?

Why did Shopify stock fall 15% this week?

The company’s 94% year-over-year revenue growth to US$978 million during the fourth quarter of 2020 was phenomenal. Revenue and earnings surpassed analyst estimates. However, management toned down investors’ enthusiasm as it guided for slower growth in 2021. Vaccine rollouts and an opening up world economy could dampen e-commerce growth as shoppers revisit physical stores again.

It’s a known phenomenon that valuation can sometimes surpass and overshoot actual fundamental growth metrics. This is the case on SHOP’s stock as a hyped market bid up its shares and other tech stocks whose businesses thrived during COVID-19 lockdowns.

Now that the pandemic could be over soon, e-commerce firms could lose some business to traditional brick and mortar retailers. As for Shopify, e-commerce growth could “normalize” in 2021. However, we may need to be careful with the word “normal” whenever this Canadian tech giant is involved.

What could normal growth look like for SHOP’s business in 2021?

In just a few short years, the $154 billion company grew to become the second-largest e-commerce retailer in the United States. Amazon remains in pole position, but the leader’s recent acquisition of Selz, a startup helping small businesses set up online shops, could be a sign that the king is rattled. After an 86% year-over-year revenue growth to US$2.9 billion in 2020, Shopify is growing too fast for competitors to feel comfortable.

Analysts expect SHOP’s revenue to grow by 39% in 2021 to $4 billion. Another 35% sequential sales growth could follow in 2022. In short, the e-commerce giant could grow sales by 88% from US$2.9 billion in 2020 to $5.5 billion by 2022 in a “normalized” business environment. This is still an insane growth rate for a large business – by any normal standards.

Expansions into non-English speaking geographies, further investments in a fulfillment network, payments processing revenue, and tapping into the retail point of sale niche are some of the strong growth drivers that will propel the company’s revenue and earnings growth this year.

Can you buy the dip today and still earn positive returns?

Shopify should continue to report strong growth in the near future. The business emphatically turned profitable last year. Its normalized net income could expand from US$491 million in 2020 to over US$650 million in 2022. Moreover, the company is fast becoming a giant free cash flow generator, shareholder dilution could be minimal going forward.

That said, I still have concerns with the company’s valuation.

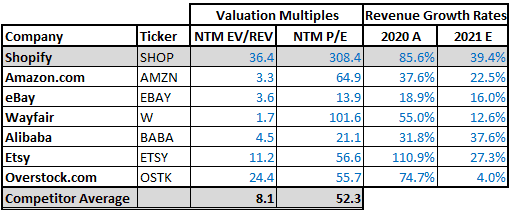

Even after a 15% retracement recently, SHOP’s stock is still richly valued. Its forward (next 12 months) price to normalized earnings multiple (NTM P/E) has since declined from 521 by September 30, 2020, to 308 times 2021 earnings.

SHOP’s stock remains expensive compared to its competitors in the internet and direct marketing retail segment. The business must grow into its current valuation, or else a correction is necessary if it doesn’t. You may thus easily lose money on a new position today.

Evidently, the company shares are expensive for good reasons though. The company is growing faster than its competitors. You can still buy Shopify’s stock as a long-term core position today. It looks safe to bet on its sustained revenue, earnings, and cash flow growth in the future. Holding the new position over the next five to 10 years could still make investors richer. Perhaps one should wait until the current sell-off shows some signs of cooling off before initiating a new position.