Since Shopify (TSX:SHOP)(NYSE:SHOP) stock has recently experienced a significant pullback, it could be tempting to buy some shares if you are convinced another rally is coming. But you might want to wait before buying shares of the e-commerce platform. Here’s why.

Shopify stock is overvalued

Shopify consistently beats estimates and delivers high double-digit earnings quarter after quarter and year after year. When you think the stock’s rise is over, be careful because here’s another run.

But it might be wiser to wait before buying Shopify, as the company’s multiples don’t look very good. Shopify stock has a P/E of 584.98 and a P/S of 63.47, making it very expensive.

Shopify is still a great company. The pandemic was favourable to its business and the provision of traffic and e-commerce activity.

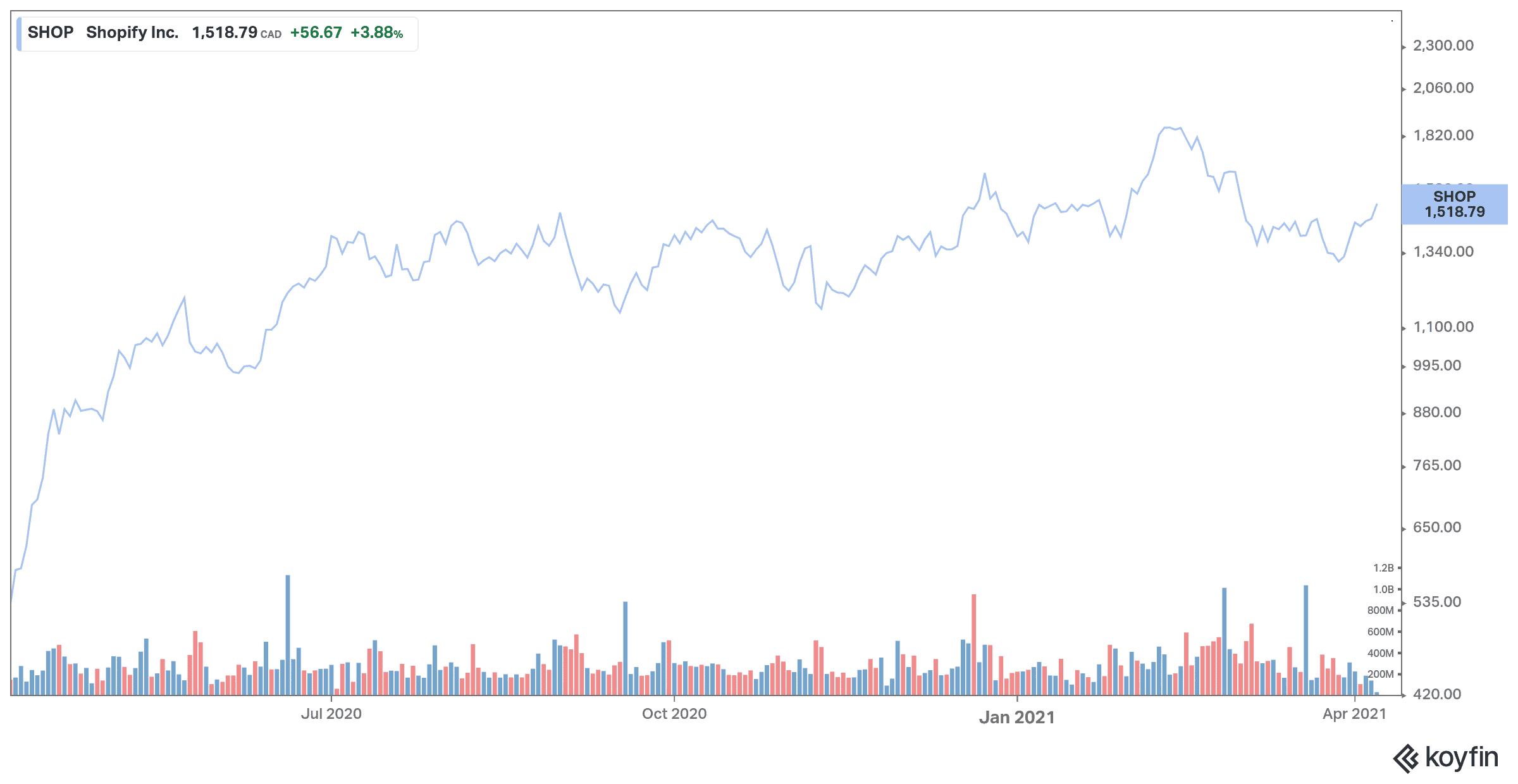

Shopify stock has fallen more than 20% in recent weeks, as the global market turned away from tech stocks after a historic run in 2020.

Tech stocks like Shopify have performed extremely well in the stay-at-home environment caused by COVID-19, which has prompted people to shop more online and businesses to improve their online game, both of which are down the aisle of Shopify.

Shopify has seen a huge increase in traffic to its platform from the start of last year, as businesses large and small have turned to e-commerce to help them weather the pandemic and beyond.

The numbers also back it up, as Shopify saw its revenue increase 94% year over year for the fourth quarter, while adjusted net income was US$198.8 million, or US$1.58 per diluted share, down from US$50 million, or US$0.43 per share, a year earlier.

For the full year 2020, Shopify’s revenue grew an astounding 86% year over year to US$2.93 billion, while adjusted net income increased to US$491.3 million, or US$3.98 per share, diluted versus net income of US$34.3 million, or US$0.30 per share, a year earlier.

The company saw traffic to its platform nearly double in 2020, where Shopify reported a 96% increase over 2019 in gross merchandise volume, or the total dollar value of transactions, which climbed to US$120 billion for the year.

Shopify took advantage of the surge in its share price during last month’s close with a public offering of 1.18 million shares, generating gross proceeds of US$1.55 billion for the company. Shopify said it plans to use the funds to strengthen its balance sheet and provide flexibility to execute its growth strategies.

The tech company provided a more moderate forecast for 2021, saying that while the shift to e-commerce continues at a strong pace, reopening physical stores after the pandemic will likely cause the growth rate to decline compared to 2020.

The long-term story still looks great

Still, the company appears to have a lot of growth ahead of it, as Shopify continues to expand internationally, its distribution network continues to expand and assets such as Shop App and Shopify POS appear to be just beginning.

So, while 2020 may have been a bit of an anomaly in terms of growth — and Shopify management said so in their 2021 outlook, which was presented in fourth-quarter earnings — the trail still looks long and broad.

But in the short term, it appears best to look at tech stocks that are less expensive than Shopify and have a better outlook for 2021.