Consumption and investment ideas sometimes conflict with one another severely. However, buying beaten-down Air Canada’s (TSX:AC) stock at $17 a share did seem like a much better option than spending on a $900 New iPhone SE in April 2020.

I recommended buying the struggling airline’s oversold stock eleven months ago while delaying the instant gratification from owning the most recent iPhone last year. The investment was already in deep profit by December, but AC stock pared most of the gains in January. Shares have recovered now. However, being human, the fear of losing the gains back to the market is kicking in.

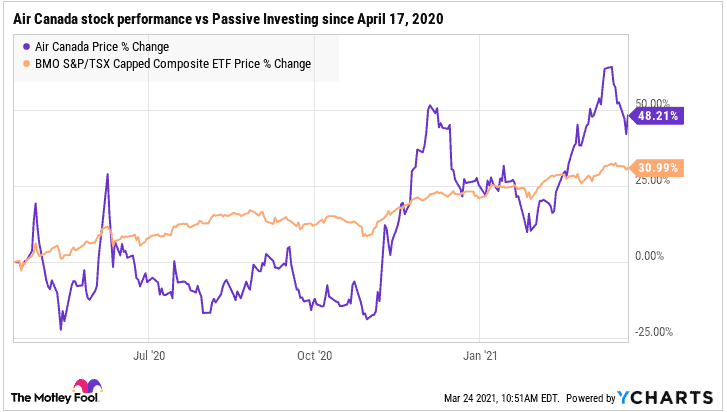

Air Canada stock returns vs passive investing

Truth be told, Air Canada’s stock price has been a bit too volatile for many investors’ tastes. I bet most investors who bought AC stock around the $17 levels last year have taken some profit. Most could have sold out of the high-risk position during a difficult January.

The reality is that contrarian investing carries a significant amount of risk. The strategy seeks compensation from outsized returns. What is beginning to frustrate me now is the fact that there’s no end in Air Canada’s stock volatility in the near term, yet a passive investor in the TSX Composite Index is catching up fast on the gains enjoyed on a riskier AC stock bet.

I would have liked it if AC’s stock looked to potentially double from here. But it doesn’t. It would hurt to see a passive investor in a BMO S&P/TSX Capped Composite ETF gaining until she matches the gains on Air Canada stock, yet I have endured so much volatility. The added risk in holding an airline stock during this devastating pandemic won’t be compensated.

Could this be the best time to take profit on AC stock and walk away?

As the economic recovery gains momentum in the energy, REITs, and financial sector, the TSX appears well positioned to maintain valuation growth momentum well into 2022.

On the contrary, as things now stand, the recovery in the airline industry is taking longer than desired. Vaccine rollouts are taking forever to make significant COVID-19 pandemic containment progress. Most planes remain grounded, and countries are already battling a deadly third wave of coronavirus infections.

It feels like Air Canada could potentially lag behind the broader economy’s recovery process in 2021. Given a mean analyst price target on AC stock of just $28.30, it appears like a 9.7% potential gain over the next 12 months may not be compensating much of the volatility risk in the struggling airline’s business.

Perhaps it’s time to take our gains and redeploy somewhere else.

The airliner’s business outlook for 2021

Analysts expect the airline to report a 30% year-over-year revenue growth in 2021 to just $7.6 billion while normalized income recovers from a $4.2 billion loss in 2020 to a $2.4 billion loss for this year. However, net debt could increase from $5.5 billion on December 31 last year to a staggering $8.3 billion level. The balance sheet is getting weaker.

The longer COVID-19 continues to spread and claim lives globally, the worse Air Canada’s financial position becomes. Government bailouts won’t be enough to sustain the business’ current valuation. The company’s business footprint is shrinking. And given ZOOM’s substitute for business travel, corporate and individual travel budgets may remain low for years.

Foolish takeaway

Skies need to open up, and normalcy should return for Air Canada’s business prospects to improve.

As a long-term investor, I tend to keep holding positions. However, periodic reviews are necessary. We have to test and see whether the original investment thesis still holds and check whether competing offers are of better value.

The sad news is that vaccination and pandemic containment efforts aren’t working as fast as I would like. Perhaps it’s time to take the current 48% gain and invest it elsewhere where the long-term investment risk will potentially be more richly rewarded. Many such options remain on the TSX, and Fool analysts do have a free sample list to give out today.