Air Canada (TSX:AC) stock has had a rough year. If you were a shareholder at the start of 2021, you probably have had a rough year as well. This is understandable. These have been trying times. Today, there are many who are thinking that Air Canada is a top stock to own. The theory goes like this – Air Canada will have massive exposure to the post pandemic recovery. Air Canada’s stock price will therefore soar – but I’m not convinced.

Let’s dig in.

Air Canada: it’s all about the vaccine

It’s undoubtedly true that Air Canada will benefit from a recovery. This is a waiting game. As more and more people get their shots, optimism will take hold. But today, the third wave of the coronavirus is upon us. We’re not out of the woods yet.

So the saga continues in 2021 with workforce and capacity reductions. Air Canada’s global network has been effectively dismantled. It took a decade to build and was gone in one fell swoop in 2020. This has come with unimaginable financial losses.

What is emerging is a dramatically smaller, more expensive airline industry. For example, Air Canada’s 2020 capacity was reduced by 67% versus 2019. And the cuts have not let up. In Q1 2021, capacity will be reduced by 85% versus Q1 2019. These are dramatic cuts. These cuts cost money.

Air Canada stock will benefit from a recovery, but to what extent?

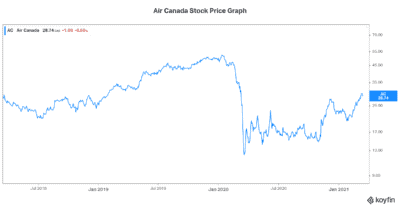

We can’t expect Air Canada to come out of this unscathed. Air Canada’s stock price has reflected this carnage. And in my view it will continue to reflect this carnage in the longer term. Yes, Air Canada’s stock price has more than doubled since March 2020 lows. In a year of recovery from the coronavirus vaccine, this is no surprise. The graph below highlights Air Canada’s stock price volatility.

We love it on the upside, but we have to be aware that the downside is huge. This is a very capital-intensive industry that is a victim of too many external forces. And these external forces may be working against the company for years to come.

A long road ahead for Air Canada

Even Air Canada CEO Calin Rovinescu has given us a sobering timeline for recovery. He’s also given us an indication of how difficult the road ahead will be. Finally, he’s prepared us for the fact that the airline industry will be forever changed. In fact, it will take at least three years for a recovery in the airline industry. The vaccine won’t be instantaneously available worldwide. Unfortunately, the current size of Air Canada’s fleet will probably remain as is for the next three years at least.

We should therefore prepare ourselves for a variety of scenarios. The first and most pessimistic one is that business and long haul travel will take seven years plus to recover. Air Canada’s position is that it will take three to five years. In our own personal estimate, we must take a few things into account.

For example, how long will the vaccine rollout take – globally and domestically? Also, have new habits set in? Habits that will change the airline industry for the long term. Take business travel, for example. Is there a new way of doing business? Will companies decide to permanently cut or reduce business travel and opt for the less expensive Zoom meetings?

Much has changed. The question of a recovery is easy. There will be a recovery. The question of the extent of a recovery is much more difficult. Will we go back to our old ways? Or have we found something better?

The bottom line

In short, Air Canada stock will likely continue to recover. The devil is in the details though. Can Air Canada recover back to $50 in this new world? I think that’s more questionable. In fact, I would say no, it probably can’t. The risk in Air Canada stock remains high — and the upside remains much lower than what investors are pricing in.