Air Canada (TSX:AC) has been and continues to be one of the most popular Canadian stocks. The airline is so popular because its stock price sold off massively to start the pandemic and is still nearly 50% below its pre-pandemic high today.

The stock has struggled through no fault of its own. Unfortunately, that doesn’t really make a difference, and the only thing that can really help Air Canada is a return to normalcy.

Airlines are companies that can scale rapidly and create great margins for themselves. However, because of all the planes they need for this scale, it’s also an industry where the companies will struggle to save costs.

So with Air Canada burning through millions of dollars of cash every day, you can’t just buy and hold the stock forever, waiting for a recovery.

Furthermore, that may not even be the best investing strategy anyway. If other companies offer better prospects for an investment today, you don’t want to hold Air Canada, which will underperform.

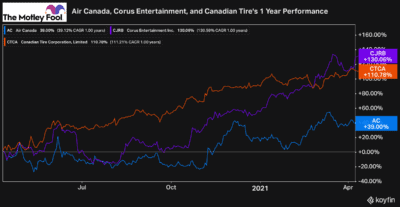

For example, exactly one year ago, I first recommended investors forget about Air Canada. Instead, I recommended Corus and Canadian Tire as two substitutes that offered far more potential.

As you can see in the year since both performed better. Air Canada stock has recovered somewhat too. However, it barely beat out the TSX, up 37%, over the last year.

That’s not a terrible result for investors, but given all the risk they took on to achieve the same return as a low-risk index fund, and it wasn’t the best investment to make.

Going forward, Air Canada still has a tonne of risk today. So although the stock has rallied somewhat over the past year, that may not always be the case.

Could Air Canada actually go to $0?

Because the stock is being impacted so badly, it’s not out of the question to wonder whether the stock might go to $0. Air Canada is a stock that has had trouble in the past and has seen its fair share of selloffs in the stock price.

It was less than 10 years ago, the last time the stock had major trouble, and shares traded below $1 a share. This time around, though, despite a major impact on its business, Air Canada has a lot more potential to weather the storm this year.

The massive economic stimulus from governments has played a big role in helping airlines worldwide stay alive, especially when you consider how much cash they’ve been able to raise.

So while there is certainly a tonne of risk with Air Canada stock today, it’s doubtful the stock will ever go to $0.

How much potential does Air Canada stock have?

Just like how it’s highly unlikely the stock goes to $0, it’s also highly unlikely it returns to its pre-pandemic price above $50 a share anytime soon.

I mentioned above how the company is losing cash every day. In addition, I also mentioned how Air Canada stock has had to raise cash to weather the storm in the short term.

These two factors will play a big role going forward and likely limit Air Canada’s upside in the short term.

That’s why it’s so hard to invest in the stock today. It’s tough to put a target price on where the stock can go. It’s especially difficult because nobody knows when these airlines can truly recover for good.

Analysts have even had a tough time figuring out where it can go from here. However, the consensus target price today is right around $30. So according to analysts, there isn’t that much upside potential at the moment.

That’s the risk of buying Air Canada stock today. With limited upside and a tonne of uncertainty, several Canadian stocks offer far more potential. So even though it’s doubtful the stock will ever go to $0, I would still avoid it today.