It finally looks like an end to the COVID-19 pandemic is in sight. Multiple vaccines have been released, with many countries well underway with distributing these vaccinations. Even with variants, we should see a massive shift in the next year. Yet it has many investors wondering if they should be dumping pandemic-related stocks.

I’ll look at three industries and discuss if you should hold on to these pandemic stocks once a recovery is completely underway.

E-commerce

There was a massive boom in the e-commerce industry almost immediately after the pandemic hit. With everyone stuck at home, we needed items, and we wanted to stay safe. Obviously, this created a huge demand for companies that were able to meet the demand.

One such stock, of course, is Shopify (TSX:SHOP)(NYSE:SHOP). Shopify soared during the pandemic and continues to climb towards $2,000 per share with some dips recently. It beat analyst expectations again and again during the pandemic, but can this continue?

The answer is yes and no. On the one hand, the e-commerce industry was already expected to boom over the next decade. But it’s true that the pandemic sped things up. Shopify management admitted it’s unlikely to see such a strong year as it had in 2020. However, it does plan to see continued solid growth in its subscriptions and through its recurring revenue. Plus, the company always seem to have tricks up its sleeve on making more money.

So, for Shopify stock, if you own it, keep it. E-commerce will continue to boom. In fact, I’d argue it’s s still a solid buy if you have the funds, as shares trade about 11% below all-time highs as of writing.

Telehealth

Telehealth stocks also saw a massive boost during the pandemic. Again, with everyone stuck at home but still needing medical services, telehealth became invaluable. But again, many wonder whether telehealth stocks will even be used when everything returns to normal.

In short, yes, they will. It’s unlikely that telehealth companies will suddenly become obsolete. If you used these services, and it’s likely you have, why would you go to see your doctor for a conversation you can have safely and conveniently at home? This brings down wait times, allowing doctors to see more patients. It also gives more experience to younger doctors as well as more opportunities for people to talk to healthcare professionals in rural areas.

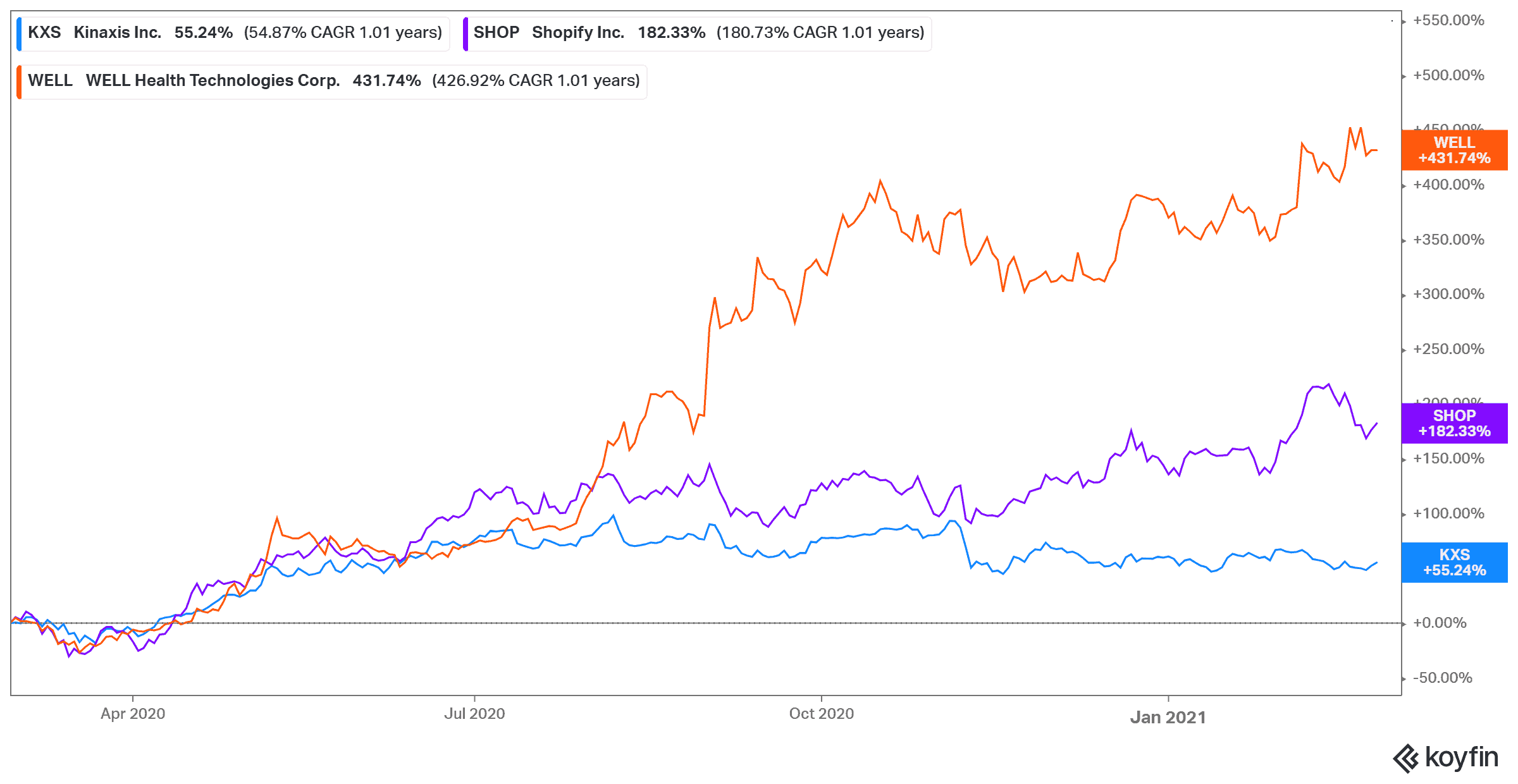

Telehealth got a boost it wasn’t likely to have seen without a pandemic. Now, it’s a necessity. That goes for a company like WELL Health Technologies (TSX:WELL). The company continues to expand through acquisitions, most recently making a huge move into the United States. Yet the company is still cheap for investors looking to buy long term. If you’d bought a year ago, shares are already up 435% for this stock.

Software as a Service

The Software-as-a-Service (SaaS) sector is similar to e-commerce. It already existed but got a major boost during the pandemic as everyone came online. Companies that provided these services received a boost practically across the board. Yet, again, many worry there will be a drop post-pandemic.

This one makes the least sense. Companies like Kinaxis (TSX:KXS) are stocks that will continue to grow revenue, pandemic or not, and this year proved it. Consumers needed to change their shopping behaviour, and Kinaxis was there to help companies manage this. The company provides supply chain management solutions around the world, with its cloud-based business seeing recurring revenue continue to grow year over year.

In fact, Kinaxis is up 55% this year but has a compound annual growth rate of 34% over the last five years. It consistently grows its sales and free cash flow, with no long-term debt on hand. There’s been a stock correction recently that could disappear when earnings come out on Mar. 4 with management’s earnings guidance.