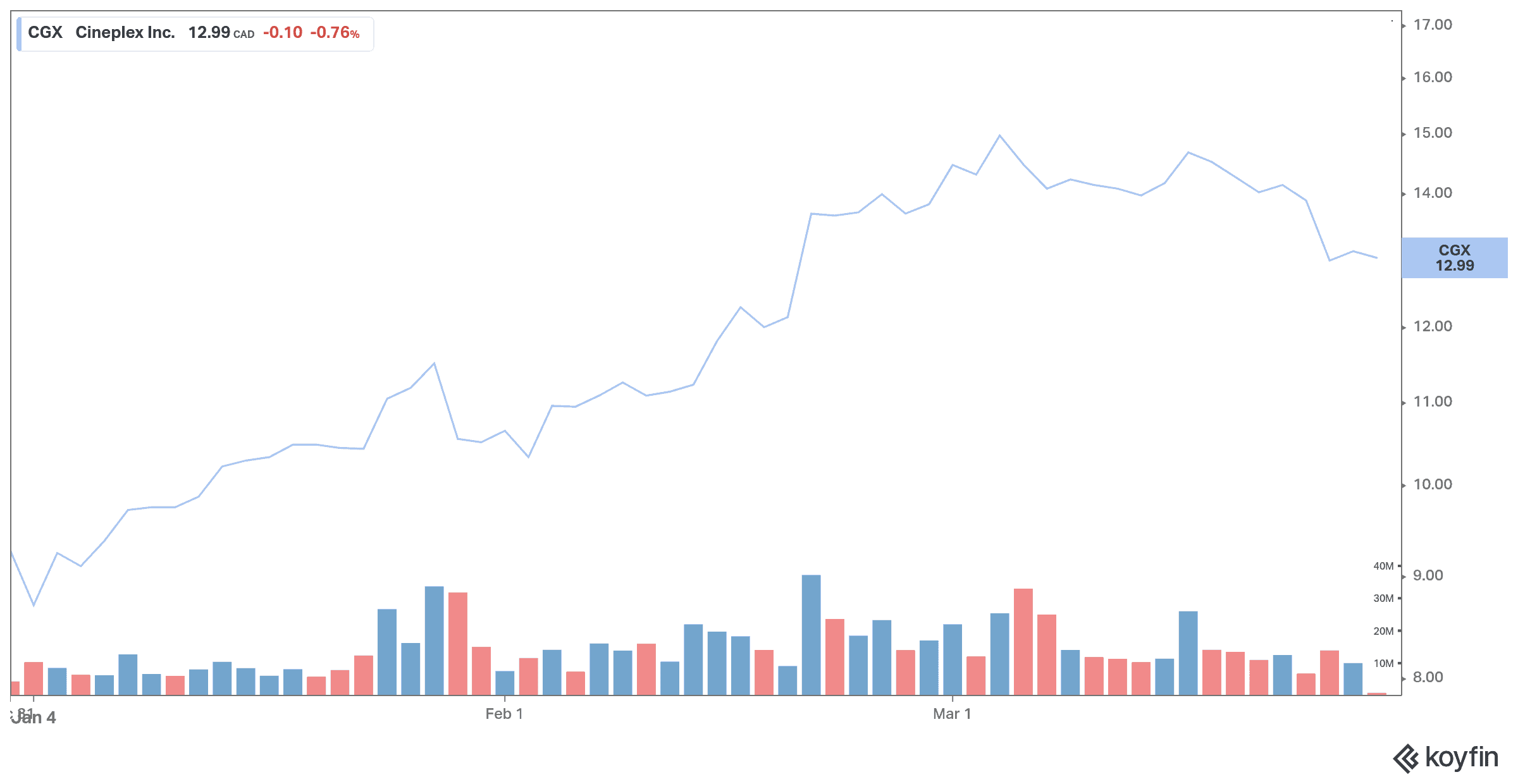

Cineplex stock is up about 50% year-to-date. It’s still far from its all-time high of $54.81, which was reached on May 2, 2017. Cineplex stock may continue to rise if the recovery is strong but the company is facing many threats.

Cineplex is facing many threats

Movie theatres could barely function in Canada for most of 2020. There was a brief stint this summer when the provinces reopened. However, in the fall and winter, movie theatres had to face once again restrictions and lockdowns. Many provinces began to reopen toward the end of the winter with limited capacity. In addition, Canada has stepped up its vaccine deployment and now appears to be on track for its initial projections.

Cineplex released its results on February 11. Total revenue fell 88% from 2019 to $52.5 million in 2020. Box office revenue per customer fell 14%, while dealership revenue per customer grew 33%. Cineplex reported an adjusted EBITDA loss of $32.1 million.

The ongoing COVID-19 pandemic continues to pose a huge threat to the film industry. Canada has lagged behind its peers in its vaccine rollout, shaking those hoping for a rapid recovery in 2021. We can’t predict exactly when this pandemic will be behind us.

Before COVID-19, mainstream cinema faced an existential threat from the rise of streaming services. Netflix was still the dominant platform in the late 2010s, but fierce competition had emerged in the form of Amazon Prime, Disney+, Apple TV+, and a host of smaller niche offerings. The pandemic only worsened the situation.

Cineplex has taken several cost-cutting initiatives, such as renegotiating rent payments and downsizing, to reduce losses and cash consumption. In addition, the company strengthened its liquidity position by selling and leasing its head office and expanding its loyalty program with Scotiabank. During the last reported quarter, Cineplex said it expects to return to normal operating levels in the second quarter.

Should you buy Cineplex stock?

With an improving operating environment, an expected recovery in consumer demand, and a weaker cost base, Cineplex stock could deliver stellar returns in the years to come. Shares of Canada’s largest theatre operator are very cheap, with a price/earnings to growth (PEG) ratio of 0.03.

The closer we get to the end of the pandemic, the more likely this company’s share price will rise. Investors may begin to realize that income will start again when the locations reopen. Cineplex will gradually repay its debt with increasing cash flow. If a bailout does occur, it will take much less time to get back on its feet and skyrocket its valuation.

Cineplex has had a tough year and could continue to experience tough times in the short term. Recovery might not be as quick as expected. Investors are betting on a rebound, but Cineplex stock still has a long way to go.

However, buying Cineplex stock now could offer you significant long-term returns if it manages to rise in the post-pandemic era. The stock is trading at an attractive discount, which is a good entry point for long-term investors. Investors betting on Canada’s ability to fully reopen by the end of 2021 may want to consider Cineplex stock today.