Investors in Hive Blockchain (TSXV:HIVE) stock could enjoy a good week of capital gains if Ethereum maintains its current price growth momentum. Ethereum, the world’s second-largest cryptocurrency by market capitalization, recorded an all-time high price of US$2,151.25 during early hours on Tuesday. The coin has so far rallied by 189% so far this year and here’s why this has been a celebrated development for Hive stock.

Hive stock could benefit from an Ethereum rally

Hive is currently the only publicly traded cryptocurrency mining stock offering investors significant exposure to Ethereum mining economics. The rise in the crypto coin’s price will boost company’s revenue and profitability in the next quarterly earnings.

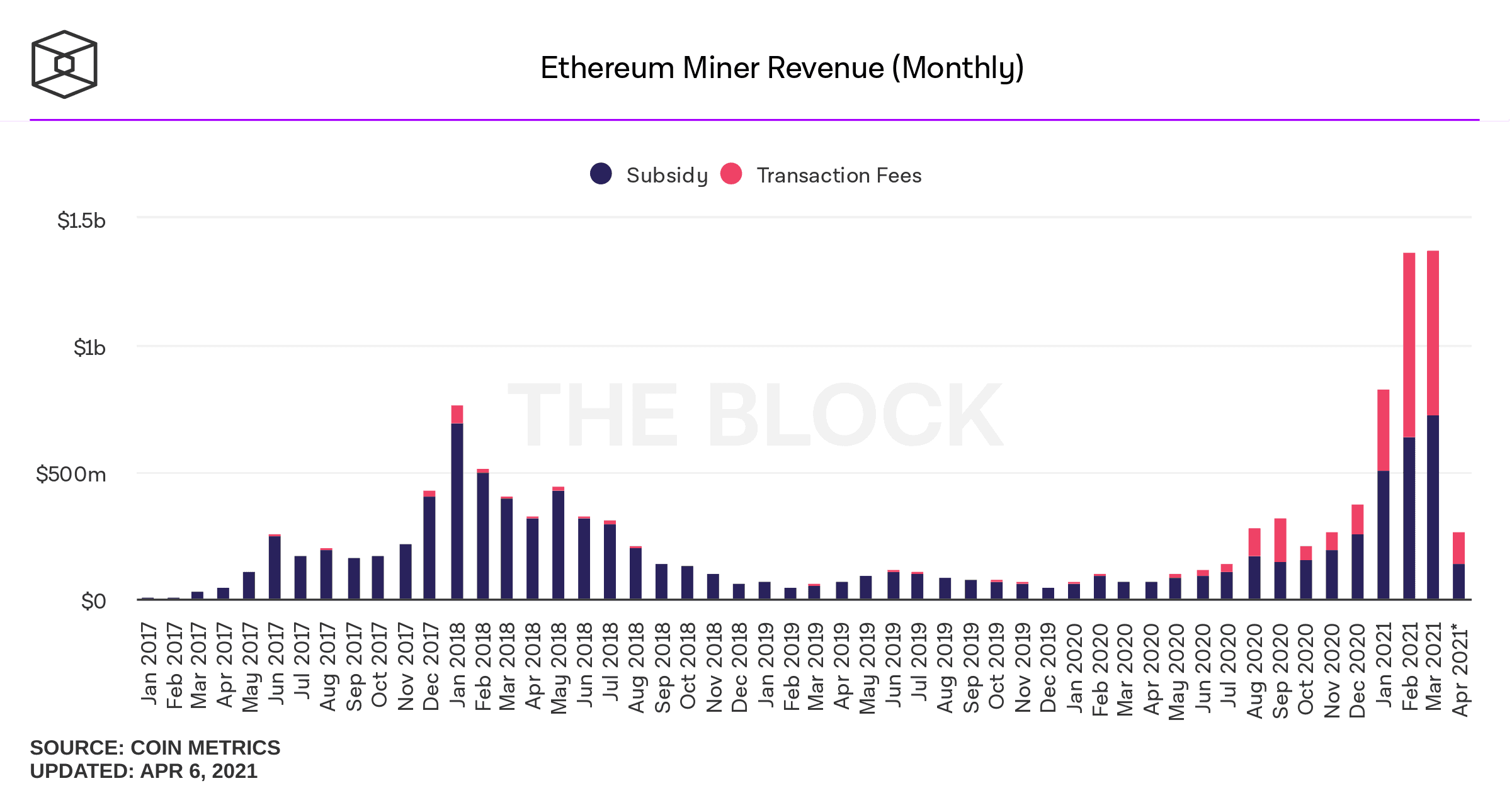

As the altcoin’s price surges, the total revenue for miners increases too. Add to that the effect of an ongoing increase in decentralized finance (DeFi) applications and related total transactions on Ethereum’s blockchain on transaction fees, and we have a beautiful setup for Ether miners.

Total revenue for Ethereum miners during the first five days of April has already exceeded that for the entire month of October 2020. The company is partaking in this ecosystem’s economic gains. As transaction fees explode in 2021, and I can’t wait to see how HIVE’s earnings will react to this nice industry setup.

Bitcoin price surge to compliment Ethreum’s impact on earnings

Hive stock investors may expect a significant earnings boost to the company’s quarterly results for March 2021 from both Bitcoin and Ether.

The company mined about 21,500 Ethereum coins and produced 165 Bitcoins during the final quarter of last year. It reported US$17.2 million in earnings before tax for the quarter ending December 31, 2020. Management estimated that a “mere” 25% change in Ethereum’s market price during that quarter could increase earnings by US$2.4 million. A similar increase in Bitcoin’s market price could have increased earnings by US$1.3 million.

The recent quarter saw Ethereum price rising by 160% and Bitcoin rising by 103% by March 31, 2021. Assuming all other variables do not change since December, observed moves in the respective cryptocurrencies could result in a 120% increase in quarterly profit for Hive to nearly US$38 million.

Things have changed of course, but the company could report significant revenue and profit increases in the next financial statements.

Time to buy?

The volatility in cryptocurrency prices naturally reflects on crypto mining tickers, and Hive’s stock is no different. If you can stomach the wild swings experienced historically, then the opportunity to buy and hold is still available.

Hive Blockchain’s exposure to a more DeFi friendly blockchain platform gives it access to a revolutionary Ethereum ecosystem that’s challenging traditional financial intermediation. The company could enjoy recurring business from transaction fee-generating operations, even if mining economics take a sudden knock.

Management intends to diversify the firm’s operating exposures. It is investigating artificial intelligence (AI), and other highly-efficient computing applications for its data centers in Sweden and Iceland. Private blockchain computing could be offered too.

Investors could therefore see dampened volatility in the long term as diversification benefits smoothen earnings. The recently announced transaction with blockchain services firm DeFi Technologies is another interesting growth-focused partnership that could deliver the goods for shareholders.