Whether the market is rallying rapidly, trading flat, or selling off, there are always opportunities for investors to consider. The state of the markets today has a lot of Canadian stocks trading at full price. There are, however, a handful of stocks that are undervalued.

Depending on what kind of stock you’re looking for and what your risk tolerance is, there are various companies to consider today.

Here are four of the top Canadian growth stocks I would consider buying in April.

A top cleantech stock

Green energy stocks are some of the best growth stocks to buy for the long term. That’s why Xebec Adsorption (TSX:XBC) is one of the top Canadian growth stocks to buy in April.

Not only does Xebec offer a tonne of potential for investors long term, but it’s also trading at a highly attractive discount.

The company makes equipment that traps and purifies raw gasses then transforms them into clean energy in the form of renewable natural gas or hydrogen.

This is revolutionary technology that will play a big role in the future, as the world works together to reverse the effects of climate change.

Xebec likely won’t remain cheap for long, though, which is why I’d be looking to take advantage of this discount in April.

Canadian tech stock

Another high-quality Canadian stock trading at a discount is one of the top tech stocks on the market: Lightspeed POS (TSX:LSPD)(NYSE:LSPD).

Lightspeed is a rapidly growing software company that offers its customers an attractive mix of services such as customer engagement, managing of operations, and the collection of payments.

Lightspeed has seen its business explode over the last year as the e-commerce industry has been growing rapidly. What’s really impressive about Lightspeed is how fast it’s grown, considering many of its customers are in the retail or restaurant industries.

These were some of the hardest-hit industries last year. This means as the economy continues to recover, there could be even more upside for the tech stock.

With the recent selloff in the stock creating a nearly 25% discount from its 52-week high, the stock is mighty attractive. That’s why Lightspeed is one of the top Canadian stocks to buy in April.

Cryptocurrency stock

In addition to a high-quality tech stock like Lightspeed, you may also want to consider a cryptocurrency stock, such as BitFarms (TSXV:BITF).

The cryptocurrency industry has been booming over the last year, and many experts expect this growth to continue.

If you’re bullish on the cryptocurrency industry, specifically Bitcoin, BitFarms could be the perfect Canadian stock to buy in April.

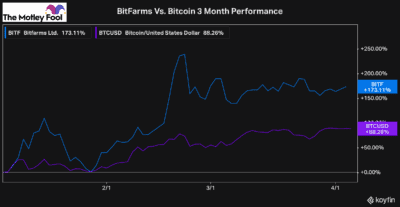

BitFarms is a miner of Bitcoin. For investors, that means it’s a leveraged investment to the price of Bitcoin.

As you can see, when the price of Bitcoin is rising, BitFarms can earn investors incredible returns. So, if you have a high risk tolerance and are bullish on Bitcoin, BitFarms is one of the top Canadian stocks to buy in April.

The top Canadian growth stock

Lastly, a list of the top Canadian stocks to buy would be incomplete without the best growth stock in Canada, Shopify (TSX:SHOP)(NYSE:SHOP), especially considering the discount the stock trades at today.

Shopify is one of those revolutionary businesses that only come along once in a blue moon. The company’s dominance in e-commerce has not only put itself in a great position, but it’s helped the entire industry to grow immensely.

The better the help Shopify can offer, and the better its merchants do, the faster it will grow. That’s because not only will its existing merchants continue to use the services, but it will drive their competitors online, too.

The costs of the e-commerce industry have been declining rapidly thanks to the scale created by Shopify and other big e-commerce businesses. This is extremely promising and shows just how much growth potential Shopify has.

That’s why, with the stock trading roughly 25% off its 52-week high, it’s one of the top Canadian stocks to buy today. It’s a stock that deserves a premium, so seeing it trade at such a massive discount today makes it a no-brainer buy.